Key Attributes:

Efficient Market | Very Low Correlation | Global Exposure | Dollar Hedge

Fund in Focus:

Motilal Oswal S&P 500 Index Fund

(NFO Period: 15th Apr’20 – 23rd Apr’20 | Min. Amount INR 500 | Exit Load: 1% if redeemed in 3 months)

Suitability:

Long-term investing (indicatively 5+ years of holding period); hedge against domestic currency depreciation and/or global inflation; Efficient economy diversification

Descriptive Highlights

Efficient Market

S&P 500 is the world’s largest index which is tracked and benchmarked globally. With a long track-record of over 63 years, it has developed a respectable vintage among global indices.

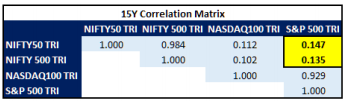

Very Low Correlation

Very low correlation between Indian Indices & S&P 500 offers an opportunity to benefit from true diversification – a combination on assets which don’t move in the same direction (low correlation) offers optimal risk-adjusted returns

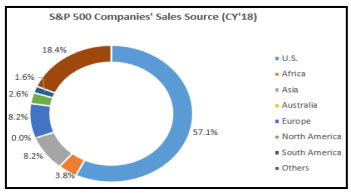

Global Exposure

Historically, a large component of sales of S&P 500 constituent companies were contributed by regions & economies beyond U.S. This mix of true-blue multinational corporations offer the benefit and/hedge of global diversity thus ensuring limited dependency on the state of a single economy or nation to drive business growth. The index is an efficient mode to achieve global diversity.

Dollar Hedge

Allocating a percentage of overall portfolio to S&P 500 also offers cushion to the overall portfolio in the form of a Dollar hedge. By far the USD is considered a strong currency and exposure to S&P 500 adds incremental value during stressful times when INR depreciates against USD.