What is Wholesale Price Index (WPI) Inflation?

The WPI Inflation is a macroeconomic indicator of inflation, tracking the change in the prices of goods sold and traded in bulk by wholesale businesses to other businesses.

Even as the WPI is used as a key measure of inflation in some economies, the RBI no longer uses it for policy purposes, including setting repo rates.

Its weighted components are as follows:

How to Calculate & read the WPI inflation data?

WPI Inflation is calculated as a weighted average of the price changes of components basket.

Mathematically, it can be written as: (Price of basket in current period / Price of basket in base period) x 100

Currently, 2012 is used as base year for inflation calculation and reading purposes.

What does WPI Inflation data mean for Financial Markets?

Tracking prices at the factory gate before the retail level, WPI helps understand the supply and demand dynamics in industry, manufacturing, and construction. It is also a good parameter to evaluate the investment potential of a country by foreign and domestic investors alike.

WPI Inflation Reading – August 2020

What is the latest reading?

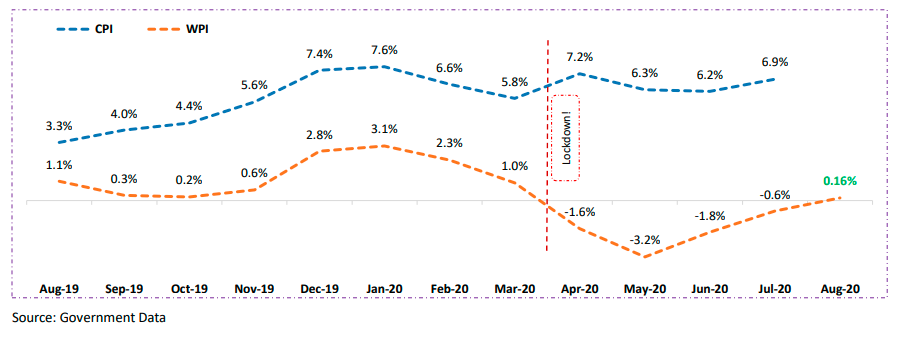

India’s Wholesale inflation up at 0.16% after being in negative zone for 4 months. It was at -0.58% in July and is up from May lows of -3.2%.

Investor Takeaway

WPI recorded positive figures, signalling that producers are slowly regaining pricing power. Unlocking 4.0 is yielding positive results as it is expediting the stabilisation of demand and supply dynamics, post the coronavirustriggered lockdown.

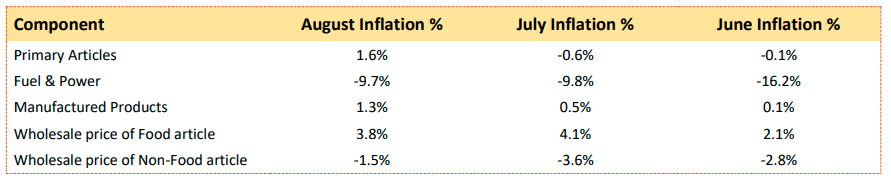

Individual Inflation Internals:

Component based Inflation statistics are as follows:

It may not be appropriate to compare the CPI inflation in the post pandemic months with the CPI for months preceding the COVID 19 pandemic. Hence not comparing with pre-pandemic numbers.

The correction of crude and mineral oil indexes in recent has reflected in narrowing core disinflation. Supply chain disruptions which led to a spike in inflation is being tackled through opening of economies.

As virus cases continues rising, short-term systemic challenges will continue to remain prevalent, thus feeding uncertainties and dampening new-found optimism. The heavy pour this season will offer modicum of relief by pushing food prices down, thereby cushioning WPI inflation in the months to come.

A similarly sharp jump in core CPI inflation last month would jeopardise our view that the RBI will loosen policy again before the end of 2020 to support the slumping economy

Click here If you want to read the complete WPI Inflation press release