Of late, there has been quite a flurry of new funds being launched by mutual funds – many of which are for the fund house to offer a new product category or to play a theme. While we are constantly on the lookout for not just interesting, but for funds that hold real promise in terms of potential to create investor wealth.

PSUs are known to have laid founding stones to economic success. Their access to capital, regulatory clearances and domain expertise have been instrumental in strengthening the businesses.

Times like now, when the private sectors are hitting a slump (almost), and the economy is turning towards the government for aid, PSUs stand strong.

PSUs covered in the CPSE basket are typically backed by state/central government and offer very high-rated debt instruments. These score well from a safety-against-default parameter

Here is the NFOs which have piqued our interest & the fund name is “Edelweiss Bharat Bond FoF”.

About Edelweiss Bharat Bond FOF

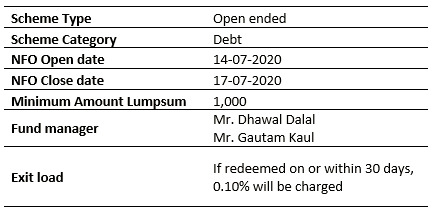

The NFO is open from 14th July 2020 to 17th July 2020. The Fund will be launched with two different maturities i.e. Bharat Bond FOF – 2025 and Bharat Bond FOF – April 2031

Edelweiss Bharat Bond FOF will invest in Bharat Bond ETF which will then invest the money in a bond issued by Public Sector companies.

• Portfolio will be majorly focused on PSU bonds issued by CPSE, CPFI or statutory body dominated in India

• Portfolio will have a conservative rating of AAA and will mature within 12 months period preceding the maturity date of the index.

• Fund does not have any lock in. Investor can entry and exit at any time.

• Investor will get the indexation benefit if he stays invested for a horizon of more than 3 years.

Food for thought:

Earlier issue (December 2019) of Bharat bond FoF April 2030 has generated a return of 10.41% (Data as on 13th July 2020) since inception while Bharat bond FoF April 2023 has generated 7.73% (Data as on 13th July 2020) returns since inception- more than most of the traditional instruments available.

Bottomline:

Investors with a conservative to low-rated risk profile and an investment horizon equivalent to that of the issue may choose to invest in the fund. The fund is a good constituent to fit into the debt allocation basis asset allocation.

In case you wish to understand more about the opportunity or simply discuss the prospects of the funds, feel free to connect with us and we would be glad to have a chat.

Edelweiss Bharat Bond FOF fund details: