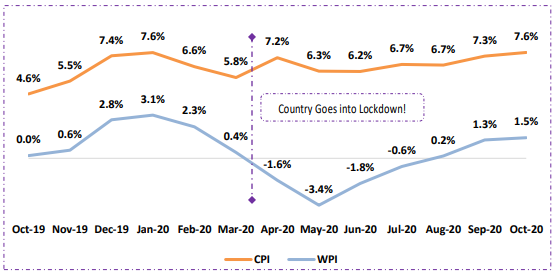

What is the latest WPI reading?

India’s wholesale inflation touched its highest figures in last 8 months, coming in at 1.48%. WPI Inflation sustained its uptrend, increasing for 3rd consecutive month. WPI inflation stood at 1.32% in September 2020 and 0.2% in October 2019.

WPI maintained its record of positive figures, signaling producers regaining pricing powers. Unlocking 4.0 is yielding positive results by aiding in expedited stabilization of demand and supply dynamics post the coronavirus-triggered lockdown.

Element Inflations

It is not appropriate to compare WPI inflation in post pandemic months with months preceding the COVID 19 pandemic.

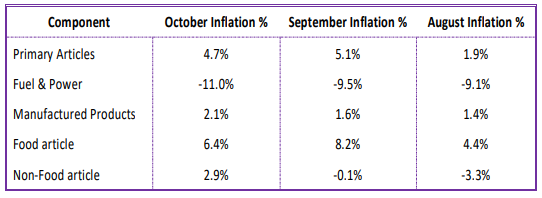

The rise in WPI is mainly credited to rise in price of manufactured items. Element study breakdown shown below:

❖ Primary Articles (Weight – 22.62%)

• Index value increased to 152.4 from 150.3 in prior month, carrying overall uptick of 4.7%

• Rise in prices of vegetables and potatoes continued to remain high, pushing WPI on the upside

• While Food article prices softened, Non-Food articles jumped significantly, recording inflation contributions at 6.4% and 2.9% respectively

❖ Fuel & Power (Weight – 13.15%)

• Index value increased to 91.1 from 91.0 in prior month, with WPI element recording -11% inflation

• Price for electricity increased, while prices of mineral oils declined. Coal prices remain unchanged

❖ Manufactured Products (Weight – 64.23%)

• Index value increased to 120.3 from 119.8 in prior month, with WPI element recording 2.1% inflation

• 13/22 elements witnessed increase in prices, whereas, remaining 9 elements witnessed a decrease in price

❖ WPI Food Index

• The Food Index consists of ‘Food Articles’ from Primary Articles and ‘Food Product’ from Manufactured Products

• While index value increased from 157.6 to 159.3, WPI inflation rate fell to 5.8%

• Unlike in WPI, food inflation was major reason for sharp uptick in CPI inflation

Investor Takeaway

WPI can see minimal lifts on the upside before normalization of “New Normal” and higher base effect comes into play.

Momentum of pick-up in vegetable prices, with higher demand on the back of festive season and unlockings will keep core inflation at elevated levels.

The rich monsoon and smoothening of demand will play key roles in determining inflation print in times to come.

As of today, rising retail food inflation and declined wholesale food inflation will present a policy challenge and hold influence on RBI meet between December 2-4.

RBI has taken note of the same in report on state of economy, flagging unrelenting pressure of inflation as a downside risk to expected economic recovery.

“The foremost is the unrelenting pressure of inflation, with no signs of waning in spite of supply management measures…There is a grave risk of generalization of price pressures, unanchoring of inflation expectations feeding into a loss of credibility in policy interventions and the eventual corrosion of the nascent growth impulses that are making their appearance,” RBI said.

Hence, it is likely to remain on pause in December meet and consider rate-cuts only after efficacy in transmission of prior rate-cuts.

It is likely for RBI to lean towards out-of-the-norm practices to continue to channelize Demand-&-Supply behaviour in the country.

Click here If you want to read the complete WPI Inflation press release