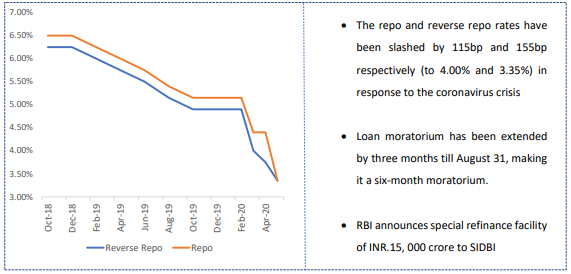

MPC Recap till date

MPC Reading – July 2020

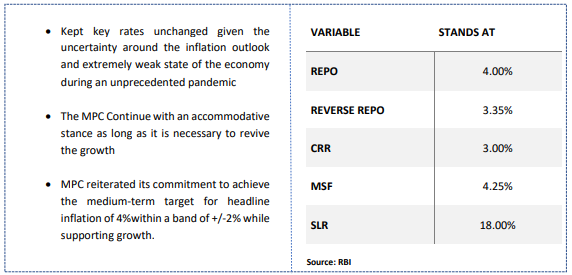

What is the latest reading?

Growth & inflation outlook projection:

Growth: For the first half of the year, RBI expects GDP growth to be contraction zone and real GDP growth to be negative for the year 2020-21. This is on the back of negative consumer confidence in July, weak external demand, and contraction in global trade.

Inflation: Food inflation has been elevated since the pandemic outbreak. Headline inflation is expected to continue at elevate levels through Q2FY2020-21. Supply chain disruptions continue as re-clamping of lockdown in a fragmented manner continues to add pressure. Inflationary pressure also evident across segments.

Other Highlight:

Liquidity reported as essential for effective transmission of rate cuts. Incremental focus on liquidity support for financial markets, improved credit flow, digital payments and leveraging technology. Liquidity measures include INR 10KCr. Liquidity to NABARD & NHB, provisioning to allow stressed MSMEs to restructure debt, Gold loan LTV enhanced to 90% of value

Key takeaways:

As signs of revival defer and the pandemic is yet to taper significantly, the Central Bank may want to have enough rate headroom as dry powder and err on the side of caution. Improved statistics on containment efforts of the pandemic may nudge the Real GDP situation into the positive trajectory soon. RBI is being judicious with the use of monetary tools which seems like a good idea as world economies continue to stare into the fog.