With the budget shockers and global sell-off, Indian equities are going through challenging times. With regards to the budget, the government did announce a few reforms like the introduction of Long Term Capital Gains (LTCG) tax on equities which may have caused some knee-jerk reaction. I can agree to the fact that it is an inconvenience; however, reactions may have been blown out of proportion to a certain extent

Global markets are undergoing a long due correction and Indian equities are taking cues from the same. However, the underlying reason is strong global growth in key developed markets like the US and UK. After a slump for almost five years, ~mid-2017 onwards, earnings have performed impressively with over two-thirds of the S&P 500 companies beating earnings estimates. It sounds surprising that strong global growth is leading to fall in markets. The reason attributed is that this growth is leading to inflation, which in turn will lead to increase in interest rates and thus the interest cost for companies will go up. We believe as long as there is strong growth, markets will continue to inch up and give the highest returns among all asset class.

Back home, the promising outlook for Indian economy also continues to remain intact. With the demographic dividend in place for India and the structural reforms being rolled out, we can expect a positive effect show up in the upcoming quarters.Here’s a quick round of facts, the Indian economy is now 2.5 trillion-dollar economy – seventh largest in the world. On Purchasing Power Parity (PPP) basis, we are already the third largest economy. Meanwhile, Moody’s has increased India’s sovereign rating from Baa3 to Baa2 further strengthening the case for India’s growth.

Indian society, polity and economy had shown remarkable resilience in adjusting with the structural reforms. GDP growth at 6.3% in the second quarter signaled turnaround of the economy. IMF, in its latest Update, has forecasted that India will grow at 7.4% next year. While manufacturing is recovering well, the service sector is poised for growth rates of 8% plus. Meanwhile, exports are expected to touch a growth rate of 15% by the end of this FY.

Such strong positioning and macro-economic fundamentals will only push Indian equities ahead and give the highest return among all asset classes

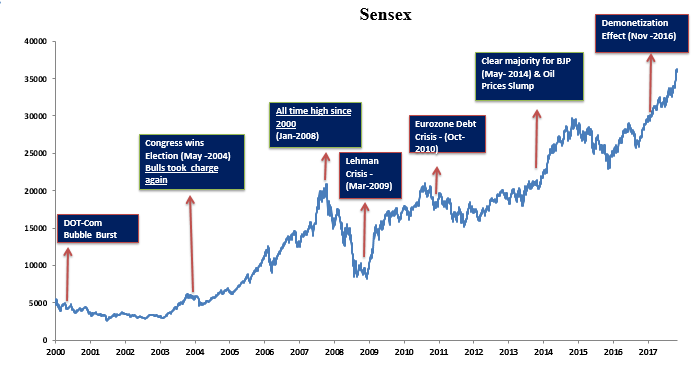

The following graph just shows how the Indian Equities have gone through much severe events than a mere ‘budget’

Like we have seen in the recent past with demonetization and GST, the markets may display a knee-jerk reaction to structural reforms, but in due course of time we only find everyone cheering.

____________

“Markets tank as budget shoots down investor expectations” and similar headlines are dominating the finance sections of all news publications as the equity markets are dwindling at quite a pace. While there’s a lot of chaos, opinions and analytical charts floating around, nobody’s really guiding the small guy on the street – the middle-class Indian who has been trying to meet his financial goals through consumer products like mutual funds and concepts like SIP.

Today, you are more likely to receive one of the two common advices offered by almost everyone you know (irrespective of their proficiency in the world of investments) – “this is an opportunity to buy more for less” or “everything’s going down the drain, save whatever you can”. Alas, only if analyzing such situations were so straightforward!

At the very outset, we would like to establish one prime fact – ‘Nobody, literally nobody, can time the market precisely though many are paid to try!’

So, if you are a common Indian trying to add value to your investments by taking some action, step back and pause at least till you read through this piece.

Stop reading ahead if you never intended to touch this money till after five years from now

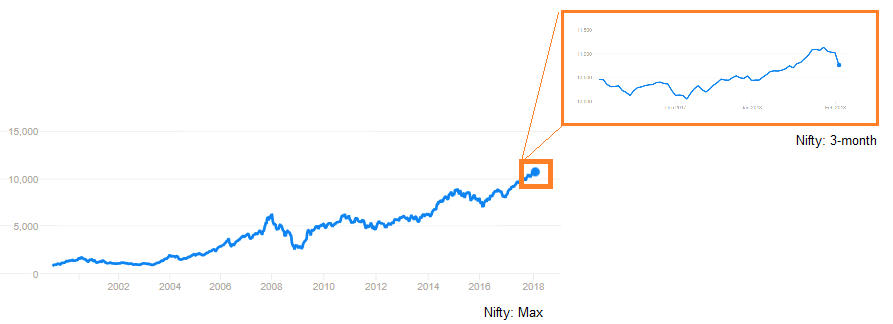

No, seriously. If you had invested for a goal that is at least five years away from today with an understanding that the volatility smoothens out over a longer period, these are testing times. Equity as an asset class is the only to offer superior inflation-adjusted returns over a longer term. Take a closer look at the Nifty chart, short-term would always be volatile, while with a broader term perspective the uptrend is clear.

In the shorter term (the 3-month chart- top right) Indian equities might look scarily volatile. However, with a closer look you would observe that the past quarter is not even a blip in the total growth trajectory. Also, you must take note of the fact that though there are bouts of volatility, Indian equities have a history of bouncing back harder.

If you have a longer-term goal, it is highly advisable to put that pink newspaper down, lay back and sip your favorite cup of tea.

Are you a long-term equity investor? Here’s what you should do.

Case 1: You are an SIP investor.

In case you have been investing through the SIP route, it is recommended to continue your SIP. The better news is that this dip in the market is no less than an attractive sale for an investor to buy more. By continuing your SIP you will essentially start averaging your purchase price at lower levels which only strengthens the case for your long-term high returns.

Case 2: You have invested a lumpsum amount

If you have invested into an ELSS fund for tax saving, there’s no option but to hang in there till the investment completes the lock-in of three years. For any other equity/equity-oriented funds we recommend holding on as Indian equities will pass this phase and recover in due course of time. However, having said that, it is recommended to rebalance your portfolio if your goals are a year or lesser away. If this is the case, please reach out to the fisdom experts and let us guide you through this storm.

Reach out to the Fisdom experts on 080-3040-8363 or write to us at ask@fisdom.com