RBI’s June edition of the Financial Stability Report suggested that the gross bad loan ratio is expected to rise to a percentage between 10.2% – 11.2% of the total loan book in March 2018 as compared to 9.6% in March 2017. For public sector banks, things can get uglier – the ratio may go up to 14.8% in March 2018 from 11.4%.

Wait! Too much information and too little sense? Let’s take a step back.

Commentary on non-performing assets, or affectionately known as NPA by the press and economy elite, have been doing the rounds in almost every news media and public discussions since quite some time now. But, is this actually such a big problem? Is it really going to affect your ‘common-man life’?

Let’s break this down into simpler pieces and understand what’s the noise all about.

First things first, what exactly is an NPA?

A bank is nothing but Uber for money. Banks collect money from people who have it (depositors) and lends it to entities who need it (loan). For banks, the loans they disburse are an asset.

What is an asset? An asset is anything which is expected to generate income in future. Loans are an asset to banks because it generates income for them in the form of principal and interest receipts.

Now, a non-performing asset literally refers to an asset which is not performing as expected. In this case, it refers to a disbursed loan for which interest payments are not made for at least 90 days and is on the verge of default.

NPA is very similar to cancer for the banking system; it can be controlled but eliminating it completely is quite mission impossible. With banks being flush with liquidity and their need to pay depositors’ interest, banks and bankers are in quite a spot. The straightforward way to service depositors’ interest is by lending and lending inherently runs a huge risk of lending to entities who would default on repayment – a.k.a ‘non-performing assets’.

The Indian economy is on the verge of facing an NPA crisis

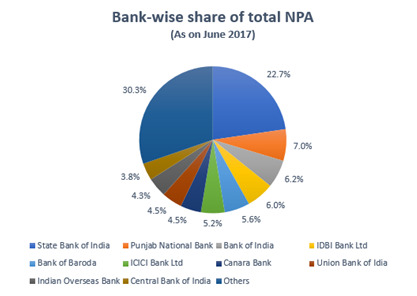

As of June 2017, the total NPA level stood at ~ INR 8.3 lakh crores.

(Source: CARE Ratings | NPAs in Banks – June 2017)

State Bank of India forms the largest share of the total NPAs with 22% followed by the rest. Interestingly, ICICI Bank is the only private sector bank among the list of top ten banks with the highest levels of NPAs. And, not-so-interestingly, the biggest banks of India are also the biggest NPA-holders in terms of absolute value.

The top ten banks with the highest NPAs contribute to almost 70% of the total NPA value. High concentration is always a risk. In this case, if the NPA scenario aggravates further for any of the top-ten, it may spell trouble for the banking system as a whole. At the same time, it would only be fair to understand that an alleviation of the NPA-burden for only the top-ten would result in an overall improvement in banking health.

How’s this NPA drama going to affect you? Four perspectives.

- Recycling of funds through the system will be more difficult

When NPA levels of banks rise; BASEL norms require banks to reserve more money as against the probability of default. This means that the banks will have to lock in more money as a provision and will have lesser money to lend. If a bank has less money to lend and more money for which interest has to be paid (deposits), either the depositors will have to accept lower interest rates or borrowers would have to agree to pay higher interest rates or the banks would have to take a hit to its profits – none of the case being favorable. - Employment levels will continue to remain subdued

In continuation to point one- with higher NPAs, banks will not be able to offer private corporate the amount they are seeking. With limited capital, only limited capital expenditure and expansion can be done by a corporate; and with such limited growth, the demand for human resources will remain challenged. - The taxpayer will always bear the brunt

In case of an eventuality where the NPA levels for a bank cross the red line, there’s a bright chance that the government may step in to bail it out.

Why, you ask? The banking system is the bell-weather of the Indian economy and any limp in this system can push the economy towards devastation.

Now, once the government plays the ‘good guy’, it will obviously add to the fiscal deficit and the most convenient way to manage this deficit is through taxation policies - Investor sentiments can be hurt

In line with the above pointers, banks holding higher NPAs would see their operating profits shrinking and jeopardize the interests of their shareholders. If you have invested in the shares of a bank with a very high NPA, it is probably time you reconsider your decision.