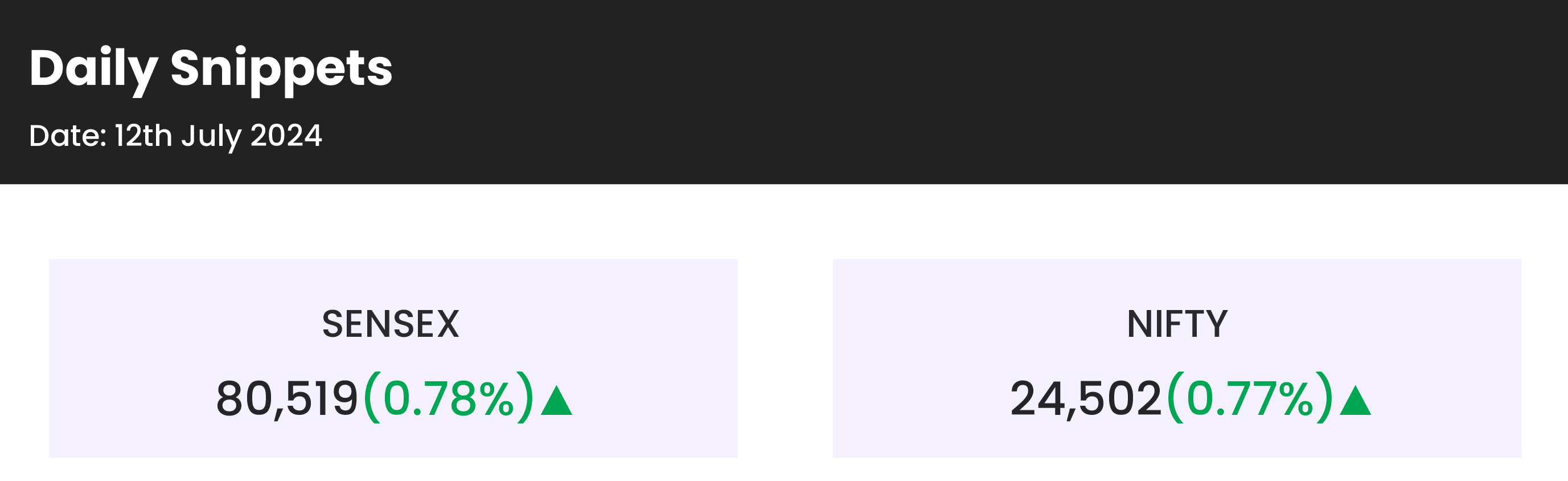

Technical Overview – Nifty 50

The benchmark index had again another strong day, rising by almost 1% on the day. With a strong forcing, the index closed above the one-week consolidation. At 24,600, the index reached a new all-time high. The index increased by almost a percent during the week.

On a 75-minute timeframe, the momentum indicator RSI (14) has given a symmetrical triangle breakout on the weekly chart. As long as the MACD on a daily timeframe keeps rising and stays above its polarity, the upward trend should hold. The 10-DEMA served as support for the index, also index is trading above the major DEMA, indicating an overall upward trend.

Diffusion Indicator: % of stocks above SMA 200 of the benchmark index are at 92% indicating overall bullishness in the majority of constituents of a benchmark index.

Based on benchmark index OI data, a base formation may take place at the 24,400 level, where put writing is almost 60 lakhs. At 24,600, call writing is almost close to 32 lakhs, which might act as a resistance. The PCR value of the benchmark index is 1.17.

The support and resistance levels for the next sessions are at 24,350 and 24,250 and 24,700 and 24,800, respectively.

Technical Overview – Bank Nifty

A day marked by volatility for the banking index, which surged in the early hours of the day before encountering resistance at the 52,820 level at the 75-minute chart’s gap zone. The benchmark index, which shows the banking index’s weekly correction of more than half a percent, outperformed the banking index.

On a daily timescale, the momentum indicator RSI (14) indicates a hidden positive divergence, indicating that the upward momentum is expected to persist. The index took support at 20-DEMA in the previous session, but follow-up seemed diminishing and bulls not showing interest in a banking index. MACD has a negative crossover over the daily chart.

Based on benchmark index OI data, a base formation may take place at the 52,000 level, where put writing is close to 21 lakhs. At 52,500, call writing is almost close to 25 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.88.

In the event of a decline, the opinion is still to buy on dips and to pyramid over 52,850 levels. The resistance and support levels for the upcoming sessions are 52,650, 52,850 for resistance, and 52,000, 51,750 for support.

Indian markets:

- Indian stock market benchmarks, the Sensex and the Nifty 50, rose nearly 1 percent each to hit fresh all-time highs in intraday trade on Friday, July 12, driven by gains in select IT and banking heavyweights.

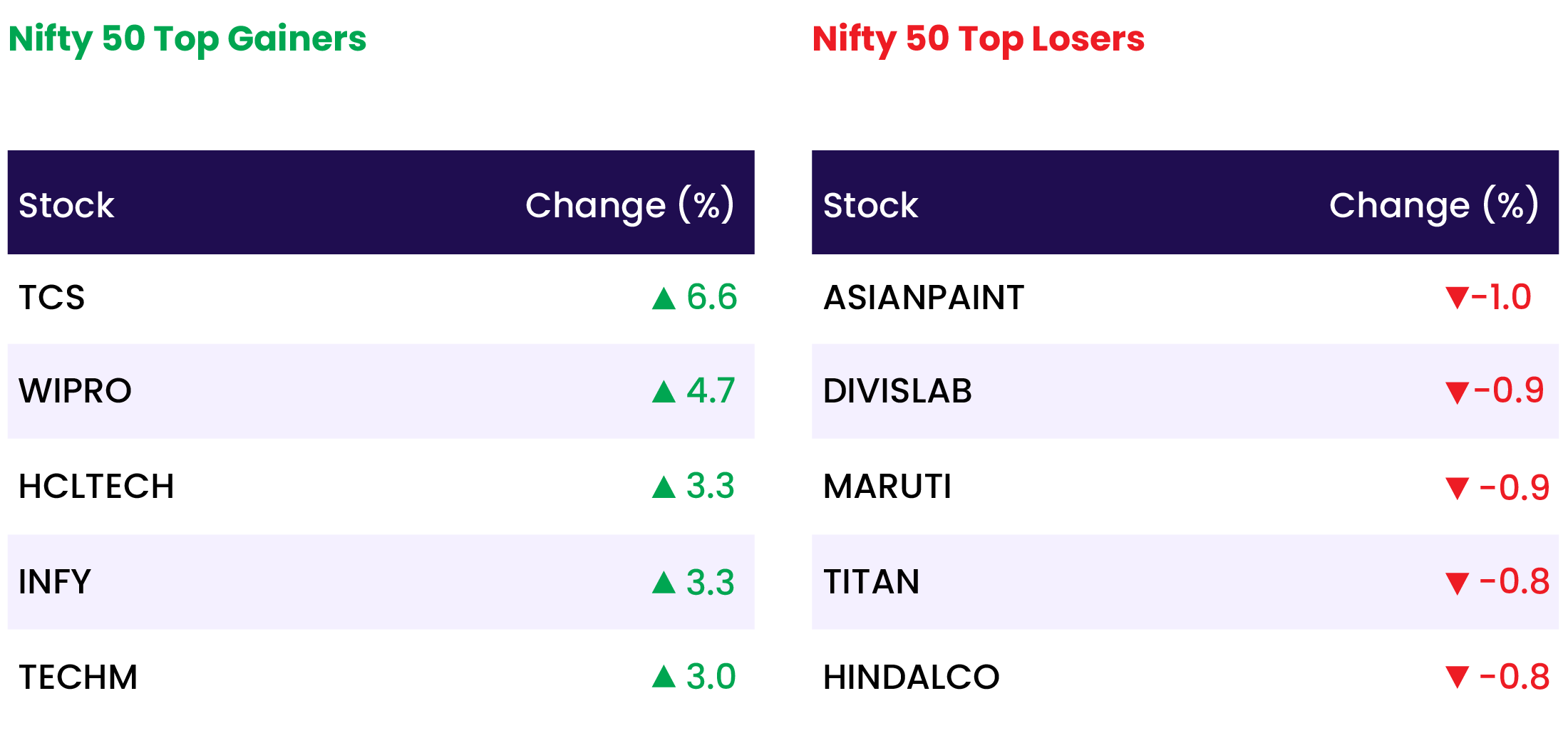

- Among the sectors, the IT index surged 4.5 percent, and the Media index gained more than 2 percent.

- Conversely, the Realty index shed 1.5 percent, the Power index declined nearly 1 percent, and both the Capital Goods and Auto indices fell by 0.5 percent.

- The BSE midcap and smallcap indices ended with marginal losses.

Global Markets:

- Japan’s Nikkei 225 led losses in Asia on Friday, snapping a three-day winning streak and plunging over 2% after hitting a record high in the previous session.

- The Nikkei dropped 2.45%, while the broad-based Topix retreated 1.1%.

- South Korea’s Kospi was down 1.18%, while the small-cap Kosdaq slipped 0.24%.

- In contrast, Hong Kong’s Hang Seng index was up 2.7% in its final hour of trade, while mainland China’s CSI 300 climbed 0.12%.

- Australia’s S&P/ASX 200 rose 0.8%, setting a new all-time closing high.

- Overnight in the U.S., markets fell even as inflation readings for June came in at the lowest level in about three years, giving the Federal Reserve room to lower rates.

Stocks in Spotlight

- Anand Rathi Wealth shares surged nearly 3 percent, following the company’s strong earnings report for the April-June quarter of FY25.

- Cyient shares surged over 7 percent to Rs 1,905 after the company announced a strategic expansion of its semiconductor business through the establishment of a wholly owned subsidiary.

- Tata Consultancy Services shares rose 7 percent after multiple brokerages upgraded their ratings and raised the target price for the IT giant, driven by its better-than-expected Q1 FY25 results.

- Inox Wind shares surged over 10 percent to hit an intraday high of Rs 175 on the National Stock Exchange (NSE). The stock has gained attention as investors anticipate the upcoming Union Budget to emphasize continued support for renewable energy by the government.

News from the IPO world🌐

- Sebi puts SK Finance’s Rs 2,200-cr IPO in abeyance

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 4.5 |

| NIFTY MEDIA | 2.1 |

| NIFTY OIL & GAS | 0.6 |

| NIFTY FMCG | 0.4 |

| NIFTY PRIVATE BANK | 0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1687 |

| Decline | 2248 |

| Unchanged | 101 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,754 | 0.1 % | 5.4 % |

| 10 Year Gsec India | 7.0 | 0.1 % | 1.3 % |

| WTI Crude (USD/bbl) | 83 | 1.5 % | 17.4 % |

| Gold (INR/10g) | 72,732 | 0.1 % | 8.0% |

| USD/INR | 83.50 | 0.0 % | 0.6 % |