(This article has been published in Finsight- February 2017)

(This article has been published in Finsight- February 2017)

LIC Jeevan Akshay VI has been a heavily advertised product in the insurance space. This is an immediate annuity scheme (the one where you pay a lumpsum amount and receive a regular income stream for a definite period or life) with multiple payout options and tenures.

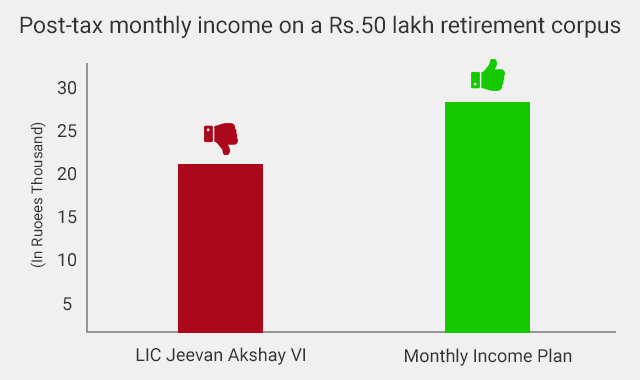

The LIC Jeevan Akshay VI scheme offers an annual return between 6.9%-7.4%, with a return of principal, – where the rate offered is higher for older investors. For instance, if you have saved Rs 50 lakh towards retirement and invest this in Jeevan Akshay VI, you can expect a monthly payout of Rs 26 thousand pre-tax. But if you have other retirement income as well and fall into the 20% tax bracket, your post-tax income could fall close to Rs 21 thousand per month.

We believe this is a poor return:

- The absolute number is fairly low, especially since you are further liable to tax on it

- It doesn’t protect you against price-rise in your golden years. In the example above, you get the same Rs 21 thousand even 15 years after retirement. But in the meantime, the purchasing power of that money has fallen to a fourth

Thus, our verdict is that this is a poor product. If you have a retirement corpus and want a monthly income from it, you are better off investing it in a Monthly Income Plan (MIP). As shown in the illustration, a MIP has the potential to give the higher return. Since 15% of it is equity-linked, it can also deliver a higher return over the years to protect you against price-rise.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F30rvntN||target:%20_blank|” button_position=”button-center”]