The first full-time lady finance minister of independent India has turned Santa Claus with almost every consecutive weekend being Christmas. She comes bearing gifts for the economy and this weekend was no different – this time the biggest gift was in the form of a corporate tax rate cut.

While the streets are filled with euphoric traders and sceptical economists with contrasting opinions ranging from “this was much needed” to “fiscal prudence is now becoming a myth”, there’s one tale I remember from childhood which captures the current situation aptly. Here’s an excerpt:

It was late at night, the streets filled with silence. Ajay, a professional martial artist, had a long day and walked slowly down the lane leading to his home. Just as he approached the corner, he found himself surrounded by four local ruffians, armed with pocket knives– it was a legitimate armed robbery! Ajay’s pace slowed down as thoughts raced ahead. With knives pointed towards him, he was threatened and asked to hand over all his valuable belongings.

Contrary to what you may have expected, Ajay simply handed them over and got himself out of the situation at the earliest. Back home, he narrated this incident to a friend who had come over for dinner. Upon hearing the entire episode, the friend asked in surprise, “You’ve been training all your life for such a situation, then why to back down when the moment arrived?” to which Ajay offered a profound explanation – “When outnumbered and all odds are against one; to fight is a sign of courage, but to live to fight another day is wisdom.”

The response stuck in my head –

“To fight is a sign of courage, but to live to fight another day is wisdom.”

We’ll get to this in a bit

So, what did the government exactly propose?

The government proposed a steep cut in the basic tax rate for corporates. It has been trimmed down from an effective (incl. surcharge & cess) 34.94% to a much lower 25.17% given that a company may opt to be taxable under this rate regime only if it agrees to forego all other concessions & exemptions it may have availed. However, even for some companies who choose to remain under the old rate, the MAT reduction from 18.5% to 15% could benefit. Minimum Alternate Tax is nothing but a provision to ensure that companies with profits under a threshold are covered under the tax rate through the tax liability may be minimal or even zero.

But we are running in deficit. How can the government sustain such a revenue loss?

True. In her statement, the Finance Minister mentioned that the revenue foregone through the tax cut and other relief measures is to the tune of INR 1.45 lakh crores. However, the idea is that this loss is expected to be temporary as the resultant spur in the economy is expected to not only set-off against this loss but also create the foundation for a more robust economy.

“To fight is a sign of courage, but to live to fight another day is wisdom.”

Taking the assistance of simple mathematics, if the price-to-earnings ratio (the price of all listed shares dividing by earnings per share) of nifty today is c. 27x and the excess liquidity transferred by way of tax-saving (equals revenue foregone by the government) is INR 1.45 lakh, it effectively translates to a valuation jump in Indian equities to the tune of approx. INR 39.2 lakh crore to justify the current, reasonably strong valuation. Obviously, this is a crude way to compute but should help offer perspective to the situation.

How does this affect me as an investor? Why did markets zoom by almost 5% in a day?

India Inc. has been asking for this since a long time now – it helps strengthen Indian companies’ position vis-à-vis global peers in the international market while significantly adding to the bottom-line.

For shareholders, this is essentially an upward revision in their profitability estimates. With a lower tax incidence, more money is left with the company which can flow in either of the two directions – direct increment in shareholder value through higher dividends and increased earnings per share or increased capital allocation towards productive expenses.

But then, is this simply a tactical move or is there something more structural?

Drawing on from the fact that companies are expected to have significantly improved cash flows and will utilise it in one way or another, the expectation is that this improved liquidity with a robust competitive landscape will enable companies to spend more towards driving sales in a more aggressive fashion. Once consumerism is spurred and the supply-side starts reacting, we will have the economic engine push with higher horsepower.

Are there any specific sectors that stand to benefit strongly?

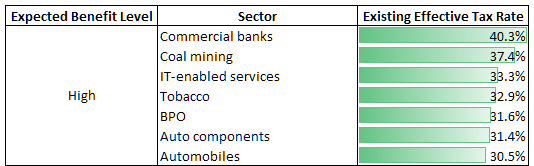

Sectors with a significantly higher effective tax rate (net of exemptions, reliefs & surcharges) are expected to be benefitted the most in a quantum directly proportional to the difference in current and proposed rate.

Commercial banks and IT are expected to benefit the most from the move. Given that these sectors have a significantly high-weighted representation on the indices, we could expect to see index valuations getting enriched as well.

As an investor, what’s the actionable?

With this booster shot to the economy coupled with gradually improving on-ground liquidity situation and upcoming festive season, we can expect an uptick in consumerism, albeit of limited magnitude. Investors must capitalise on this opportunity while bearing in mind the government and central bank’s collaborative alignment towards reviving the Indian economy by buying into equities while averaging their cost at all junctures. Investors may choose to invest in multi-cap & large-cap funds with higher exposure to financial services and IT as a part of the sectoral diversification. However, it is strongly recommended to stick to asset allocation while taking investment decisions.

For those still pondering about the right way to navigate through the current market scenario, feel free to simply reply to this email & let us guide you through the jungle that the financial markets have become.