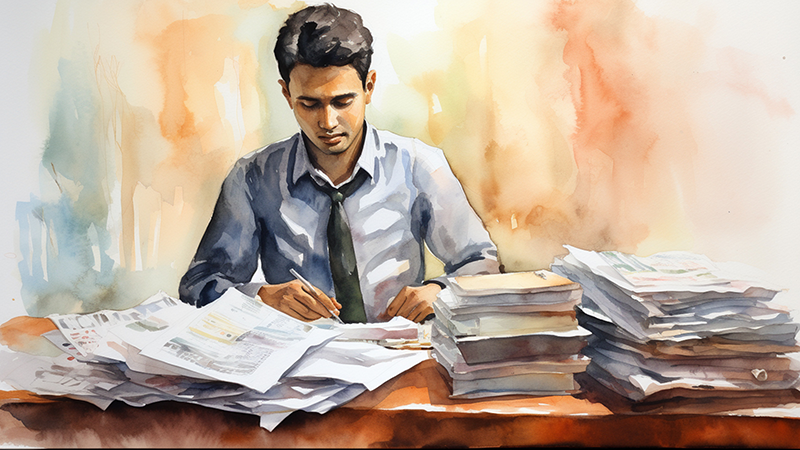

Filling out the Income Tax Returns is one of the yearly rituals that every taxpayer has to go through. The deadline for these ITRs is usually extended last minute to accommodate a large number of taxpayers and the website that is usually slow as the deadline for ITR filing approaches. After submitting the ITR, the next step is verifying the same followed by its processing by the Income Tax Department. After processing of the ITR is completed, the assessment order is passed which details the demand for tax liability, issues a refund order, or accepts the ITR as submitted by the taxpayer. But how would the taxpayer know what is the status of their ITR and if the ITR submitted by them is accepted?

Read More – ITR Filing Deadline – Consequences of Not filing ITR on Time

The Income Tax portal provides the facility to check the status of the ITR and resolve these queries. Discussed hereunder is the process to check the status of the ITR and related details of the same.

What are the different Income Tax Returns?

Before going ahead, let us first review the types of ITR available for taxpayers. Given below is a snapshot of the same.

| Type of ITR | Applicability |

| ITR 1 | Applicable for resident taxpayers having,Having Gross total income up to Rs. 50,00,000Having salary income or pensionHaving income from other sourcesHaving one house property |

| ITR 2 | Applicable for taxpayers having,Having Gross total income more than Rs. 50,00,000Having capital gainsHaving any foreign income or a foreign assetHaving more than one house propertyHaving a directorship in a companyHaving unlisted equity shares |

| ITR 3 | Applicable for taxpayers having,Having income applicable under ITR 2Having any profits and gains from business or professionsBeing a partner in a firmHaving a presumptive income of more than Rs. 50,00,000 |

| ITR 4 | Applicable for taxpayers having,Having income applicable under ITR 1Having salary income or pensionHaving income from other sou rcesHaving one house property |

| ITR 5 | Applicable for,FirmsLLPsAOPsBOIs |

| ITR 6 | Applicable to companies not claiming exemption under section 11 |

| ITR 7 | Applicable to persons or companies that have to file ITRs under following sectionsSection 139(4A)Section 139(4B)Section 139(4C)Section 139(4D) |

Also Read:How does the new Annual Information Statement help you file tax returns?

Who can view the ITR Status?

The Income Tax portal has provided the facility for e-filing the ITR as well as many ancillary services like e-verification of the ITR, raising any grievance related to submitting returns, reviewing the status of ITRs submitted, linking PAN card and Aadhaar card, raising any query, etc. this facility can be viewed and availed by the following entities.

- All taxpayers who are registered users of the portal can review any ITR filed against their PAN number

- Any Authorised Signatories, ERI, Representative Assessee for ITRs that are filled by them in the capacity of their roles.

The services that can be accessed by the registered users include the following,

- View and download the ITR V which is the ITR Acknowledgement

- View and download the uploaded JSON (from the offline utility)

- View and download the completed ITR form in the PDF format

- View and download the intimation order

- View the returns that are pending for verification

What are the prerequisites for checking the ITR status?

The e-filing portal has also laid detailed prerequisites that have to be met by the taxpayers for checking the ITR status. These prerequisites are mentioned below.

- Prerequisites at the time of pre-login

The pre-requisites that are required in the pre-login to check the ITR status are

- Filing at least one ITR through the e-filing portal and having a valid acknowledgment number for the same.

- The taxpayer should have a valid mobile number

- Prerequisites at the time of post-login

The pre-requisites that are required in the post-login to check the ITR status are

- The taxpayer has to be a registered user on the e-filing portal having a valid user ID and corresponding password

- The taxpayer should have filed at one ITR on the e-filing portal of the Income Tax Department.

How to check ITR status?

The IT portal provides two modes that can be used for checking the status of ITR filed by taxpayers. These modes and the process to check the ITR status are detailed below.

- Checking the ITR status using the ITR V

- Under this option, taxpayers can check the status of therein ITR without using their valid login credentials. Taxpayers can click on the ‘Check ITR status’ under the tab ‘Quick Links’ on the homepage of the e-filing portal of the IT Department.

- The user will then be redirected to a new page that requires them to provide their Acknowledgement Number under ITR V followed by the Captcha Code.

- After submitting the details correctly, the taxpayers will get the status of their ITR displayed on their screens.

- Checking the ITR status login credentials

- The first step for this mode of checking the ITR status is to login into the IT portal.

- Taxpayers will be able to view the status of their ITR on the dashboard of the website after logging in.

- Alternatively, users can also click on the option ‘View Filed Returns’ under the tab ‘e-file’.

- The next step is to select the assessment year for which the user wants to check the ITR status.

- If the ITR is already processed, the status will be reflected as ’ITR Processed’.

- If the ITR processing is yet to be finalized post its verification, the ITR status will be reflected as ‘Successfully e-verified.

Conclusion

After successfully filing the income tax return, taxpayers need to e-verify their return for further processing. Once the ITR is successfully e-verified, the onus is on the department to complete the processing of the same and pass an assessment order. If there is any discrepancy or error in the filing of the return, taxpayers can submit a revised return before the processing of the ITR is completed.

FAQs

Yes. it is mandatory to e-verify the ITR for completing the processing of the same

Taxpayers can check the status of previous ITRs filed by them by logging into their account on the e-filing portal and selecting the assessment year they wish to check the ITR status for.

To check the ITR status without logging in, users will have to click on the ‘Check ITR status’ under the ‘Quick Links’ tab on the homepage of the e-filing portal. Following this, they will have to enter the Acknowledgement number and the captcha code to proceed. This will display the ITR status on their screen

The ITR status is updated by the Department depending on the stage of the return processing. Therefore, taxpayers have no authority or control over changing the same.