Overview

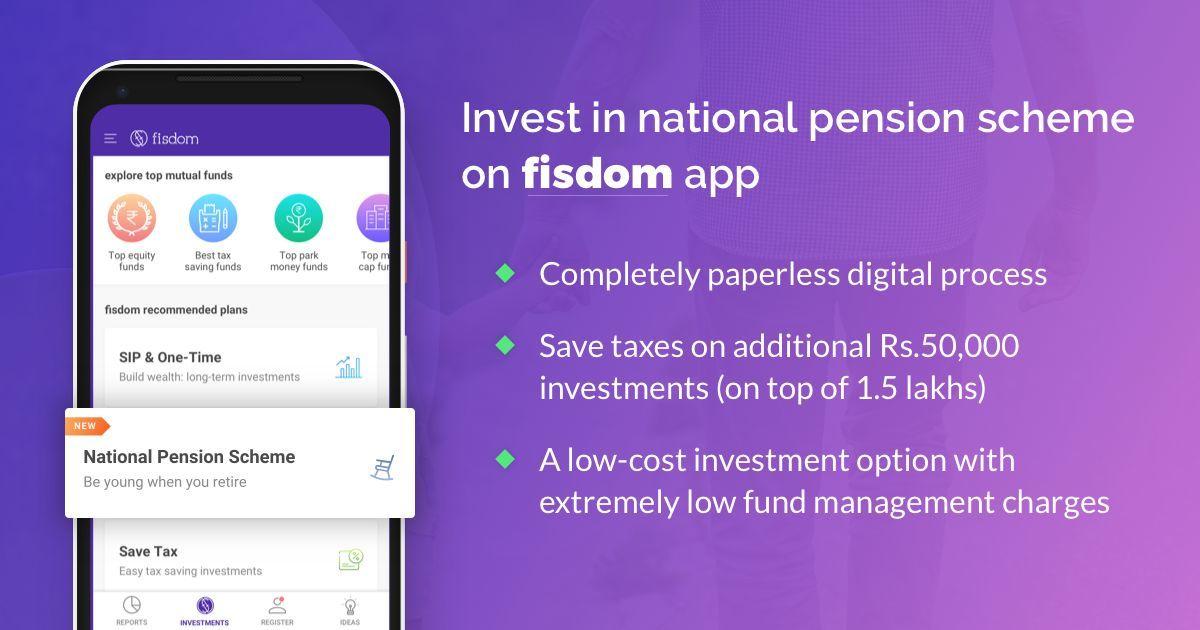

NPS (National Pension System) is a defined contribution-based Pension Scheme launched by Government of India with the following objectives

- To provide old age income

- Reasonable market-based returns over long run

- Extending old age security coverage to all citizens

NPS is based on a unique Permanent Retirement Account Number (PRAN) which is allotted to each Subscriber upon joining NPS.

NPS accumulates savings into subscribers PRA while he is working and use the accumulations at retirement to procure a pension for the rest of his life.

PFRDA has also made NPS available to all citizens of India, with effect from 1st May 2009 on a voluntary basis. In pursuance to PFRDA’s commitment to make available an avenue for saving for old age to all sections of society

Features:

- Portable Account – the NPS account (PRAN) remains the same irrespective of change of employment or geography.

- Online platform – On joining NPS, each Subscriber gets log in ID and Password of NSDL system for accessing NPS details online.

- It offers choice of Service Providers, Funds, Investment Options, Pension Fund Manages, Annuity Service Provides and Annuity Plans to Subscribers

- It offers Subscribers freedom to switch the Service Provider, Fund, Investment Option and Pension Fund Manager once every financial year

- Flexible contribution mechanism – Amount and frequency of contribution can be changed as per the Subscriber requirement

- Prudently regulated – NPS is regulated by PFRDA, with transparent investment norms and regular monitoring and performance review of fund managers by NPS Trust

- Efficient grievance management through CRA / PFRDA Website, Call Center, Email or Postal Mail

- Transparent investment norms – Investment Portfolio under each asset class can be viewed on respective Pension Fund Manager’s website.

- Extremely Low Cost of operations – with 0.01% as Fund Management Charge, NPS is one of the World’s least cost investment options

Eligibility

A citizen of India, whether resident or non-resident can join NPS, subject to the following conditions:

- User should have age between 18 – 65 years as on the date of submission of his/her application to the Point of Presence (POP) / Point of Presence–Service Provider -Authorized branches of POP for NPS (POP-SP).

- User should comply with the Know Your Customer (KYC) norms as detailed in the Subscriber Registration Form.

- NPS is not allowed for HUF, Person of Indian Origin, Overseas Citizen of India

The following applicants cannot join NPS:

- Un-discharged insolvent

- Individuals of unsound mind

- Pre-existing account holders under NPS

The Scheme

About NPS – Types

Under NPS, Subscriber gets the option to open two accounts known as Tier I account and Tier II account. A Tier I account is mandatory to open in order to join NPS. Tier II account is optional and can be opened at any point of time – at the time of opening Tier I account or later.

Difference between Tier I and Tier II accounts are as mentioned below

| Tier I | Tier II |

| A.k.a Pension Account | A.k.a Investment Account |

| Redemption allowed after 10 years of account opening or 60 years of age, whichever is earlier | Any time redemption |

| Minimum contribution is INR 1,000/year | N/A |

*Fisdom allows only Tier I investments currently; will allow Tier II soon.

About NPS – Allocation

- NPS allows the contributor to choose allocation towards asset classes – equities, corporate bonds and government securities in accordance with their risk profile and financial plans.

- Notably, the highest equity exposure a contributor can take is 50% for any given combination of allocation. The contributor can change the asset allocation once in a financial year.

- The NPS also allows an auto-choice model which dynamically changes asset allocation along with age. The three auto-choice models allowed are basis lifestyle – aggressive, moderate & conservative. Fisdom only allows active choice as of now, will allow for auto-choice soon.

Exit

A contributor can exit the scheme after 10 years of opening or at attaining the age of 60 years, whichever is earlier. Following are the provisions for redemption.

| Exit after 10 years but before 60 years of age | Exit after 60 years of age |

| Only 20% of the corpus can be redeemed lumpsum; balance to be invested in annuity | Up to 60% can be redeemed lumpsum; balance to be invested in annuity |

| If corpus =< INR 1 Lakh, entire amount can be redeemed lumpsum | If corpus =< INR 2 Lakh, entire amount can be redeemed lumpsum |

Flexibilities allowed if contributor wishes to redeem after age 60 are as below:

- Subscriber can defer the decision to invest in Annuity for 3 years.

- Subscriber can defer the decision of lump sum withdrawal for 10 years.

- Lump sum amount due for withdrawal at the age 60 can be withdrawn in 10 instalments as per the choice of the Subscriber.

- If Subscriber does not want to exit at the age of 60 years, she can keep on contributing towards NPS till the age 70 years.

Death benefit

In case of death of the contributor, the nominee (or legal heir, in absence of nominee) reserves claim to the accumulated corpus amount.

Partial Withdrawal

In the entire life span, 3 partial withdrawals are allowed from Tier I account before attainment of at 60 years as shown below

- First partial withdrawal allowed after 3 years of NPS account opening

- 2nd & 3rd partial withdrawal can be opted at any time after the 1st partial withdrawal is done

- 25% of the Contribution amount will be allowed for specific purposes like Child marriage, Higher education, Treatment of Critical illnesses, buying home etc.

Tax Benefits and Implications

Benefits

Salaried Individual

- Investment up to 10% of Salary (Basic + Dearness Allowance) is deductible from taxable income u/s 80CCD (1) of Income Tax Act, 1961 subject to 1.5 lakhs limit of section 80C

- Additionally, investment up to Rs.50,000 is deductible from taxable income u/s 80CCD (1B) of Income Tax Act, 1961

Self-Employed

- Investment up to 20% of Gross Annual Income is deductible from taxable income u/s 80CCD (1) of Income Tax Act, 1961 subject to 1.5 lakhs limit of section 80C

- Additionally, investment up to Rs.50,000 is deductible from taxable income u/s 80CCD (1B) of Income Tax Act, 1961

Employers

- Employer contribution towards NPS of up to 10% of employees’ Basic+DA can be booked under expenses in the Income Statement hence allowing for a tax-break.

- Tax benefit for employer & employee are mutually exclusive and hence can be claimed as a tax deduction by both entities

Tax Implications

- Up to 40% of Corpus withdrawn in lump sum is exempt from tax

- Balance amount invested in Annuity is also fully exempt from tax

- Pension received out of investment in Annuity is treated as income and will be taxed appropriately

For Tier II investments, no tax benefit is applicable. However, indexation benefit can be claimed on the capital gains

APPENDIX

Annuity Investment

As discussed above, on exit from NPS or retirement some portion of Corpus must be invested into Annuity scheme to provide monthly pension then after. Entities registered with PFRDA to provide annuity service are

- HDFC Standard Life Insurance Company Limited

- ICICI Prudential Life Insurance Company Limited

- Star Union Dai-ichi Life Insurance Company Limited

- Life Insurance Corporation of India

- SBI Life Insurance Company Limited

Annuity schemes available for NPS subscribers are as mentioned below

| Type of Annuity Scheme | Description |

| Annuity for life | Annuity / monthly pension are paid during the life time of Annuitant. On death, the payment of annuity ceases |

| Annuity guaranteed for 5, 10, 15, 20 years & beyond | Annuity / monthly pension are paid during the life time of Annuitant |

| Increasing annuity at 3% p.a. simple rate | Annuity / monthly pension are paid during the life time of Annuitant. On death, the payment of annuity ceases |

| Annuity for life with return of purchase price in event of death | Annuity / monthly pension are paid during the life time of Annuitant. On death, purchase price is returned to the Nominee |

| Annuity for life with the provision for 50% of the annuity to the spouse of the annuitant for life on death of the annuitant | Annuity / monthly pension are paid during the life time of Annuitant. On death of the Annuitant, 50% of original monthly pension is paid during the life span of Spouse of the Annuitant. On death of the Spouse, the payment of annuity ceases |

| Annuity for life with the provision for 100% of the annuity to the spouse of the annuitant for life on death of the annuitant | Annuity / monthly pension are paid during the life time of Annuitant. On death of the Annuitant, monthly pension is paid during the life span of Spouse of the Annuitant. On death of the Spouse, the payment of annuity ceases |

| Annuity for life with the provision for 100% of the annuity to the spouse of the annuitant for life on death of the annuitant, with return of purchase price on death of the last survivor | Annuity / monthly pension are paid during the life time of Annuitant. On death of the Annuitant, monthly pension is paid during the life span of Spouse of the Annuitant. On death of the Spouse, purchase price is returned to the Nominee |

Charge Disclosure – As regulated by PFRDA

| Intermediary | Charge Head | Charge | Frequency | Mode of Deduction |

| PoP | *Subscriber registration | INR 200 | One time at time of registration | Deducted from initial contribution amount deposited by Subscriber |

| *Contribution processing | 0.25% of the contribution amount subject to minimum INR 20 & maximum INR 25,000 | Per transaction | Deducted from amount deposited by subscriber |

*Above charges are exclusive of GST