Macroscope: RBI Monetary Policy Meet

Economy | Monetary Policy| Beyond

A move towards new normal

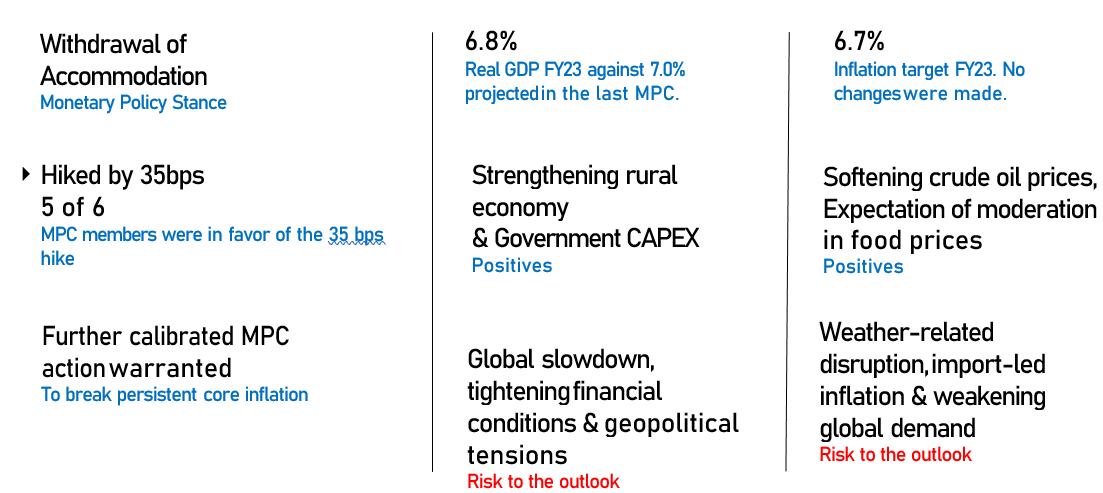

Key MPC Announcements:

CPI Vs. Policy Rate Response

RBI executes a rate hike for the fifth consecutive time this year in a gambit to control inflation

- The six-member Monetary policy Committee (MPC) of the Reserve bank of India increased the policy repo rate by 35 basis points to 25 per cent on December 07, 2022. The total rate hike done by RBI is 225 bps to date.

- The hike in the benchmark interest rate was very much on expected lines as inflation continued to stay above 6 per cent, the upper level of the tolerance band of the RBI since January This is the fifth such rate hike by the central bank this year. We expect RBI to hike the rate by another 35-45 bps in the next MPC.

Fixed Income Play

What should investors do?

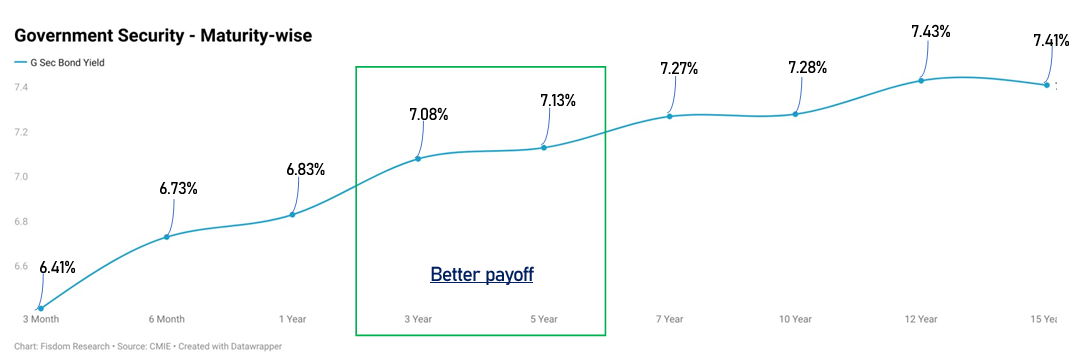

Government security – Maturity-Wise

- We view the interest rate cycle as close to, but not fully peaked, out Intermittent volatility is imperative.

- Current spreads warrant exposure to fixed-income portfolios with an average effective maturity between three to five years or a matching holding horizon, whichever is lower, while prioritizing a lower modified duration over a higher

- Target maturity funds with defined maturity and Held-Till-Maturity structures will be accretive to fixed income Within the segment, we lean toward PSU and SDL debt mixes versus corporate bonds. We maintain our view to orient portfolios towards a sovereign and AAA-rated securities.

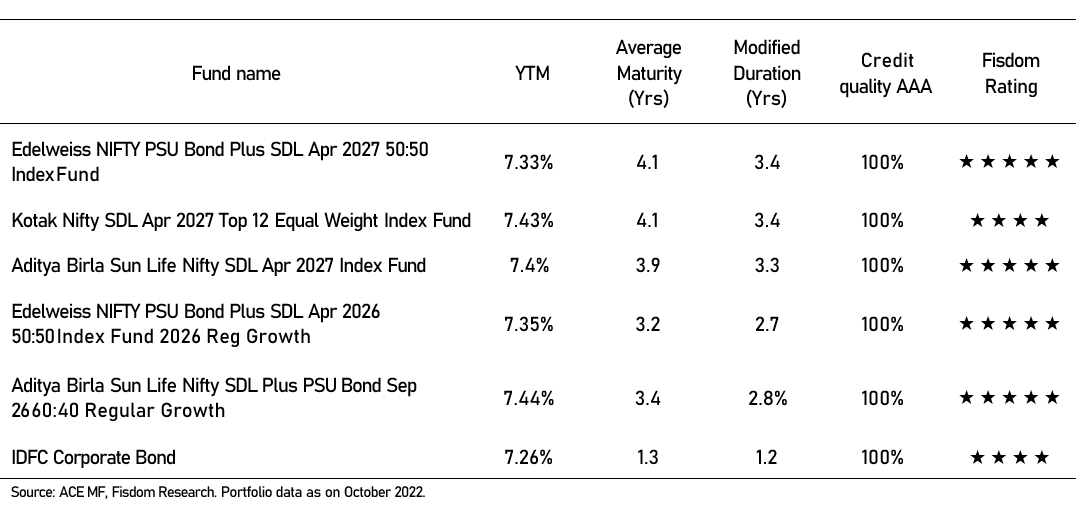

Promising short and medium-term target maturity and open-ended funds

Most follow a roll-down strategy