“When it comes to investing, the key is to not only seize opportunities but also stay ahead of the curve” said Charlie Munger, a billionaire investor and vice chairman of Berkshire Hathaway.

This quote is apt in today’s ever-changing investment market, where new opportunities keep emerging all the time. Today, India’s investment landscape has changed and expanded to offer several investment options to those who are looking out actively. However, most investors, especially those who are new, find it challenging to choose the right investment option. This is where smallcase comes in.

So, what are smallcases?

In this blog, we’ll introduce you to smallcases and the benefits of investing in them. We will also throw light on Fisdom’s tie-up with smallcase and how it creates larger potential investment opportunities for millions of investors.

What are smallcases?

smallcases are a basket of stocks or ETFs that are curated based on investment themes, strategies. Smallcases can be thought of as a collection of different investment instruments like stocks or ETFs that are grouped together based on a common theme.

For instance, if you’re interested in investing in the healthcare sector, you could choose a smallcase focused on this theme, which would include stocks and/or ETFs from companies involved in healthcare and related fields.

They are a ready-made solution for investors looking to build and manage their portfolio without the hassle of individual stock analysis or account management. These smallcases can be based on sectors, themes like ESG( Environment, Social, and Governance), momentum, volatility, etc.

Some of the top portfolio managers that have designed smallcase portfolios are Wright Research, Windmill Capital, Capitalmind, and Weekend Investing.

Why are smallcases unique investment solutions?

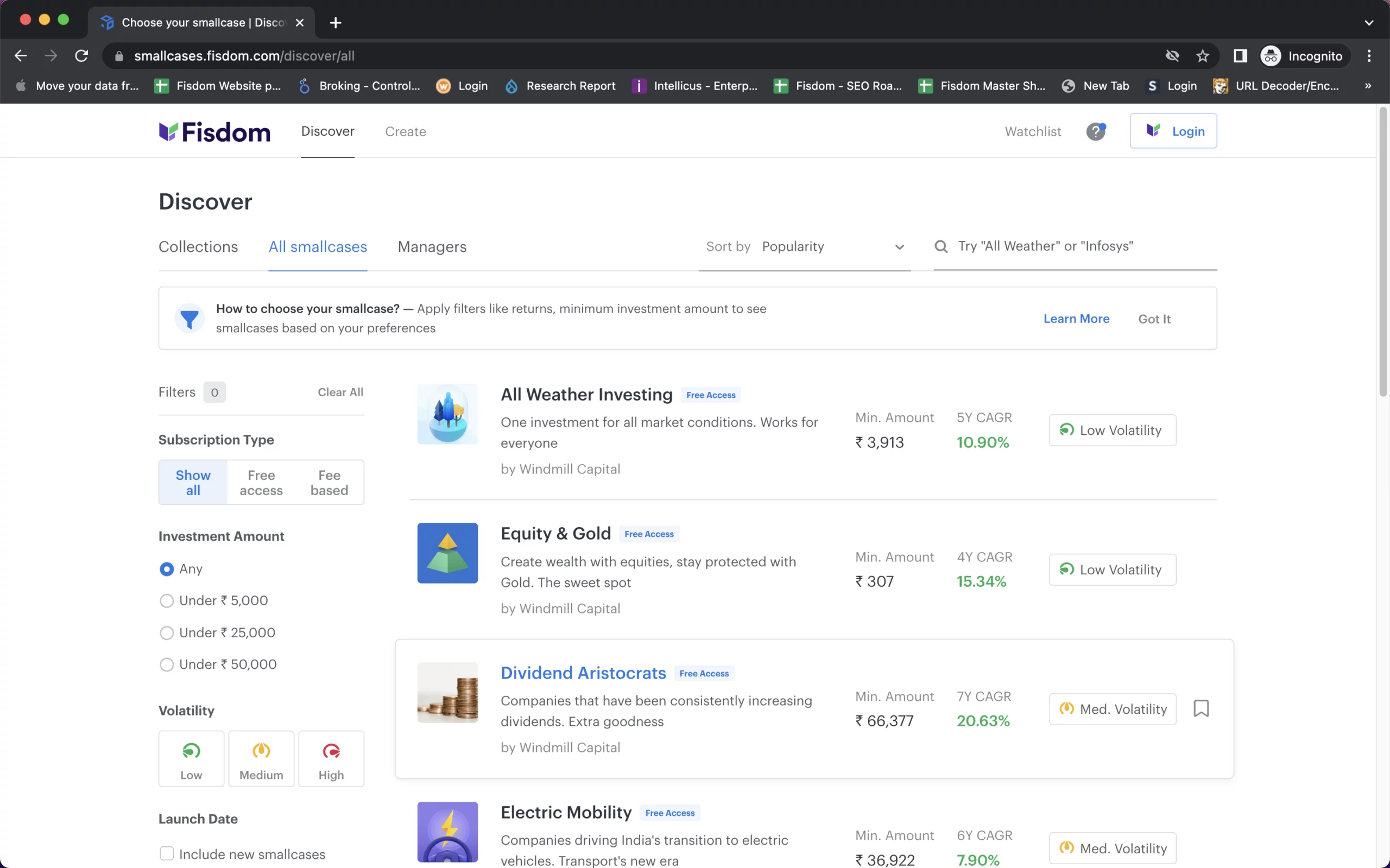

Smallcases allow investors to invest in stocks or ETFs based on particular themes or investment themes. They are easy to manage and require less effort from investors. Moreover, they offer a cost-effective investment option as there are no separate fees for buying and selling. smallcase offers a wide range of themes for investors to choose from. Some of the popular themes include:

- All weather investing – A portfolio that is designed to perform well in all market conditions.

- The great Indian middle class – A portfolio that invests in companies that cater to the Indian middle class.

- Safe haven – A portfolio that invests in companies that are considered safe investments.

- Electric mobility – A portfolio that invests in companies that are involved in electric mobility.

- Bargain buys – A portfolio that invests in companies that are undervalued.

Fisdom joins hands with smallcase

Fisdom has partnered with smallcase to enable its investors to explore smallcase investments. This significantly expands the variety of investment options available to investors. By leveraging Fisdom’s platform and smallcases’ themes, investors can experience a seamless approach to investment-making decisions.

How to invest in smallcase through Fisdom

To get started with placing a smallcase order, investors can follow these steps:

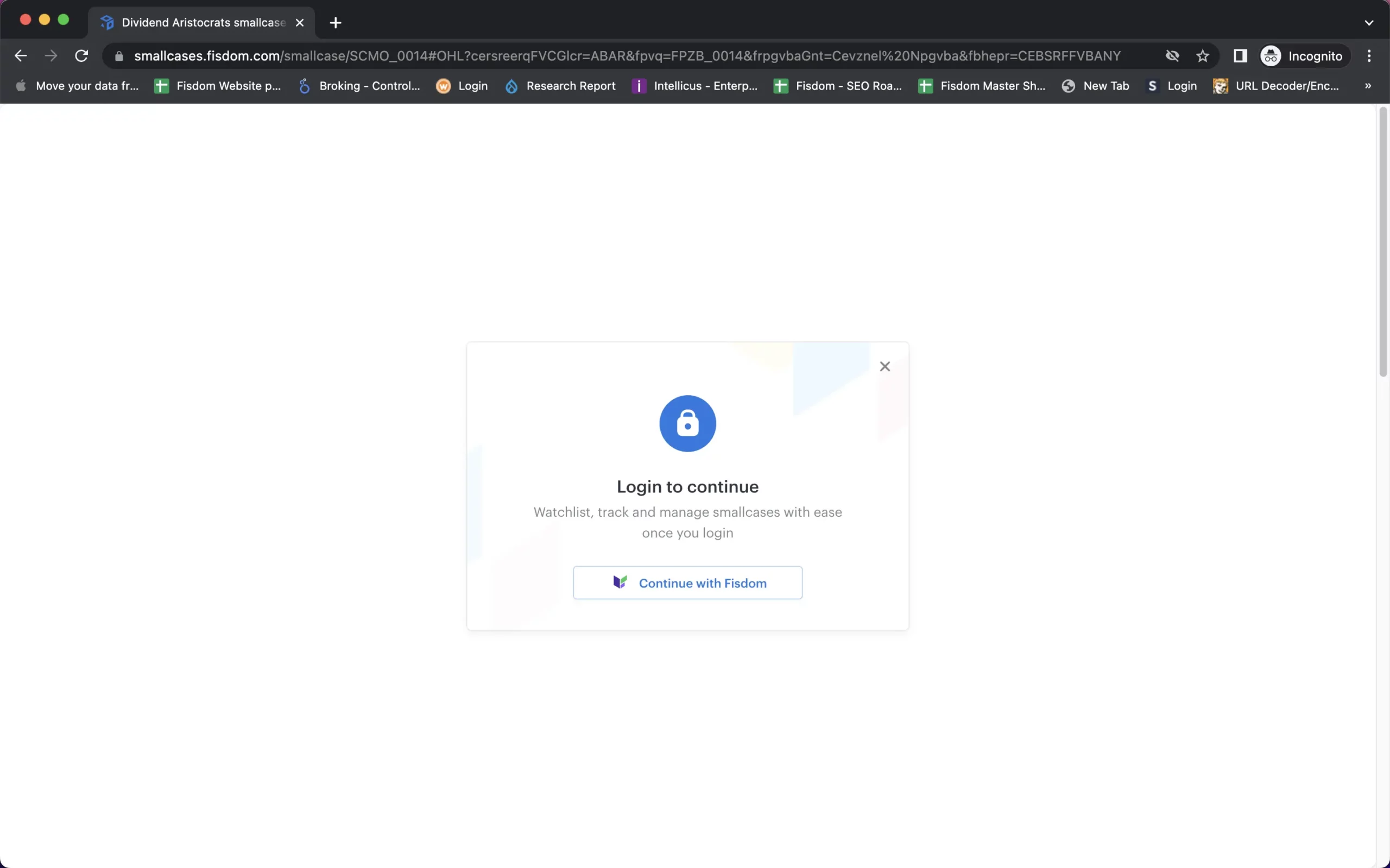

- Investors who are new to investing can utilize the option ‘find your smallcase’ on smallcase.fisdom.com. After clicking on ‘Invest Now’, investors will be redirected to the Fisdom Demat account to execute the trades.

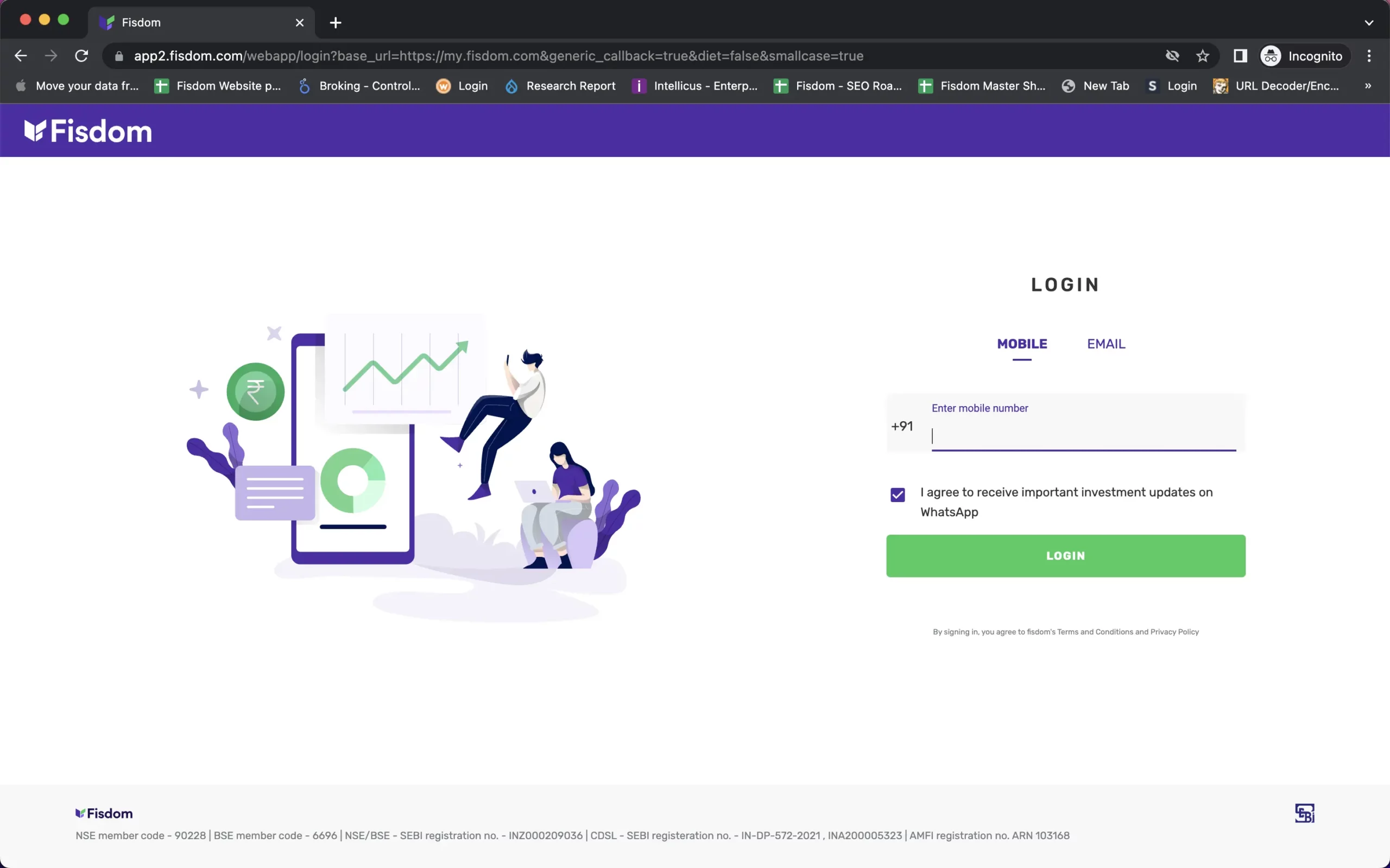

- After clicking on ‘Continue with Fisdom’, user will be asked to enter Fisdom-registered mobile number to login.

- To explore smallcases, click on the ‘All smallcases’ option and continue exploring

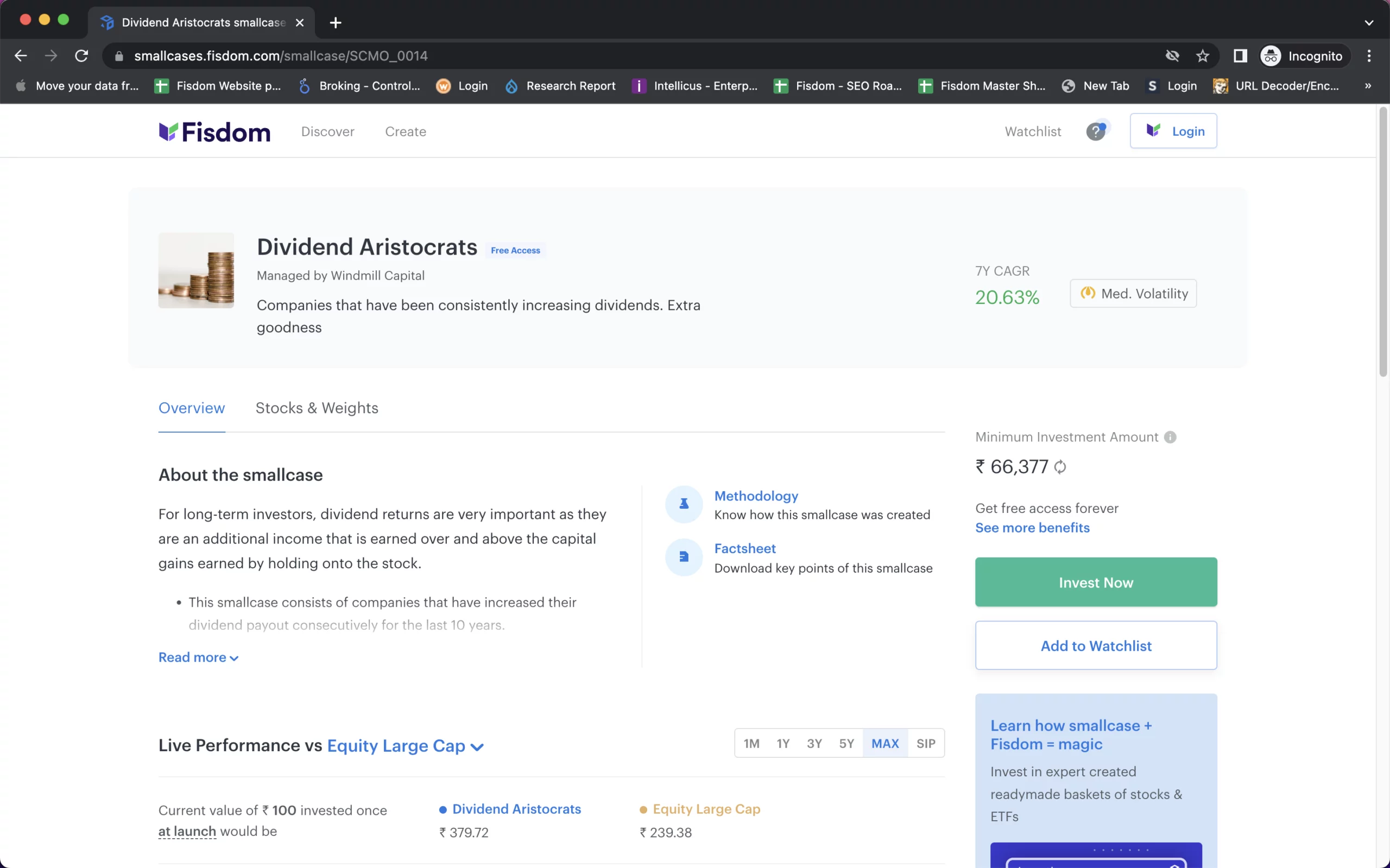

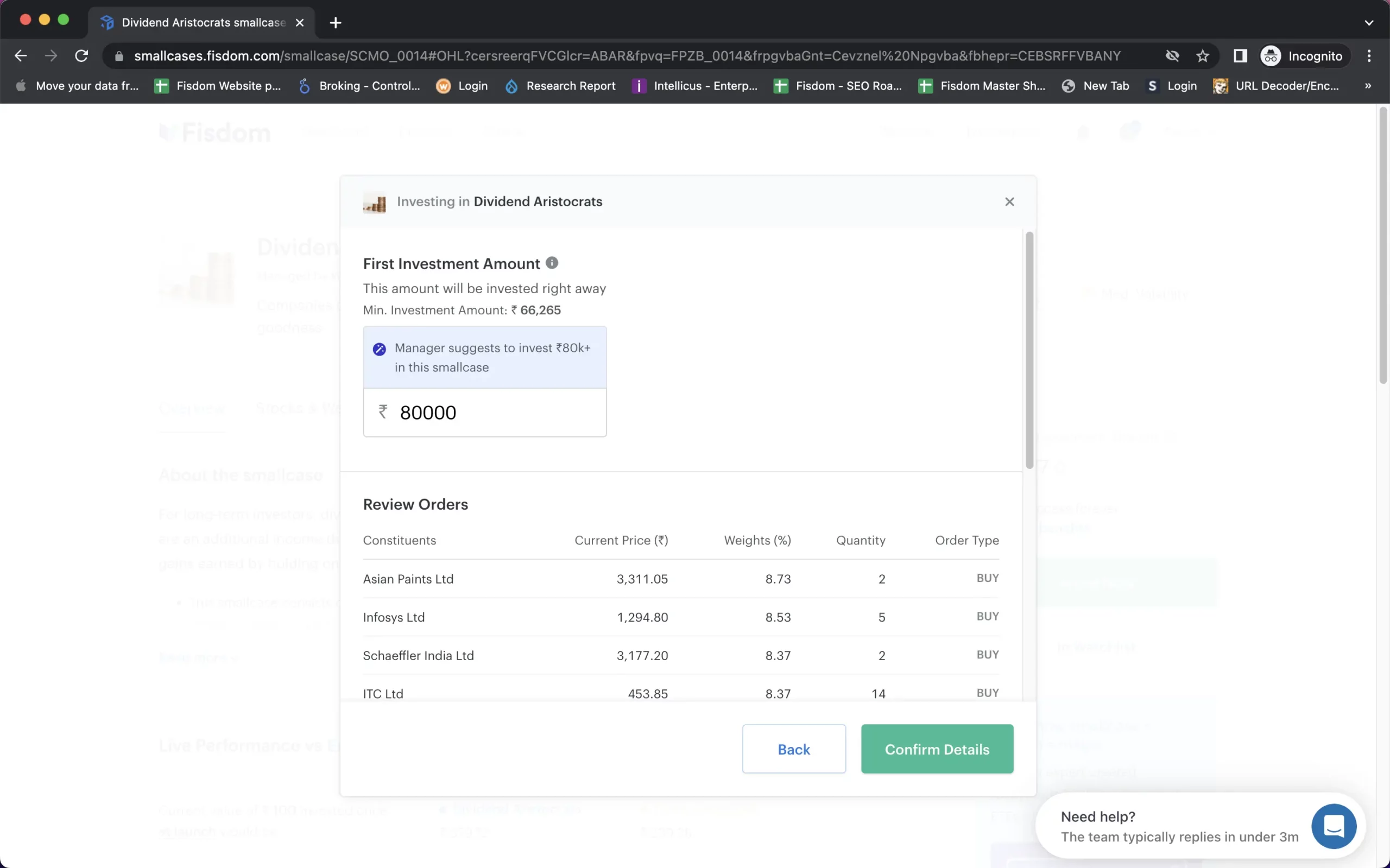

- Select a category with the available smallcases and proceed towards allocating funds.

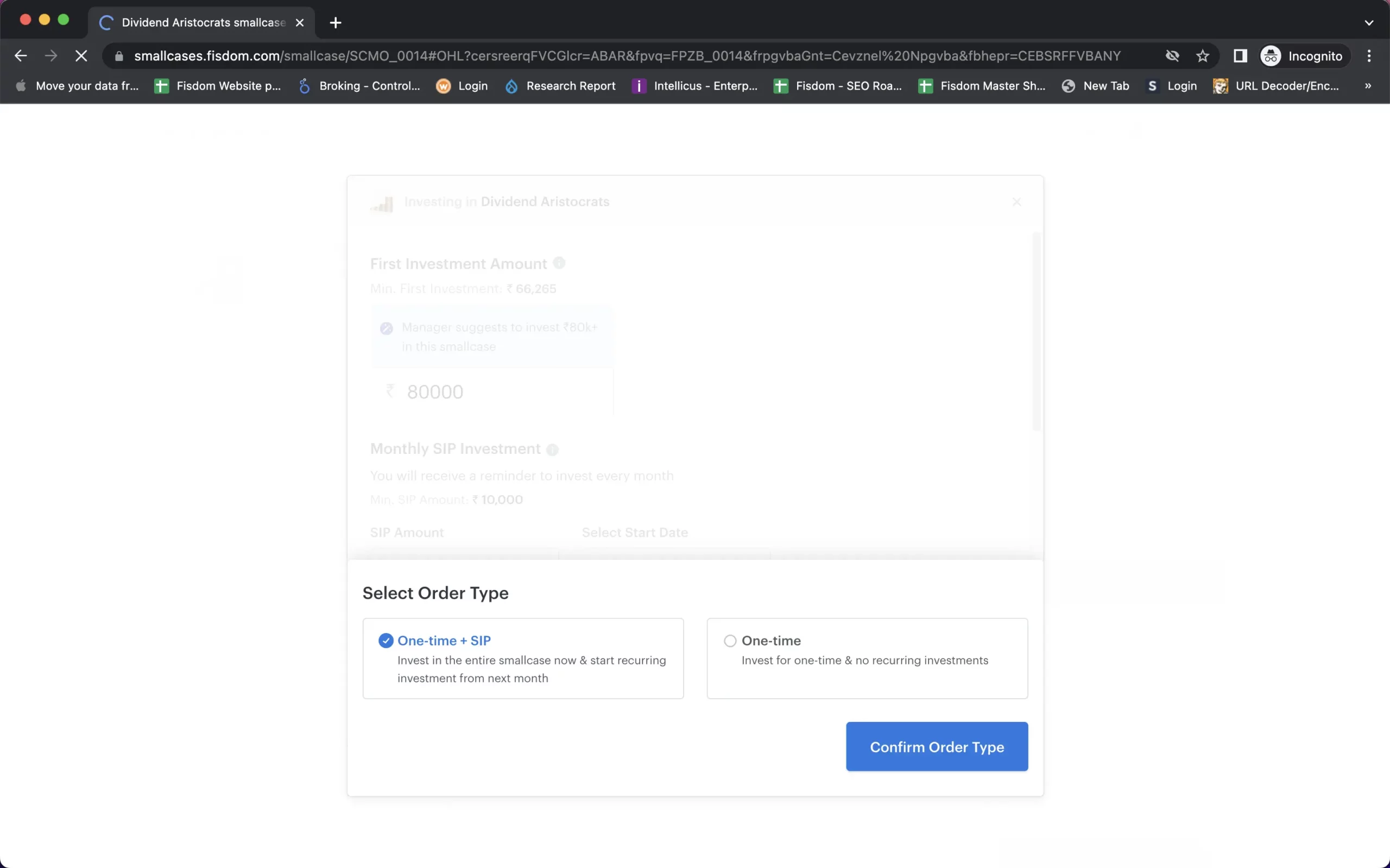

5. Enter the investment amount after going through the portfolio details and proceed to choosing between ‘one-time’ or ‘SIP’ investment mode.

6. Confirm order type to proceed with the investment.

Benefits of investing in smallcases

Smallcases offer benefits for both experienced and novice investors alike. For experienced investors, it provides an informed and profitable investment option, especially as they have the potential for higher returns. For beginners, smallcases provide a hassle-free entry to invest in the stock market with diligent research done by experienced professionals. Smallcases are a transparent investment option as the composition of the basket is provided by the platform before investing, so there are no surprises. As a long-term investment instrument, smallcases have performed much better than mutual funds and stocks, which makes them a must-have asset in your portfolio.

Conclusion

Smallcases are a great way to invest in the market with a chosen theme and an expertly curated portfolio. They provide an effortless investing experience and make investing more accessible for everyone. With Fisdom and smallcase joining hands, it’s now even easier for an investor to make his/her investment journey smooth and fruitful.