As I am getting closer to being a responsible adult, I realize the importance of investing and that equity mutual funds are the only way I’m going to be wealthy with optimal risk. I don’t gamble, especially with my money.

I was now ready to take the plunge for the sake of a wealthy future; but just as I was proceeding to download the popular investment app which promised to make my money work for me, the pink newspaper lying next to me caught my attention. “NIFTY at all time high; investors euphoric” read the headlines. Somehow, I started feeling that it is not wise to buy into a mutual fund at such high price points, what if the market crashes? Is this a bubble that is soon going to burst? A small part within me whispered – “What if this is just the beginning?”.

*Absolutely confused for one long minute*

Suddenly out of nowhere, like partial déjà vu, my memory started playing the same conversation but this time, between mom and dad. Yes, this was something I vividly remember my parents discussing years back – probably 10 years back. I was a 16-year old kid then. While I did not understand much, I remember my mom saying, “Let’s not be greedy, we are simple people and should invest in a fixed deposit or recurring deposit so that we save enough for our old age” and that’s exactly what they did. But let me tell you, after the taxes and inflation, they don’t seem much happy about their retirement wallet.

Now this has given me a brilliant idea. 10 years back, the market was at all-time highs like now and the fixed interest rates were low like it is now. My biggest fear was a fact; the markets had collapsed to new bottoms just after it hit the peak. Today, everything looks the same; there are chances that history might repeat itself. I got down to research. Armed with a calculator, paper, pen and MS-excel I tried to figure out, what would have happened if my dad had gone ahead with starting an SIP into an equity mutual fund.

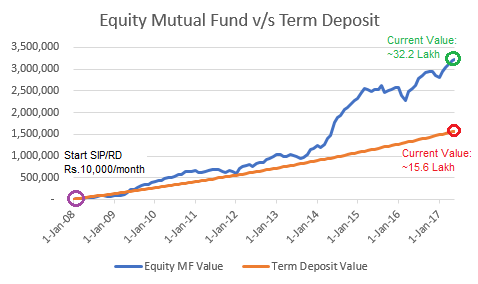

I picked one of the top recommended funds shown by the investment app – the one that claimed to make my money work for me. It was tough to get the historical data, but the good guys at the app company fetched me the historical data I was looking for. I got them all on an excel worksheet and started calculating what would have happened if dad started an SIP right at the peak (just like now) and continued till today. Like my dad, even I believe in investing for long-term – for the rainy days. Also, I decided to benchmark it against his actual wealth growth – the term deposits. What I saw next was crazy.

My mind was blown away! The period post-2007 had witnessed a butterfly effect with the fall of Lehmann Brothers manifesting into the sub-prime crisis followed by China’s slowdown and consequent dips in the market and yet, the mutual fund managed to grow at a ~24% compounded annual growth rate, which is much higher than the sub-7% post-tax returns offered by banks on term deposits.

My dad effectively lost over half of what he could have had today!

Notably, the magic of compounding works best for a SIP arrangement and when these monthly investments are disciplined and continued for longer terms. In the shorter term, the amount may dip due to certain events, but towards the longer term it always goes up.

Getting back to my initial dilemma, I was now able to fit the pieces together. I finally understood how to “buy low and sell high”. Nobody can time the market, but an SIP averages your purchasing cost to a lower amount. For instance, today the rate per unit (NAV) of mutual fund is Rs.500 and increases to Rs.1,000 next month. Imagine you invest Rs.1,000 every month. By the end of two months you would be having 3 units (month 1: 500×2, month 2: 1,000×1) at Rs.2,000. This means, you paid ~Rs.670 per unit, when their current value is Rs.1,000 per unit.

The power of compounding and rupee-cost averaging seem to form a magical blend to somehow create exponential profits along the way. However, the magic only works in a disciplined and long-term environment.

I respect my parents a lot but I also know that the only think constant is change and only by improvising you can be better than what you were yesterday. I’m definitely not going to make the mistake my parents made. I know the key to building long-term wealth lies in long-term and disciplined investing.

The lessons I learnt:

- It is impossible to time the market, disciplined and systematic investments is the best way to average your rupee-cost.

- In the longer term, equity outperforms all other asset classes by a huge margin.

- Disciplined investing and the power of compounding works towards creating exponential returns.

I’m future-ready, are you?

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F37ldi2e||target:%20_blank|” button_position=”button-center”]