Prologue – Asset Allocation will define your investment success

2020, from an investor’s perspective, has not been shy of volatility, drawing parallels to that of a roller coaster ride. These temporary (read as: contingent) and temperament-testing swings on the downside across global and domestic markets, has witnessed wealth preservation become the flavor of investments, over wealth creation.

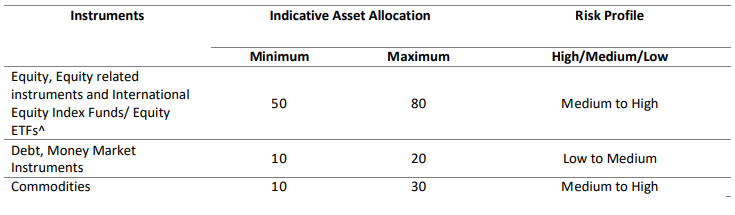

All major Asset classes have been subject to multiple pain points over the last few years, as can be seen below:

– Equity

With VIX levels touching all-time highs in 2020, with no respite in sight, investor wealth has seen massive erosion in the first 6 months of 2020. However, as economies continue to normalize, with green shoots back in place, equities today present attractive entry points to realize long-term healthy gains.

– Debt

The IL&FS crisis in late 2017, spelt doom for our shadow-banking industry, a key proponent for helping India achieve the $5 tn economy mark by 2025. The DHFL fraud, further augured feelings of discomfort in the debt industry with MFs not willing to roll debt or issue fresh CDs without adjusted risk premiums.

This clearly shows why risk-averse investors should not compromise on credit quality to realize growth, but stick to AAA/AA rated papers, or investigate the likes of “risk-free” Govt. papers.

– Gold

Gold has lived up to its merit of being a safe-haven asset touching all-time levels at Rs. 55,000/10 gm levels. However, this potential may be short-lived, as economies continue to adapt to the new normal. As has been seen before, Gold’s attractiveness as an investment case tends to be weaker during healthy economic periods, in comparison to other asset classes.

As can be seen above, an investor overweight on either asset class, can see misalign their portfolio in terms of risk-return metrics. An investor stands to maximize his investment growth, when the portfolio enjoys a healthy mix of all elements:

- Equity (Domestic + Global)

- Debt (High quality papers)

- Gold

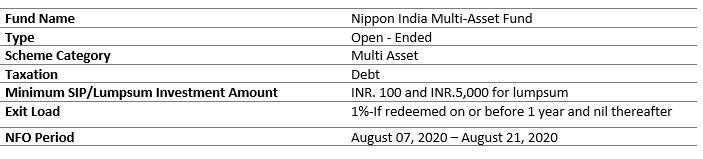

Interestingly, playing to this opportunity, Nippon India mutual fund is launching a New Fund Offer based around the asset diversification- “Nippon India Multi Asset”. Quick look at the features – open-ended, Multi asset.

Asset Allocation of Nippon India Multi Asset Fund is as follows:

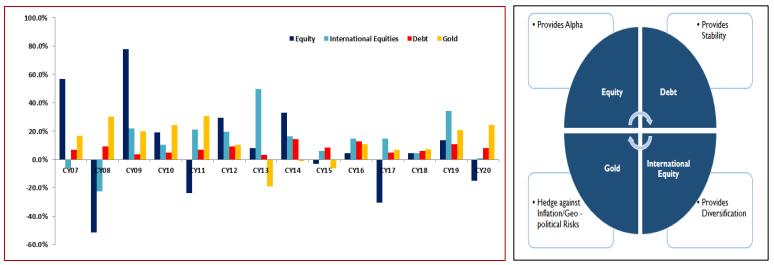

Every asset class has its “season”, and an investor whose portfolio is dynamically aligned to shift into said asset class, is poised to win most. All asset classes have their designated role ranging from generating alpha to acting as hedge, thus helping portfolio to maximize diversification benefits.

Other key benefits are as follows:

Investor Takeaways:

The fund deserves an allocation in your portfolio for those who desire marginally better & consistent returns without taking higher risk and looking to make an entry into the prevailing uncertain market.

The fund is suitable for those who are having an average indicative horizon up to five years & more.

In case you wish to understand more about the opportunity or simply discuss the prospects of the funds, feel free to connect with us and we would be glad to have a chat.