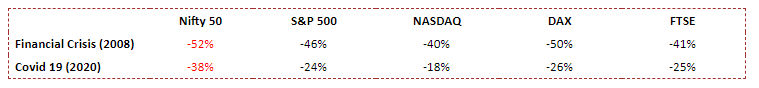

2020 has been widespread, halting activities across all longitudes and latitudes. However, the degree of impact is different between India and across the pond, highlighting the potential global markets have to offer. The table below shows how global markets stood firm across times of crisis.

Multi-Cultural Investing – The Winner’s Way

From Risk to return, international markets offer versatility and choice, to tailor to your investment needs. 3 key advantages to investing in International funds are mentioned below:

1. Diversified Grooming of Risk-Adjusted Potential

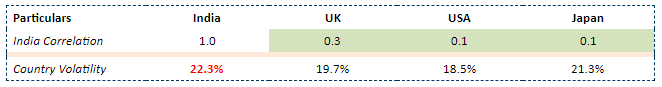

Being borderless with your investment’s aids in smarter money management as all monies is not tied to only 1 basket. The low co-relation and lower volatility makes even the most conservative investor don a global flavor in their portfolio.

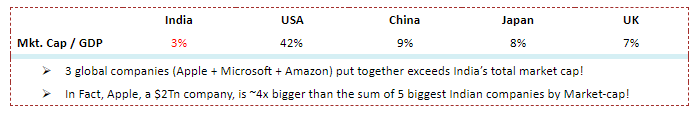

The pursuit of international-themed investing should not be limited to containing risks only but also to realize the untamed wealth creation potential. India, the promise land of tomorrow, has ~5,000 companies listed on the exchange but accounts for ~3% of world’s market Cap! So where is the other 97% equity upside rested? In land, foreign to Indians, but not to money!

2. Bet Big – Win Bigger: Going Global Welcomes Growth Opportunities

Global markets host the biggest companies in the world, which are shaping today’s youth and defining tomorrow’s leaders.

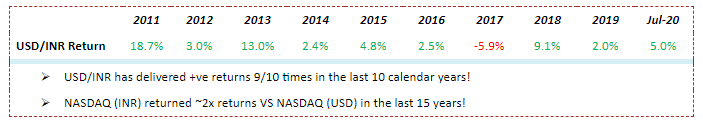

3. Depreciating Rupee Can Appreciate Your Returns

Today, the value of INR is lower than USD, at values lesser vs in 2010’s, and even lesser than in 2000’s. The graph below highlights how an index return can increase multifold if the currency play is done right!

Already excited to go hunting for your favorite global fund? Axis MF brings your portfolio a flight to the rest of the world.

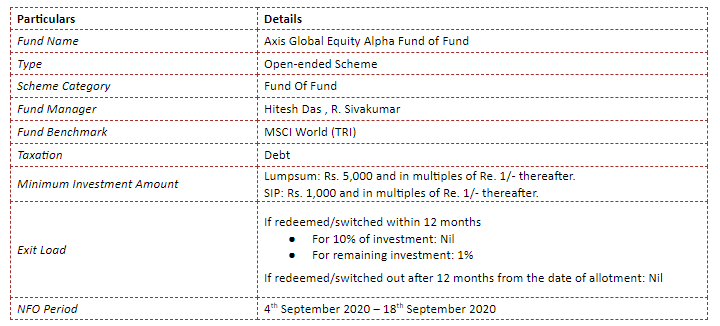

Axis Global Equity Alpha FoF

Axis Global Equity Alpha FoF is a fund of fund which will invest in Schroders International Selection Fund (SISF) Global Equity Alpha (underlying scheme).

SISF is a leading global asset manager with £526+ Bn AUM across asset classes. Operating in 37 countries, they have over 200 years of market expertise!

Fund Philosophy aims to tackle 3 key persistent inefficiencies:

- Markets fail to look far enough ahead when appraising the earnings power of companies

- Markets extrapolate historic growth and fail to correctly interpret catalysts that change the trajectory of growth

- Markets over-react to short term news flow

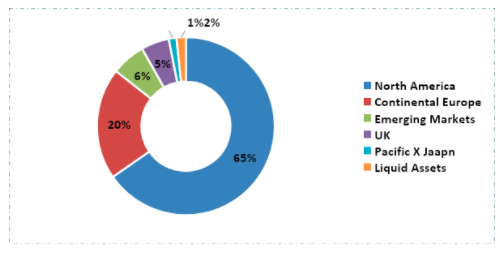

Geographic Allocation Of the Fund

As an institution and individual, we often resort to overseas to fulfil multi-purpose necessities. Then why do we invest any differently? Think of cross-seas investing as your 1st step in broadening your domestic mind and money.

Be it books or speeches, sound asset allocation merits a special mention when talking of investing. International investing is an outcome of this principle, for it maximizes upside potential on a global level, while arresting downside risks on a domestic level.

Investor Takeaway

From hedging to a coolness factor, this fund offers it all. International funds merit accolades for their ability to maximize upside and limit downside. The fund can act as a hedge in these uncertain times and be a frontrunner in bullish times. It is more suitable for those wearing higher risk appetites but can feature in limited fashion in moderate risk-return profiled portfolios.

Those investing in this fund, and category should look at an average indicative horizon of up to 5 years & more.

Key Details About The Fund

In case you wish to understand more about the opportunity or simply discuss the prospects of the funds, feel free to

connect with us and we would be glad to have a chat.