An anniversary and a quarter past the first sighting of the Covid-19 has Indian benchmark be crowned as the eight largest index of the world. Championing broader appetite and dynamic growth across market-caps has been key factor for the cumulative equity listing value to surpass the once unbelievable three trillion-plus mark.

When markets fell last year, large-caps highlighted how to invest. Since then, mid/small caps have shown why you should invest, in the markets run-up to trading at its all-time high.

Today, rendering of unorganized under organized markets, incorporation of cost-efficient demand-smart forecasting, and a demographic-savvy economy, has levered markets to welcome risk capital and bid adieu to polarizations.

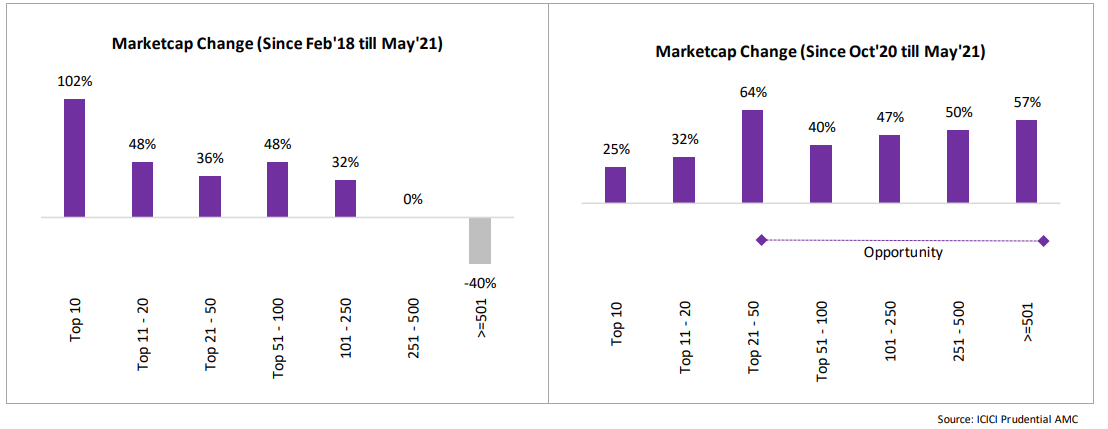

In hitting the ‘reset’ button, the graph below shows how markets have revived across the spectrum, as opposed to brandishing blinding favoritism to any particular segment.

The table below highlights the sentiments reflected above:

The broadening of market width comes at a time when macros and micros bear inclinations to pro- growth strategies via like-wise policies and practices. The results are immediately visible in emergence of new alphas with risk capital following suit.

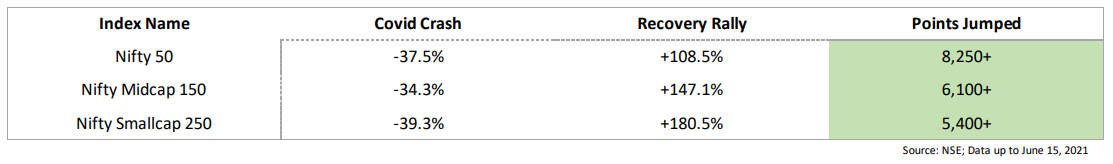

The table below shows how quickly sans-large segments have not only recovered but also flourished in times of the virus continuing to be feature headlines:

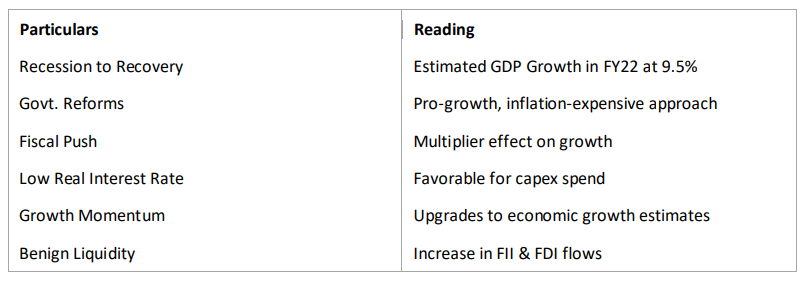

Recent developments have welcomed newer investor hesitancies questioning economic prospects and hence sustainability of market sentiments across market-caps.

In quelling these queries, shown below are factors which will keep the economy running and the spill-over positives of cross-cap participations:

The fund is positioned to benefit from structure as well. Donning a Flexicap mandate, the fund will enjoy more flexibility in taking positions across market segments, without any pre-defined limits.

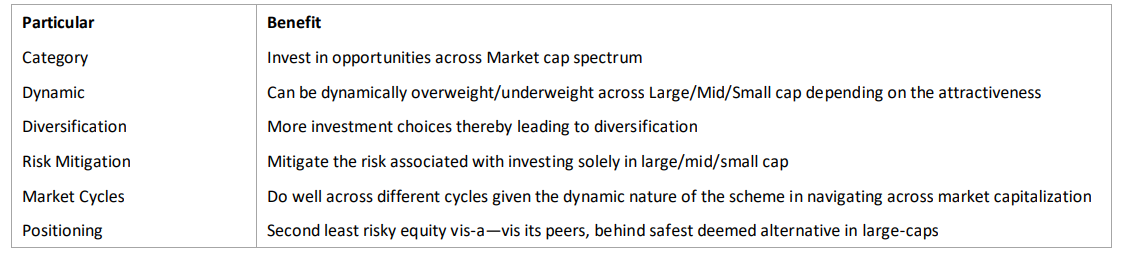

The table below highlights the benefits the flexi-cap category enjoys:

Excited to go hunting a fund which can help you avail best of equity markets in a manner which equity investing merits?

ICICI Prudential MF presents a new fund offering in its Flexicap NFO!

ICICI Prudential Flexicap NFO presents a no market-bias equity fund, tapping into underpenetrated securities to amplify your portfolio return potential in a diversified and dynamically tactical manner. It is designed to offer key investment opportunities across economic cycles which are geared to welcome decadal growth across the spectrum.

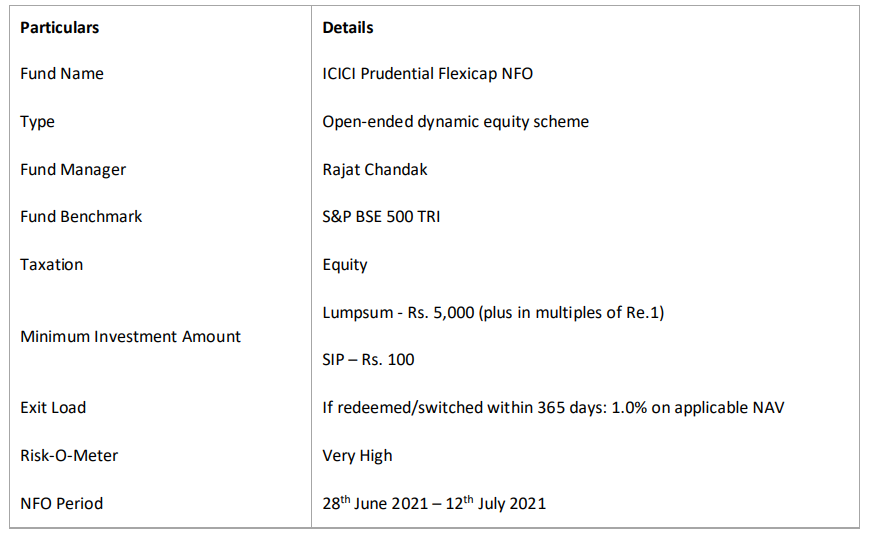

A snapshot of the workings of the fund are as follows:

Fund Positioning

• An open-ended equity scheme investing across large cap, mid cap & small cap stocks in a disciplined manner

• Portfolio will be Sector and Benchmark Agnostic

Investment Approach

• Mix of top-down and bottom-up approach, using former for large, and latter for mid and small caps

• Top-down approach includes parameters such as growth, inflation, earnings potential and pipeline

• Bottom-down approach includes parameters such as opportunity size, management, historical returns and track record

Investment Philosophy

• Aim to identify and invest in opportunities across market caps through an in-house Marketcap model

• In-house Marketcap model comprised of:

o Market Cap Weight as a % of total Marketcap

o Valuation

o Relative Strength Index (RSI) Differentia

Security Selection

• Stocks will be selected basis various factors such as, macros, company fundamentals, valuations, etc.

• Minimum large-cap allocation at 50% with remainder distributed between other market covenants

• Opportunities from S&P BSE 500 universe will be considered for investment

Investment Process

• The Fund Manager decides the Marketcap attractiveness basis prevailing market conditions

• The Fund Management team identifies opportunities in that particular segment

• Large/Mid/Smallcap allocation will be assessed and re-balanced on a periodic basis, based on the in-house model

Investor Suitability

• “Change is the only constant” and “The future is now” are the two descriptive ways of describing the flavor of this fund. Investing in this fund of the equivalent of hitting two birds with one stone

• The fund is suitable for long term equity investors with high risk appetite with an investment horizon of 5 years and above

Key Details About the Fund