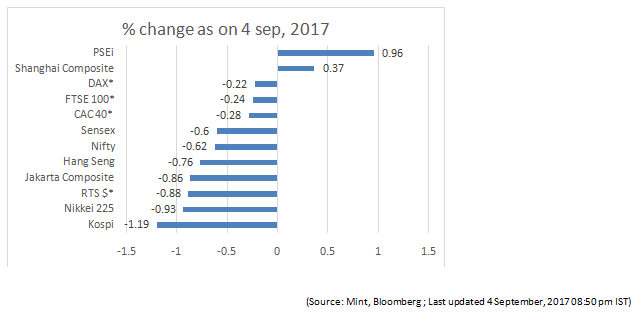

How much damage can the North Korean missiles do? I’m unsure about human casualties, but the nuke sure has started devastating financial markets all over the world.

Almost all major global indices have shed their numbers as an aftermath to North Korea’s recent missile test. This missile has not just put global sentiments under pressure but has also made investors jittery about safety.

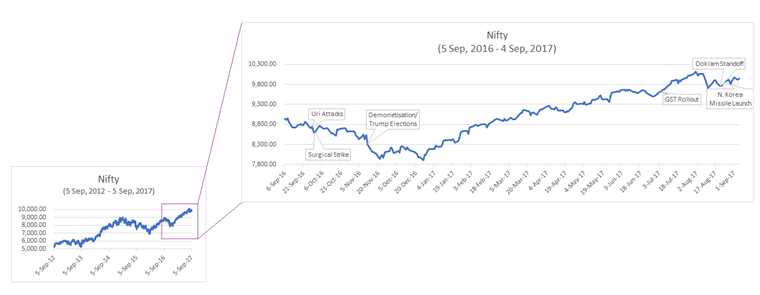

While global economies are gradually picking pace, recent geopolitical tensions have paused their growth to quite some extent. A brief look back into time shows that, at least as far as Indian equities are concerned, almost everything that could have gone wrong has gone wrong in the past one year – right from the de-legalizing of currency notes to the recent Doklam standoff against China.

Indian equities have performed quite well since the past five years. In fact, Nifty has returned a CAGR ~ 13.75% over the last five years! However, considering the number of geopolitical events in the last one year, it only makes sense to take a closer look.

So, just as a small investigative exercise, I decided to plot all major geopolitical events that took place in the last 365 days on the NIFTY’s price chart. Here’s what it looked like.

With a simple assumption of continuing an SIP into NIFTY through the period, my investments would have grown at ~11% in the year that went by! Honestly, considering that the best equity mutual funds outperform NIFTY by a comfortable margin and that Sep’16-Sep’17 has been an eventful year, the returns look quite healthy.

The world economies have always been under pressure, only for different reasons at different times. While crude was once the biggest reason for worry, Brexit came and stole its thunder only to be followed by Trump’s election as POTUS and now, North Korean antics. I believe, the markets reflect economic progress and that the world will always have its fair share of worries, but that won’t stop the global economies from growing.

Short-term is always volatile; but, when you look at the charts from a wider perspective, you will find an upward trend. This is the trend one should be a part of. Riding short-term volatility makes no sense for someone who wishes to build wealth by participating in the growth trend. The difference is as between a speculator and an investor.

Now, the real question is – what lies ahead for the Indian investor and how should he go about with his investments?

3 reasons to invest in Indian equities:

- Strong macro-economic fundamentals

– We expect India’s GDP growth at 6.6% YoY and 7.4% YoY in FY18 and FY19, respectively.

– Inflation has been softening consistently since the last three years and is expected to remain well within RBI’s target range.

– Fiscal deficit has improved in FY17 TO 3.5% OF GDP from 3.8% of GDP in FY16. Further improvement to ~3.2% of GDP can be expected in FY18.

– The INR is among the best performing currencies in the emerging markets and is expected to stay strong.

– Foreign Direct Investment inflows in India has doubled over the past decade to ~USD 42 bn as of FY’17. This accounts for ~1.9% of the Indian GDP. Further strengthening of up to 2.5% of GDP is expected over the next five years. - Active participation in the Indian equity market

– Foreign Portfolio Investors continued to invest ~INR 6,319 cr. in July’17.

– Domestic market participants have been net buyers with the net purchase amount being ~ INR 11,800 CR. IN July’17.

– Demonetization has accelerated the shift of savings from physical to financial assets.

– With softening of interest rates, bubbling up of real-estate and poor performance by gold, investors are seeking capital appreciation through capital markets. - Positive outlook on India’s growth story

– Strong governance and effective regulatory framework will boost economic growth

– Gradual increase in consumption, fueled by redistribution of wealth may improve the investment cycle even further.

– Corporate earnings are placed well on track for revival over the next fiscal.

– After demonetization and the implementation of GST, the Indian economy is witnessing a gradual shift of the unorganized to the organized sector.

A common feeling among investors today is that although they may or may not understand the world of equities well, they feel the urge to try and actively manage their investments. So, for the ones who are looking for ways to add value to their investments, here are a few tips-

3 ways to get the biggest bang for your buck today

- Stick to your plan

When in confusion, don’t move. If you had started investing towards a particular financial goal and if you are not close to your financial goal or the time horizon you had planned for, don’t touch your investment. Continue investing as planned. However, if you have shorter term goals – the ones where you need the money within the next three years, it is advisable to accordingly shift money from equity funds to debt funds. - Don’t try to time the market

Nobody can really predict the market’s movement, although many are paid to try. While you may want to buy low and sell high, the prime question is – how low is low and how high is high? If you can’t answer this with enough conviction, quite often than not you may lose out. Disciplined investment is the key to long-term wealth. - Keep SIPping, don’t be adventurous

The concept of investing in a periodic and disciplined way through a Systematic Investment Plan has quite a number of merits to it. The biggest advantage of investing through an SIP ensures that you continue averaging your cost of purchase at different price points. The law of averages will ensure that you don’t suffer because of catching a high price point. The last thing you would want to do know is pump all your money at one go, unless you really love living on the edge.

Don’t let North Korea nuke your financial goals. Stay disciplined, stay focused.