What Is The Latest Reading?

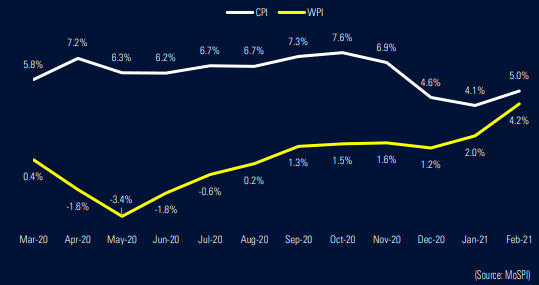

India’s wholesale inflation more than doubled from previous month figures to hit a 27-month high, since November 2018. February 2021 inflation stood at 4.17% vs. 2.03% in January 2021, increasing for second consecutive month.

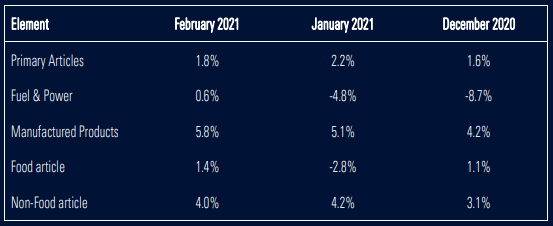

WPI maintained its record of positive figures, signaling producers regaining pricing powers. The rise in WPI is mainly due to price increases of commodities in Primary Articles and Fuel & Power.

Wholesale food index jumped from -0.26% in January to 3.31% in February.

Element Inflations

Analyst Commentary

Low base effect and expected pick-up in food prices (after remaining soft for months) will be key sub-elements to observe in future readings for the wholesale price index. Pick-up in demand, and rising commodity prices can further influence the metric on the upside.

In the manufacturing vertical (index weight = 64.23%), 17/22 elements witnessed price rises due to higher input costs. Key input material in oil saw price surge due to hopes demand improvement on the back of COVID-19 vaccinations. Declining crude oil inventories in U.S., tighter supplies from OPEC, and rising govt. taxes, further supported oil prices to reach its pre-pandemic level.

Post-covid clarity and supportive govt. policies will be instrumental in charting demand-&-supply discipline, thus assigning sensibilities in printing WPI expectations in the near-term. RBI can act as catalyst for the same by resorting to out-of-the-norm practices to ensure successful transmission of rate cuts, thus meriting organization in charting interest (borrowing/lending) rates.

Click here to read MoSPI’s original press release on “New CPI For February, 2021”