What is the latest reading?

India’s retail inflation eased for 3rd straight month, registering 16-month low figure.

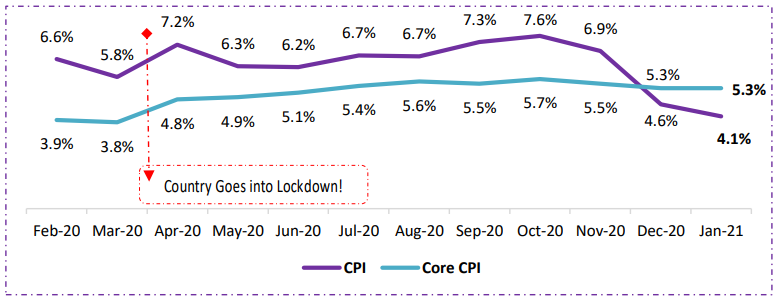

Inflation came in at 4.06% in January 2021 vs 4.59% in December 2020, thus staying in-line with RBI tolerance level for 2nd consecutive month. Core CPI remained unchanged at 5.34% after rising to its highest in ~2 years at 5.51% in Nov’2020.

Inflation has seen significant downfall over the last few months, considering it registered its highest ever levels in October 2020, and was above RBI tolerance level for 8 consecutive months up to November 2020. With inflation reducing & IIP expanding, economy is finally emerging from the long shadow of coronavirus pandemic.

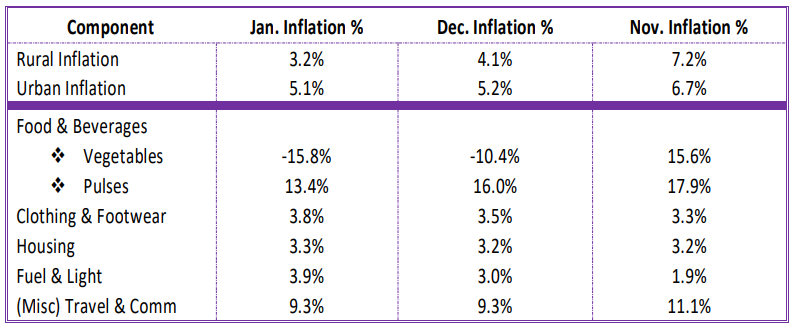

Element Inflations

Investor Takeaway

The fall in inflation can be credited to continuous fall witnessed in vegetable prices which slipped 15.8% YoY and 10.4% in last 2 months respectively.

High base-effect came into play too in seeing inflation picture a softer print. The base play can misguide real inflation figures in H1CY2021, courtesy of extraordinary inflation seen in comparison figures.

The continued downtrend in veggie prices were countered with broad-base increase in other food items. The after-effect of unlockings has translated into higher oil prices as prices follow an upward trajectory, thus posing as risk to inflation metric in coming times.

The rate of price rise in the food basket was 1.89% in January, significantly down from 3.41% in December.

As pressures on perishable food prices ready for a go on the downside, other factors such as increased input and output costs, higher labor charges and rising oil prices can dampen hopes of drop in inflation in coming times.

Core-inflation is expected to chart a similar trajectory as demand-side factors continue to battle the covid brunt.

In last bi-monthly monetary policy meeting, the central bank kept its key interest rates unchanged while maintaining its accommodative stance. Continuing to focus on growth via polices and packages, RBI is to use an arsenal of unique liquidity and similar supportive strategies to maintain current pace of expedited growth.

Broad-based domestic and global economic recovery should improve aggregate demand, posing an upside risk to inflation. Favorable base effect, appreciating rupee and any risk of new covid-strain led slowdown, will be a tailwind for CPI inflation.

It is likely for RBI to remain on pause in April meet and consider rate-cuts in near future after efficacy in transmission of prior rate-cuts.

Click here If you want to read the complete CPI Inflation press release