What is Gross Domestic Product (IIP)?

Gross domestic product (GDP) is the market value of all final goods and services produced within a country’s borders in a specific time period. It functions as a comprehensive scorecard of a country’s economic health.

GDP Computation (Method I) – The Factor Method:

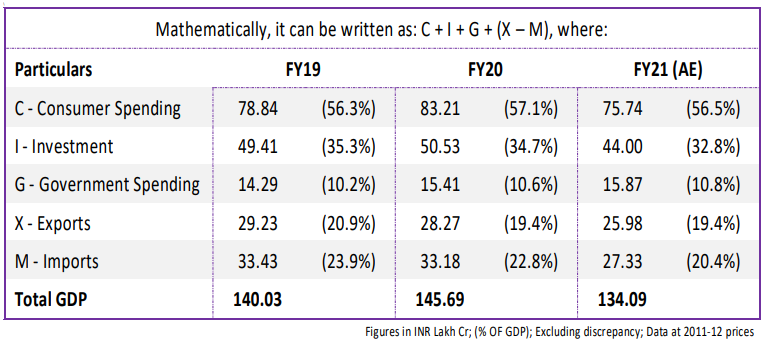

GDP Computation (Method II) – The Expenditure Method:

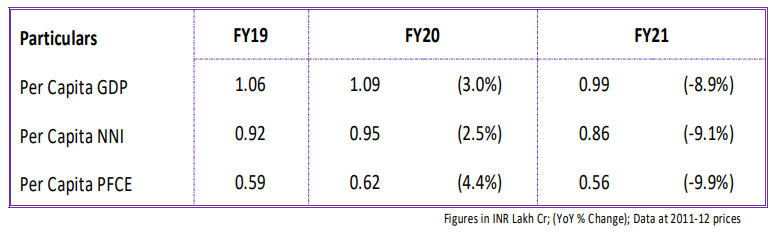

Per Capita Data – Income, Product, & Final Consumption

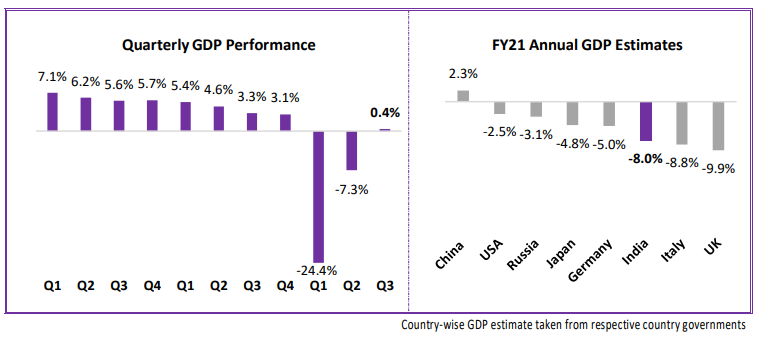

GDP Reading – Quarter Ended October – December 2021

Indian economy returned to growth in Q3FY21 with GDP & GVA reporting 0.4% and 1.0% after 2 consecutive quarters of contraction. 6%+ growth in Construction, Financials, Real Estate and Services were key drivers for growth, marking return to pre-pandemic health and strengthening of V-shaped recovery.

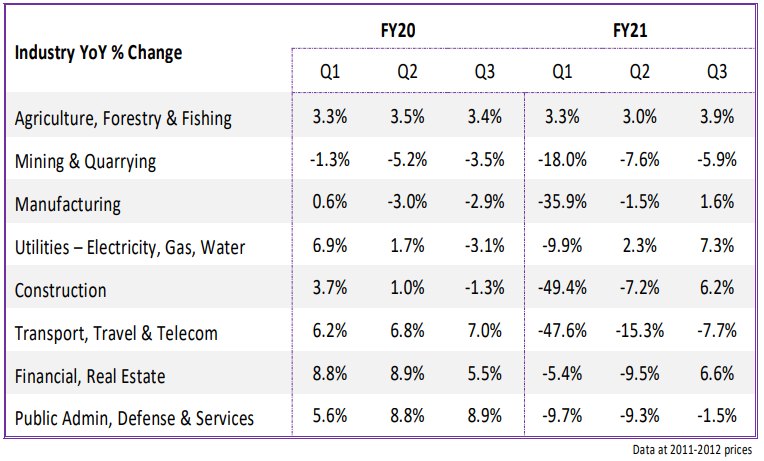

Industry Study

Of all elements, fall in government consumption expenditure in latest quarter surprised on the downside, even when Centre’s revenue expenditure increased by 19% Y-o-Y in Q3. The data reads the possibility of rolling-back of expenditure by states and local bodies, potentially reducing volume of indirect demand in coming times.

If states are to not pick-up spending, public sector contribution to GDP can continue its declining trend from 16.4% in Q1Y21 to 9.8% in current quarter.

On the other hand, Govt championed its aggressive capex plans, reflected in investment growth of 2.5% (YoY) and 13% (QoQ). Signaling re-birth of capex cycle, the buoyed investment demand in infra/capital construction seeped into healthy IIP figures of 2.4% growth in Q3FY21.

Consumer demand, measured by Private Consumption Expenditure repeated contraction, falling by 2.3% vs 11% in last quarter. Second advance estimates of stronger fiscal support, normalizing of supply chains, vaccination drives and visible stability in labour market act as supporting arguments for demand to pick-up in times to come.

The agriculture sector, the only growing sector of the economy in prior 2 quarters, continued its up-run, registering a 3.9% rise in Q3.

Pseudo non-elastic demand in utilities like electricity, gas and water supply reported healthy growth on the unlocking of the economy and festive season in the quarter. High frequency data suggests modest growth in this segment even as demand is may taper off due to high-base effect of previous quarter.

On the external front, the current account grew into deficit in Q3FY21, after surplus in the previous quarter, for the 1

st time in more than 2 decades. Driven by imports correction (-4.6% YoY in Q3 FY21 v/s -18.2% YoY in Q2 FY21), it augurs well for domestic demand recovery. Exports, on the other hand, witnessed increased contraction to 4.6% from 2.1% YoY in prior quarter. This was a result of foreign demand being impacted by COVID resurgence and follow-on restrictions across major Indian export destinations.

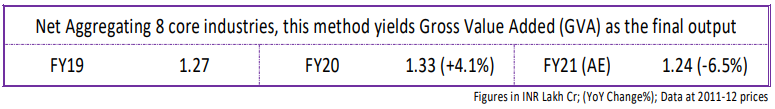

GVA growth metrics for FY21 has been revised upwards to (-) 6.5% from (-) 7.2% earlier, courtesy of revival of Transport & Travel segment. Further, govt.’s flagship ‘Atmanirbhar’ policy and broadening PLI scheme will be instrumental in printing GDP growth for the near and short-term, with long-lasting effects on long-term growth.

Risks to micro-&-macro growth in India can come from uptick in covid cases, unexpected inflationary events, critical role of private play in demand-&-supply, and continued string of strong reform-rhetoric endorsed by public individuals and institutions.

Click here If you want to read the complete Manufacturing PMI HIS Markit press release