What are Multi cap funds?

A Multi cap fund is an open ended equity scheme typically investing 65% of total assets in equity and equity related instruments. Multi cap funds can invest in stocks across market capitalization i.e. their portfolio comprises of large cap, small cap and mid cap stocks.

Why one should invest in Multi cap funds?

Multi cap funds have the flexibility to invest across market cap which enables the fund manager to tactically play on market valuations. For example in times where market is volatile the fund manager will increase portfolio exposure towards large cap stocks to limit downside.

As compared to pure mid cap/small cap funds, these funds are less risky and popular among investors who are less aggressive about returns.

Who should invest in Multi cap funds?

Investors who don’t want to get into the trouble of stock-picking or deciding which market capitalization fund would suit them may opt for multi cap funds. It is an ideal choice for investors who want to take exposure to broader equity segments.

Investor who have moderate risk appetite and investment horizon of more than 7 years can invest in this scheme. It is suitable for investors who can take slightly higher risk to earn higher returns compared to large cap funds.

What is tax implication on multi cap funds?

Since Multi cap funds invest more than 65% in equity and equity related instruments they carry taxation under equity oriented schemes. Gains earned on equity oriented schemes are taxable depending on holding period. Gains on investment horizon of upto 1 year are called short term and the rate of tax applicable is 15%.

Gains on Investment horizon of more than 1 Year are called Long Term Capital Gains. Long Term Capital Gains over and above Rs.100,000 are taxable at 10% without indexation.

Available Multi cap funds:

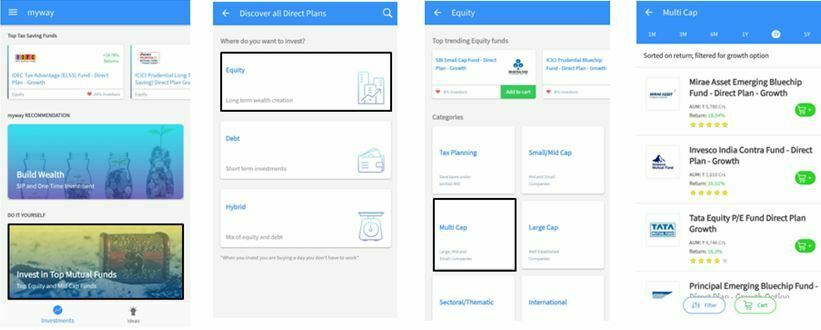

How to invest in Multi Cap Funds:

1. Log in on your Fisdom app