“In the business world, the rearview mirror is

always clearer than the windshield.”Warren Buffet

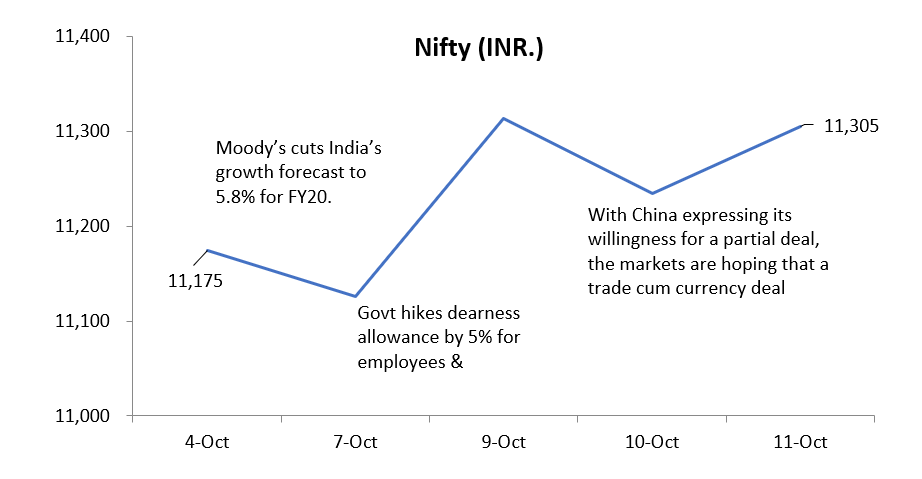

Witnessing a reversal in sentiments, Indian bellwether index Nifty bounced back to a much more favorable level of 11,305 from the previous week’s 11,175-end – up by 1.2%

Key highlights of the week included the following:

-The Union Cabinet raised the dearness allowance to 17% from the previous 12%

This move is expected to cost a total of Rs 16,000 crores to the exchequer and will benefit a total of 50 lakh Government employees and 65 lakh pensioners. This comes in as a surprise as previous increments were in the range of 2 to 3 percentage points.

Expected Impact:

This is the highest ever increase in DA in one go by the central government, we expect this to lend positivity towards the consumption sentiment as the festive season closes in.

– Public sector banks cut lending rates by up to 25 bps.

Banks including Bank of India, Bank of Maharashtra, Central Bank of India, Oriental Bank of Commerce, State Bank of India have reduced lending rates by up to 25 bps following a cut in the repo rate by the RBI last month.

Expected Impact:

With the upcoming festive season, the move is expected to extend the benefit of lower borrowing rates to customers; the auto segment is expected to benefit the most given an already slumped state of sales.

With continually reducing outflows of foreign capital, we can see a reinstatement of faith by the foreign investors and can see them turning strong net buyers soon.

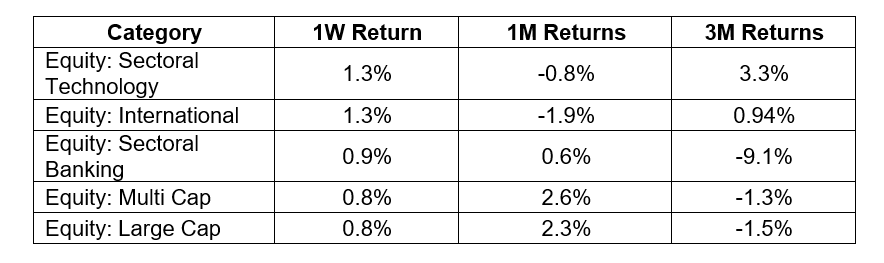

Meanwhile, here are the star fund categories of the week:

Here’s how the week’s events reflected in Indian markets

We believe corporate earnings will primarily guide market sentiments in the coming week. Hopefully, this earning season will revive domestic investor mood & act as a catalyst in bringing out the bulls in foreign investors.