Making money. Making a difference.

You should not have to pick between the two

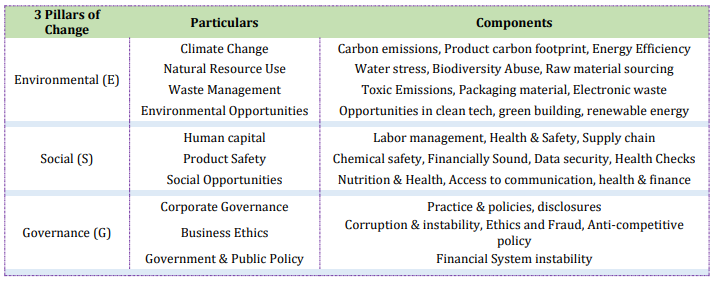

ESG investing is about assessing a company’s sustainability practices, measuring not only how much money the firm makes, but also how they make it. In fact, the 3 key factors measured is how the category derives its name. The breakdown is as follows:

As individuals and institutions endorse broader and cross-border patriotism in becoming global citizens, the purview and scope of investment world widens too.

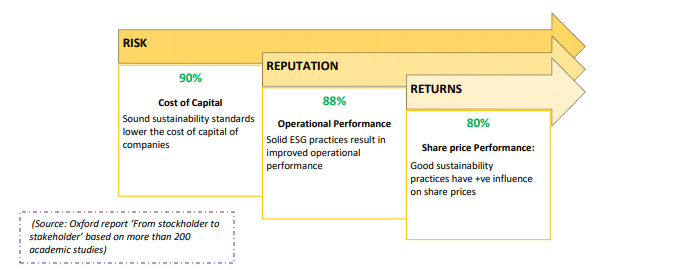

Viewing the world from a bigger lens has put light on universal issues such as Global Warming, International regulatory challenges, and unorganized labour platforms. Tackling these issues has proved to be financially fruitful for companies and investors alike per the observations made below:

Ironically, the modern world progresses today by adopting old ways of Pangea era, where unity prevailed over divisions. As we morph into one, we onboard bigger challenges. In tackling these issues, global currency has new-found favouritism for ESG investing, wearing the adage, “An Issue is an Opportunity in disguise”, on its sleeves.

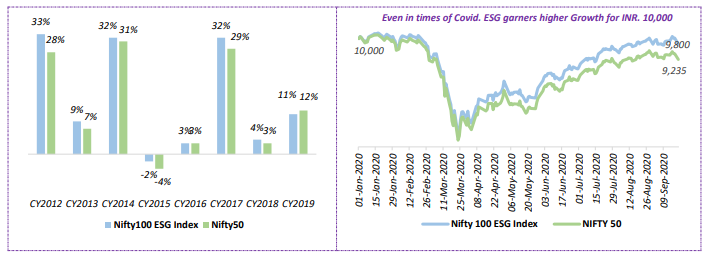

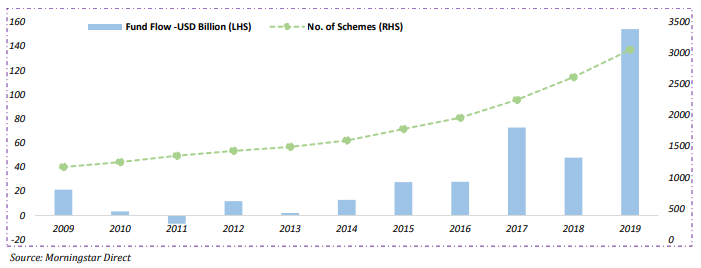

The graph below highlights the how monies have found nest in ESG fund category:

Already excited to go hunting for your favorite socio-economic friendly fund? ICICI MF introduces their ESG fund so your portfolio can boast financial and societal gains!

ICICI Prudential ESG Fund – Strike While The Iron Is Hot

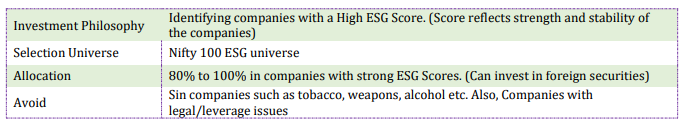

ICICI Prudential ESG Fund will encourage Sustainable Investing by investing in Companies which:

- E – Show Environmental Empathy

- S – Take Charge of Social Responsibilities

- G – Demonstrate Good Corporate Governance

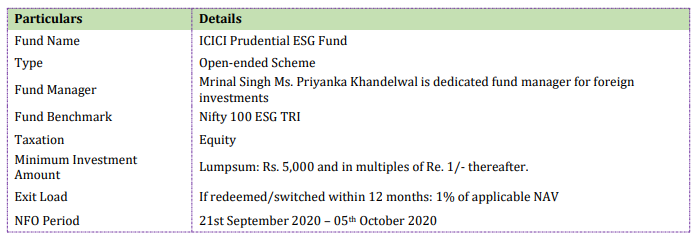

Fund Breakdown is as follows:

Investor Takeaway

From hedging to serving as awareness metric, this fund offers it all. Meriting accolades for combining finance and social securities, the fund is well poised to capitalize on the modern issues via modern solutions.

Suitability

It is more suitable for those wearing higher risk appetites but can feature in limited fashion in moderately high risk-return profiled portfolios.

Those investing in this fund, and category should look at an average indicative horizon of up to 5 years & more.

Key Details About The Fund