Tax season is as certain as sunrise.

You’ll be better off having a hat at all times!

“Request for submission of proof of investments”: This is the email subject I woke up to this morning. I realized that many, just like me, are just so engrossed in the frenzy of daily tasks that we sometimes forget our essentials – like saving tax through 80C deductible investments.

It would be too redundant to list out a comparative table enlisting tax-saving options with their pros/cons and prove how ELSS mutual fund is the best tax-saving avenue in terms of the lowest lock-in period and highest return expectation.

However today, let’s cut to the chase and let me present our top ELSS mutual fund picks for the year 2019 which will not just help you save on taxes, but also help build you some decent wealth.

[table id=39 /]

While these are our top picks for the year, you may choose to invest in the fund that matches your risk-appetite. Remember, the risk reduces as you move from small cap to midcap to large-cap allocations.(Source: Morningstar; data as on 17 Jan 2018; returns are annualized)

While ELSS is the only tax-saving investment option with a lock-in period as low as three years, the equity component has been the largest wealth creator when it comes to asset classes.

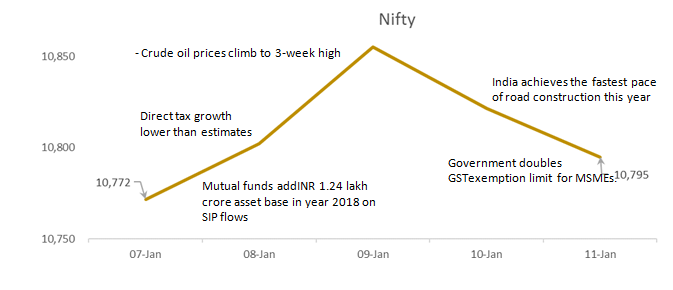

While equities work like a gold mine which takes years to mine, but at the end delivers a fortune, it only helps to see what has been moving this mine in the past week.

Now that you know the necessity of ELSS go ahead and invest through Fisdom .