What is Consumer Price Index (CPI) Inflation?

The CPI Inflation is a macroeconomic indicator of inflation, tracking the change in retail prices of goods and services which households purchase for their daily consumption.

Helping ascertain the country’s economic health, central banks actively design monetary policies to keep inflation under control. India’s target inflation range is 4 (+/-2)%.

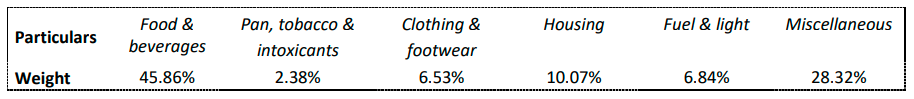

Its weighted components are as follows:

How to Calculate & read the CPI inflation data?

CPI Inflation is calculated as a weighted average of the prices of commodities.

Mathematically, it can be written as: (Price of basket in current period / Price of basket in base period) x 100 Currently, 2012 is used as base year for inflation calculation and reading purposes.

What does CPI Inflation data mean for Financial Markets?

It serves as an indicator of purchasing power of a nation’s currency, and shines light on the broader demandsupply situation in said country. It is also a good parameter to evaluate the invest potential of a country by foreign and domestic investors alike.

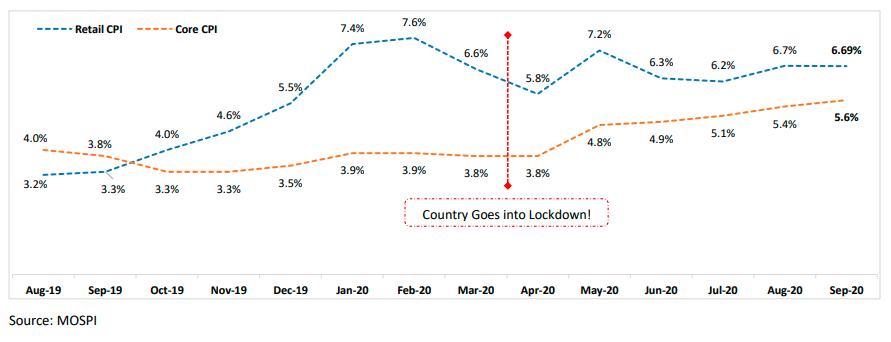

CPI Inflation Reading – August 2020

What is the latest reading?

India’s retail inflation dips marginally to 6.69%, continuing to stay above RBI tolerance level for 5th consecutive month. Retail was 6.93% in July 2020 and 3.3% in August 2019.

Investor Takeaway

At over 6%, inflation remains just above the MPC’s tolerance band of 4 (+/-2)%, creating a stagflation-like scenario where inflation is high despite a collapse in growth (Sharpest contraction of GDP on record at -23.9%).

Individual Inflation Internals:

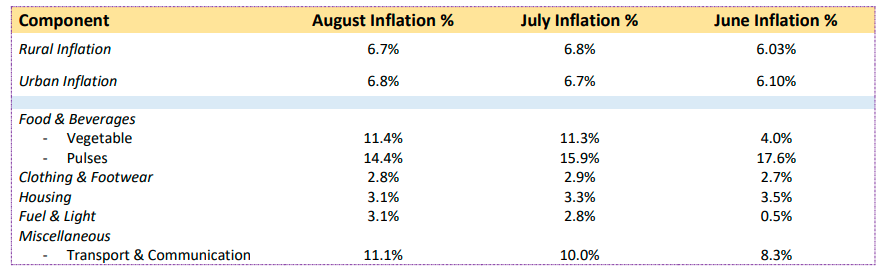

Component based Inflation statistics are as follows:

It may not be appropriate to compare the CPI inflation in the post pandemic months with the CPI for months preceding the COVID 19 pandemic. Hence not comparing with pre-pandemic numbers.

The CPI’s current elevated levels justifies (in retrospect), RBI’s decision to take a pause in the rate reduction cycle. Clearly, supply chain issues are front-runners for increased inflation appetite as is reflected in higher food (specially vegetables) and transportation costs. Supporting the system with tools like liquidity measures and restructuring facility, will propel economic drive in coming times.

As virus continues building blocks of uncertainty, we expect supply challenges to sustain over the short-term.

Central bank is to vouch for rate-cuts only after effective transmission of prior cuts and on outcome-assessment of outside-the-box policy actions. Hence, it is likely to remain on pause on the October meet and consider ratecuts in the December meeting.

Click here If you want to read the complete CPI Inflation press release.