“An Investment in knowledge pays the best interest.”

–Benjamin Franklin

Designing and drafting your child’s education can be one of the major goals you will have as a parent. A father always wants his son or daughter to be more educated than him and hence would want to provide them with a quality education. But acquiring a quality education is becoming expensive from the past few years. To be able to provide your child with a bright future, it is necessary to start saving for your child’s education early.

Currently, an Engineering course costs anywhere between 6-10 lakhs in India, but ten years down the lane, it would cost 15-20 lakhs. It is said that there will be a time when global education brands may come to India and their fees will be very high. And obviously, you want your children to get the best of education.

So, here are some ways parents can save for their child’s education:

1. Sukanya Samriddhi Account for your daughter

This scheme was launched by the Prime Minister 4 years ago on 22 January 2015 as a part of the Beti Bachao, Beti Padhao campaign. The account can be opened anytime, by the parents or the guardian, between the birth of a girl child and the time she attains the age of 10 years. It currently provides an interest rate of 8.5%. This scheme encourages young parents to build a fund for future education and marriage expenses. The account can be opened at any authorized commercial banks or Indian Post Office. Only one account per child is allowed. A minimum of ₹250 must be deposited in the beginning thereafter any amount in multiples of ₹100 can be deposited and the maximum limit is ₹1,50,000. Read More on Sukanya Samriddhi Yojana

2. Tax-free bonds

Tax-free bonds are types of financial products which the government enterprises issue. Municipal bonds are one of its kind. They offer you a fixed interest rate and hence is a low-risk investment. They generally have a long-term maturity of typically ten years or more. The interest rate is currently 6.5%.

3. Bank Deposits

- Savings Account- A savings account can be opened at a retail bank that provides interest of 3-4%. Check: Savings Account vs Liquid Funds

- Fixed deposit account – A fixed deposit (FD) is a financial product provided by banks which gives investors a higher rate of interest than a regular savings account. Generally, the rate of interest ranges between 5-8%. Explore: What are Fixed Deposits?

- Recurring deposit Account – This is a kind of Time Deposit provided by banks in India which help people with regular incomes to deposit a fixed amount every month into their account and earn interest at the rate applicable to FDs. Read More: Bank Recurring Deposits

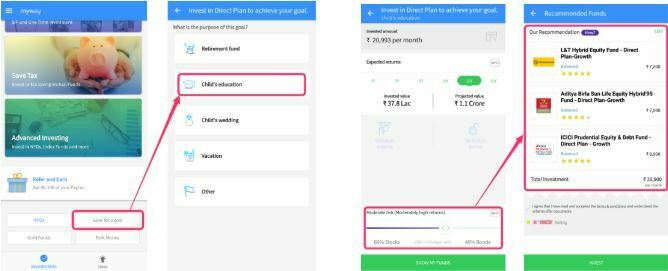

We all want our children to have a bright future. Then why settle at 6.5-8.5% returns when you can earn returns between 12-16% or more and save better for your child’s future? Yes with Fisdom you can invest in Mutual Funds using the option called ‘Save for a goal’ under which you can save for your “Child’s education” which invests your savings based on your requirements.

So, if you want quality education for your children, you have to spend more. And to be able to spend more we should have surplus funds to finance the educational needs rather than sacrificing other requirements. So, don’t take a cut on your returns, instead invest in Mutual Funds and save a large corpus for your child’s future.

Invest Now..Plan Ahead with Fisdom !