We have heard our elders saying that “Invest in Real estate, the future value of the property will fetch you prosperous wealth.” Is it true?

Let us now discuss how a Real estate as an investment option.

Yes, Investment in Real Estate can generate a regular income, and you can see capital appreciation over a period of time. People think Real estate as an investment option is good only because they look only into the returns ignoring the other factors.

There are other factors that you need to consider:

- Risk factor: There is more risk involved if you buy a property, and risk comes in the form of property disputes, your property can be grabbed, finding the tenant becomes difficult.

- Additional expenses: Incurring more expenses can affect your returns. Expenses such as brokerage chargers, maintenance costs, taxes will be incurred by you. You will pay all these expenses from your returns.

- Low liquidity: In case of emergency, to can’t sell a part of your property and make money and also your need for cash can make you sell the property at a lower price than its original cost. Thus, you incur a loss.

- Market fluctuations: Yes, there has been a time where you can sell your property more than 10 times its original value but the things are changed and are not the same.

Reasons why an investor should avoid investing in Real Estate

- An under performing asset class as it gives more or less the same returns as FDs and offers an annual rent between 2-5% which is very less when compared with the returns earned on FDs

- The value of a property depends on the geographical location of a property which makes a real asset as an unpredictable asset class.

- The typical mentality of investors where they link properties to memories and emotions ignoring the returns on investment.

- Liquidity is less because when you need immediate cash, you can’t find buyers easily and need of cash can make you sell the property at a lower cost than its market value.

They are subjected to more litigation and the risk involved is high because of property disputes or your - property can be grabbed.

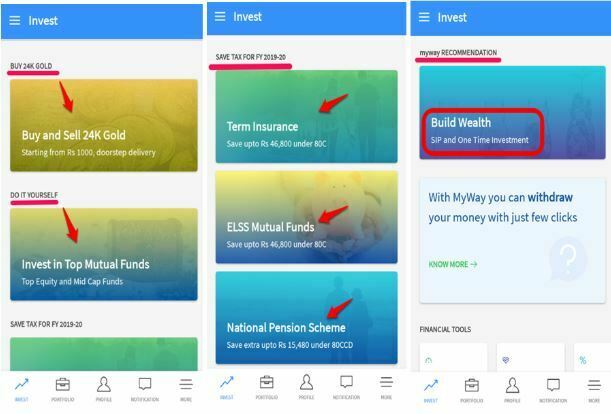

Thus, these are the disadvantages of having investments in Real Estate. But is an alternative? Yes! there are better options to invest such as Mutual Funds. Direct Plans, SIPs, Gold Funds or Equity Mutual Funds help you with wealth creation in the long term. Use “Fisdom ” to discover, track and invest in Mutual Funds.

Don’t invest in better, invest in the best!