Technical analysis along with the fundamental analysis is the primary arsenal in the kitty of every trader. There are various techniques and tools that can be used by the traders to ensure that they take profitable positions. These techniques and tools include charts, candlesticks, graphs, etc. that help the traders analyze the price movements and the prevailing trends. The understanding and analysis of these trends are further useful in charting the entry and exit points in the markets and the future price movements as well.

Some of the common trend analysis tools include the inverted hammer candlestick pattern. Given below are the meaning and a few related details of the inverted hammer candlestick pattern.

What is the inverted hammer pattern?

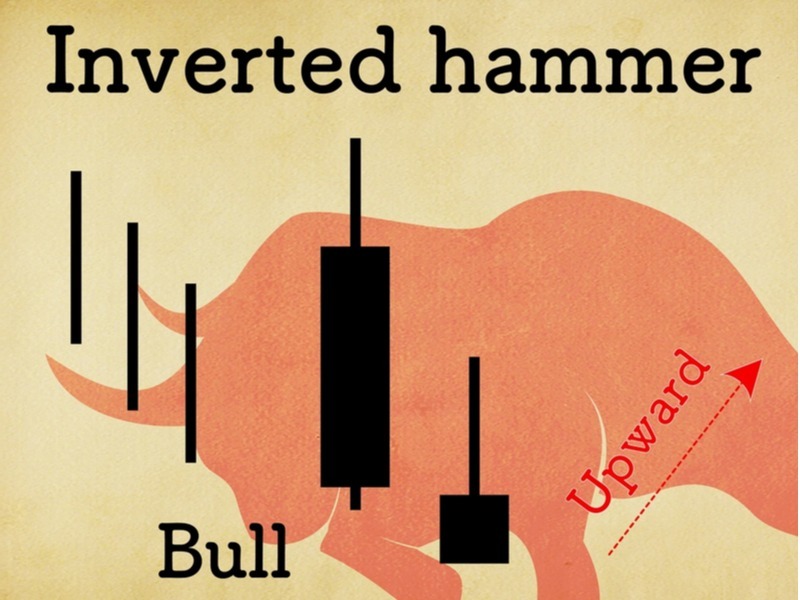

The inverted hammer pattern is a candlestick pattern that is used to identify the downward trend forming after the increased pressure from the bulls. This pattern is an indication of the reversal of the bullish trend. This pattern gets its name from the image of the inverted hammer that it forms as it has a very short lower shadow and a long upper shadow. The extended upper wick of the pattern shows that the bulls in the market are trying to drive the prices of the security in the upward direction. An important point to note regarding this pattern is that it is an indicator of a potential price change and not a definitive one.

Inverted hammer pattern in trading

The steps for using the inverted hammer in trading are given below

- The first step is to identify the pattern by looking for a candle with a long upper wick and short lower wick and a small body.

- The next step is to confirm the pattern using other technical indicators or patterns

- Traders also need to take into consideration the overall market conditions and the prevailing trend

- Traders can take a long position to take optimum advantage of the uptrend or to close (square off) an existing short position in order to prevent extensive losses.

- Adjust stop loss based on the price movements and protect the trading portfolio.

What are the factors to consider before applying the inverted hammer pattern?

There are a few factors to be considered by the traders before implementing the inverted hammer candlestick pattern. Some of these checks are mentioned below.

- The length of the upper shadow should be at least twice the real body of the candle. Traders should enter a trade only if the opening price is higher the next day.

- Traders should note the downward trend prior to the formation of this candle. This downward trend will indicate the pressure from the bears in the market

It is important to understand the basics of this pattern for its application. There can be many trading patterns that can seem similar to the inverted hammer. A clear understanding of the formation and the reasons for its formation will assert the traders in their analysis of the inverted hammer candlestick pattern and help in taking suitable trading positions.

How to identify the inverted hammer pattern?

The inverted hammer candlestick pattern is formed when the bulls push the price of the asset to resist the downward trend and therefore, the prices recover quite nicely during the trading session. The bears trying to dominant the market will further push the bulls to try the price recovery in the following day. When the bearish sentiment fails to rally is when we see the inverted hammer candlestick pattern form which shows that the price of the asset goes upwards and the bulls stay in control.

Once the inverted hammer candlestick pattern is formed, the traders should wait for the next candle to form. If the next candle is red, it will indicate the pattern has failed and the price falls below the inverted hammer. In such a scenario, no traders should be taken. On the other hand, if the next candle is green it asserts that the bulls are in control and the traders should wait till the price goes beyond the inverted hammer candlestick pattern which will validate that the price will further rise.

The use of stop-loss while trading based on the inverted hammer candlestick pattern is essential to safeguard the trader from potential losses. It should be set at the bottom price of the inverted hammer candlestick pattern. In case the pattern fails and the price goes below the inverted hammer, the traders will have to book losses, and stop-loss will help in limiting their exposure.

What are the factors to consider before applying the inverted hammer pattern?

There are a few factors to be considered by the traders before implementing the inverted hammer candlestick pattern. Some of these checks are mentioned below.

- The length of the upper shadow should be at least twice the real body of the candle. Traders should enter a trade only if the opening price is higher the next day.

- Traders should note the downward trend prior to the formation of this candle. This downward trend will indicate the pressure from the bears in the market

- It is important to understand the basics of this pattern for its application. There can be many trading patterns that can seem similar to the inverted hammer. A clear understanding of the formation and the reasons for its formation will asset the traders in their analysis of the inverted hammer candlestick pattern and help in taking suitable trading positions.

What are the pros and cons of the inverted hammer pattern?

Like any other technical analysis tool, the inverted hammer candlestick pattern has its own set of pros and cons. Let us discuss them hereunder.

- Pros

Some of the prime advantages or benefits of this pattern are,

- The inverted hammer candlestick pattern provides multiple entry points in the market when the price of the asset is beginning to increase or the uptrend is formed.

- This pattern does not require complex calculations for it to form and analyze. It is a simple price movement pattern that can be easily spotted by traders and analyzed. It is, therefore, easier for even beginners or new traders to understand and follow.

- Cons

Some of the shortcomings of this pattern are,

- This pattern is not a sole indicator of the price reversal. Traders have to understand the markets and the fundamentals of the asset as well to make a clear understanding and take up trading positions based on this pattern.

- Another disadvantage of this pattern is that it can be short-lived. The inverted hammer candlestick pattern may show a trend reversal but it can be short-lived if the buyers are not able to stay in control against the market pressure of the upcoming downtrend.

Conclusion

The inverted hammer candlestick pattern is a common technical analysis tool that can be used by new traders and experienced ones. It can help the traders identify the buyers market and provide suitable entry points for them to trade. It si however important to not forget to put stop-loss. It is a very handy tool to limit exposure in times of uncertainty.

FAQs

Yes. Inverted hammer candlestick pattern is an excellent intraday indicator of the price shift or the trend reversal.

The traders have to check for the volumes to be high on the day of the formation of the pattern. The presence of higher volumes will assert that there are more buyers in the market and are driving an increase in the price of the asset.

No. If the price falls below the hammer, it will indicate that the pattern has failed and it is not advisable to take any trades.

It is prudent to look at other technical indicators as well to confirm the trend reversal so the traders are not caught off guard.