What is index of industrial production data (IIP)?

IIP measures the industrial production on a monthly basis, highlighting state of 3 growth driving verticals. It is a key indicator of the manufacturing sector of the economy.

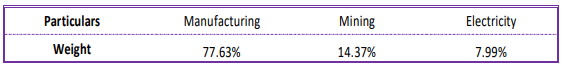

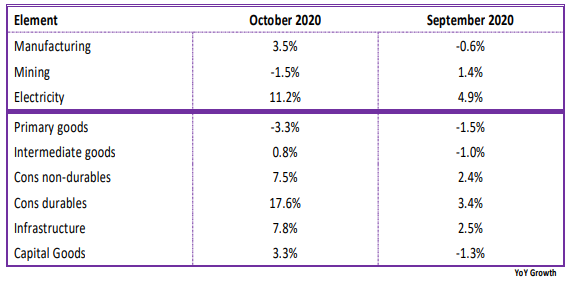

Its Economy based are as follows:

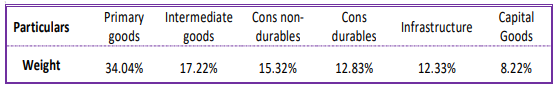

Its Use based are as follows:

What does IIP Index data mean for Financial Markets?

It serves as an indicator of corporate earnings, influencing equity & debt investors alike.

It is also a good parameter to understand the industrial activity in the country.

IIP Reading – October 2020

What is the latest reading?

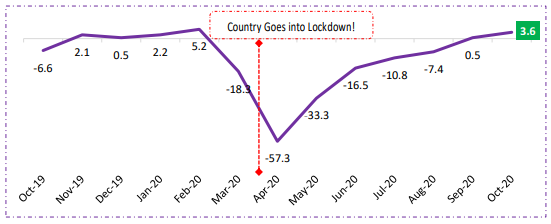

IIP grew by 3.6% in Oct’20 vs 0.5% in Sep’20 and -6.6% in Oct’19 .

Investor Takeaway

IIP maintained positive trend for 2nd straight month with growth rate touching an 8- month high. Previous high was in Feb’20 when IIP grew by 5.2%.

The rise in IIP can be attributed to buoyancy of festive demand and favorable base effect.

IIP during April -October 2020 recorded contraction of 17.5% from year ago period, as disaggregated data continues to question longevity of uptrend in very near periods.

Element Trajectory

Revival of demand and consumption can be hinted by growth seen in consumer durables, non-durables and electricity elements.

Consumer durables is the only production element to surpass its pre-covid levels, Capital goods (indicating investments) — showed growth after 21 months of contraction.

Segment study continues to show wavering demand strength, as sub-sectors bounce between tenacity with tentativeness.

Even after recording positive growth, said element is sitting 6% below its pre-covid level.

In the post-lockdown economy, manufacturing has enjoyed a uphill climb with its peers in contact-intensive services, such as hospitality, transport and tourism yet to see signs of green shoots. The next 2-3 months will be pivotal in charting country’s production health & wealth and build confidence into commentary on the upside.

Click here If you want to read the complete IIP Index press release.