Quick Take:

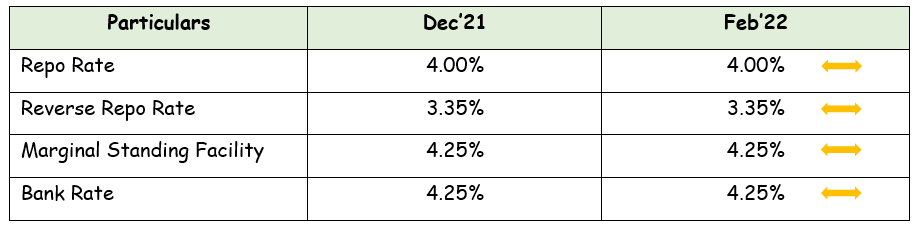

- All rates held steady; stance maintained as accommodative. Five members voted for retaining stance at “accommodative”. One member (Prof. Jayanth Varma) voted against All six members voted for keeping repo rate unchanged.

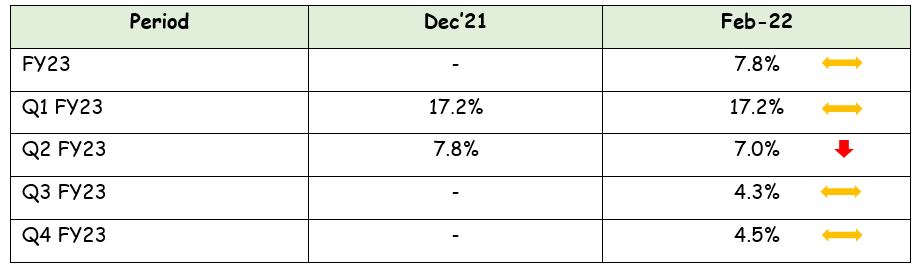

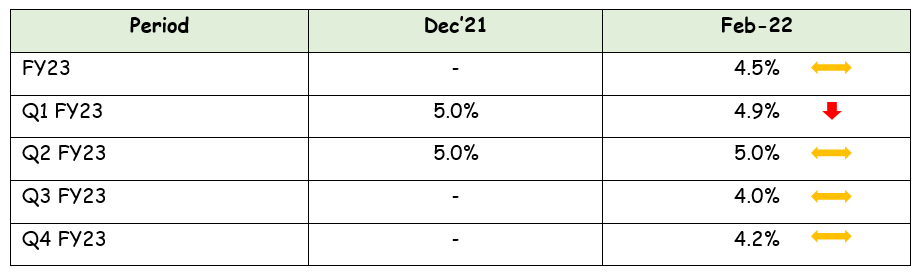

- GDP Projections for Q2 FY23 has been trimmed down to 7.0%.

- Projections eased on the back of expected favorable base effect & normal

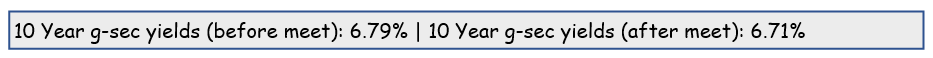

We expect the move to hold rates steady to be conducive to a fuller economic recovery. Going ahead, we could expect the central bank to adopt a rather nuanced approach while fine–tuning the

liquidity situation using VRRRs. We do not expect policy rates to be changed in haste. If at all, there is a stronger probability of the rate normalisation cycle beginning next MPC meet onwards with the first move to be observed in reverse repo rates to be followed by a change in repo rates at a later time.

General Commentary

The RBI keeps the rates unchanged as it believes the world economy has once again come under the hostage of a newer omicron variant. The RBI wants to extend continuous policy support as warranted for a durable and broad-based recovery.

The RBI noted that there had been some lost momentum in the economy due to the omicron variant’s ill effects, which could witness in the high-frequency indicators such as PMI Manufacturing & Services, Steel consumption, and sale of tractors, two-wheelers, and passenger vehicles.

Action & Exercises

The previous actions have yielded positive results for the bond market, and hence the RBI wants to rebalance liquidity on a dynamic basis. This rebalancing has involved two-sided operations: first, rebalancing liquidity from the overnight fixed-rate reverse repo towards the 14-day variable rate reverse repo (VRRR) auction as the main operation, and second, conducting repo auctions of 1–3- day maturities to meet transient liquidity mismatches and shortages.

Risk to policy decisions

- Policy actions taken by other global central banks mainly

- Higher commodity prices mainly crude oil

- Downside risk to economic activity from the high contagious Omicron variant

- Higher inflation than expected

Our Take:

Though largely anticipated, the decision to hold rates steady reflects the Central Bank’s commitment to economic growth. The announcement is expected to accentuate confidence among economic participants and trigger a stronger spirit tuned for recovery.

We expect the Central Bank to face pressures for policy normalisation sooner than later if risks such as global policy normalisation, beyond expected fuel-led inflationary pressure, accelerated

demand-led inflation materialises. The Central Bank has asserted that liquidity management would be done primarily through use of auctions. Central bank can also implement operation twist kind of tool exercise to manage the g-sec yield hardening. We can expect the Central Bank to first modify the reverse repo rate and wait before it amends the repo rate.

What should debt investor do?

In light of developments on policy rates, sovereign and corporate bond yields, fixed income investors can invest in funds with an effective maturity of 3 to 5 years following a roll-down strategy.

A mix of PSU, SDL-backed papers offer strong quality to the mix. For investors with a shorter investment horizon, a tactical allocation to corporate bonds with lower credit ratings up to AA and shorter duration should pump returns from the debt component.