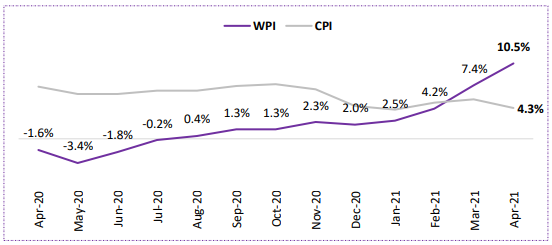

What is the latest WPI reading?

India’s wholesale inflation touched its highest figures in last 11 years, coming in at 10.49%. It was primarily led by broad based increase in food, fuel and manufactured products inflation. A low base effect and rising global commodity and oil prices imply WPI inflation to go up even further. Pass-through into consumer prices may seem

inevitable if expected normal monsoon does not materialize.

WPI maintained its record of positive figures, signaling producers regaining pricing powers. Food inflation edged up to a 15-month high of 7.6% in Apr’21 from 5.3% in Mar’21. It carries much higher weight in CPI (39.06%) compared with WPI (24.4%).

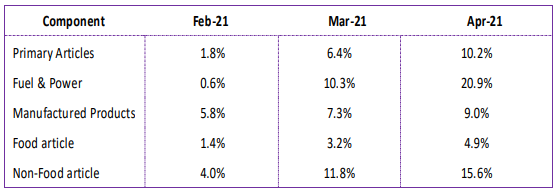

Element Inflations

Buildup of pricing pressure amid supply chain disruptions amidst the second wave of Covid-19 pandemic has contributed heavily to the rise in inflation on the wholesale level. Core inflation rose to its highest level in 2011-12 series at 8.4% in Apr’21 from 7% in Mar’21.

Manufactured products inflation rose by ~168bps to 9% from 7.3%. Of the 22 commodities, prices of 17 commodities rose, with basic metals, rubber, food and chemical products taking the lead. With international commodity prices firming up by another 1% in May’21, and unfavorable base till Sep’21, manufactured product inflation is to remain elevated. It is due to increased contribution of these items to WPI at 72.6% during February-April 2021 vs -34.4% during September-November 2020.

As pressures on perishable food prices ready for a go on the downside, other factors such as supply-side disruptions, and higher labor charges can dampen hopes of drop in inflation in coming times. The disruptions at primary mandi level may further add insult to injury in narrating the diminishing impact of multiplier effect.

The 3.8% MoM WPI increase vs 1% MoM in CPI in current month highlight greater impact of supply chain disruptions at the wholesale level. In fact, it recorded higher figures than CPI for second consecutive month. It overlapped the latter for the first time since April 2019, with gap (1.9%) as wide last seen in November 2018. Even though WPI and CPI comprise of different constituents, the rising wholesale prices of overlapping items (such as certain food items) indicates tougher times for its consumer counterpart in times to come.

Post-covid clarity and supportive govt. policies will be instrumental in charting demand- &-supply discipline, and hence printing WPI expectations in near-term. RBI to ensure successful transmission of rate cuts, before taking any further action in rate cuts.

An interesting observation lies in collaborative reading of PMIs with rising WPI, highlighting much-awaited input price pressure. “Inflation trajectory over the rest of the year will be shaped by the Covid-19 infections and the impact of localized containment measures on supply chains and logistics,” says RBI Governor Shaktikanta Das

Click here to read Office Of Economic Advisor’s original press release on “Index Numbers of Wholesale Price in India for the month of April, 2021”