What is the latest Services PMI reading?

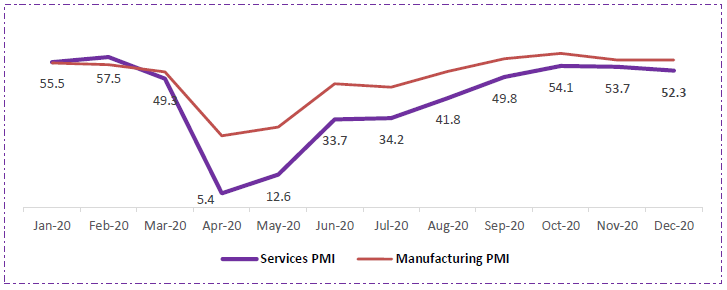

India Services PMI fell to 52.3 in December 2020 from 53.4 in month prior. Touching its lowest in 3 months, the reading still maintained growth trajectory for 3rd month in a row.

A reading above 50 denotes expansion and below 50 denotes contraction.

The slowing services PMI adds to uncertainties about strength of current economic recovery, as other high-frequency indicators such as IIP, auto sales, railway freight, power demand, and exports—have exhibited mixed trends in recent months.

The active manufacturing and distribution of covid vaccine will expedite gradual recovery process and help with uncertainty regarding pandemic and input inflationary pressures (rose at fastest pace since February of last year).

Another impediment was observed in continuous job shedding, courtesy of liquidity concerns, labour shortages and subdued demand. Payroll numbers witnessed decline for the 9th time in the last 10 months.

Reduced workforce with higher raw material cost saw new business and output rise at the slowest pace in last 3 months. This spillover of crunched top & bottom-lines dampened overall positive sentiment vis-à-vis month prior.

Global COVID-19 restrictions, particularly travel bans, reportedly restricted international demand for Indian services at the end of 2020. New export business decreased sharply, but at the slowest pace since March.

Sub-sector data highlighted Transport, Consumer Services, and Finance & Insurance as the brightest spots where sales and output expanded in December. Contractions were noted in Information & Communication and Real Estate & Business Service.

As is seen globally, manufacturing PMI continues to out-perform its services counterpart, courtesy of the latter being hit harder by Covid-19.

The coming times can see risk tilting towards the upside due to possible faster recoveries in population mobility and household spending. Agencies revising their growth estimates for India in short-term bodes well for country’s macro indicators.

The key risks will continue to be unforeseen events resulting from the virus, and current steep rates of inflation.

Click here If you want to read the complete Services PMI HIS Markit press release