What is Manufacturing Purchasing Manager’s Index (PMI)?

The Manufacturing PMI is a performance measurement of the manufacturing & services sector, derived from a 500 manufacturing companies’ survey. It aids in gauging business activity and confidence levels.

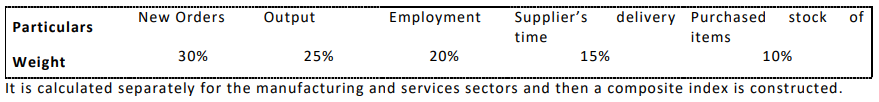

Its weighted components are as follows:

How to read the PMI data?

>50 figures indicate an expansion of the manufacturing sector compared to the previous month.

<50 indicates a contraction.

=50 indicates no change

What does PMI data mean for Financial Markets?

It serves as an indicator of corporate earnings, thereby, influen cing equity & debt investors, alike. It is also a good parameter to compare attractiveness of an economy vis-a- vis another competing economy.

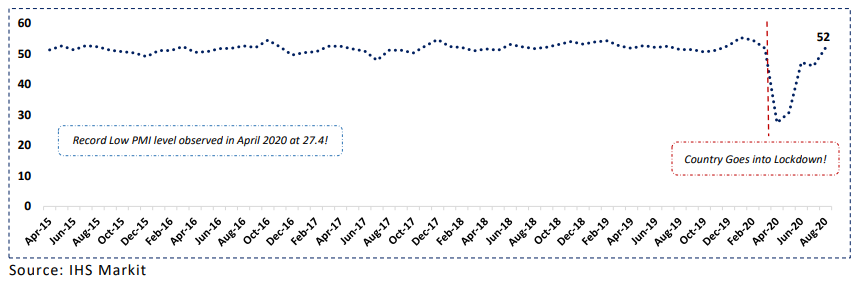

PMI Reading – August 2020

What is the latest reading?

The PMI figure in August 2020 stands at 52, compared with 46 in July, recording 1st growth in last 5 months.

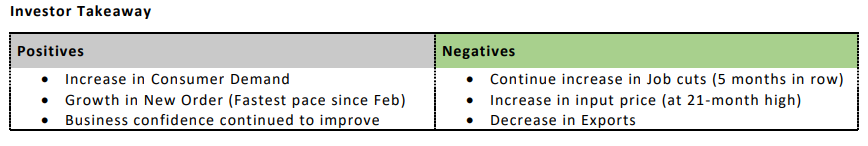

The increase in virus cases continues to keep risks of state lockdowns at bay. We continue to expect possible disruptions in near-term, given the current domestic market uncertainties. Further ahead, even when containment measures are lifted, the extreme damage that has been inflicted to corporate balance sheets means that many firms will continue to struggle. And a weak labour market will also keep a lid on household i ncomes and demand. The employment component of the manufacturing PMI helps to illustrate this point: at 45.5, it barely edged up in August. In all, the recovery in the manufacturing sector is likely to prove slow and fitful .

Click here to read the detailed press release