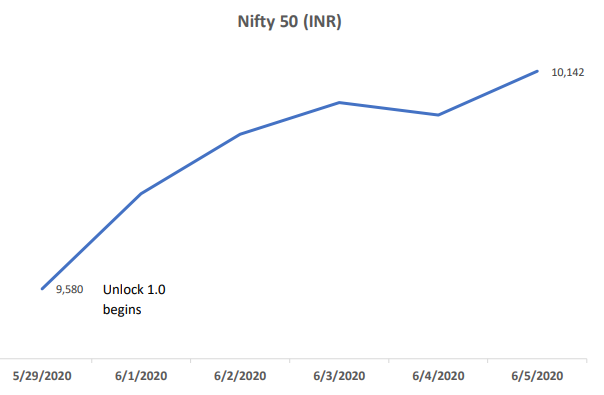

Indian markets ended on a positive note. Nifty and Sensex both were up by 6.0% and 5.7% respectively.

Weekly Capsule

– Domestic Markets Zoom as country prepares to reopen

Indian benchmark Indices surged by more than 5% for the second week running, mainly on the back of normalcy being reinstated after the biggest and strictest lockdown in the world was in place since March 25. The FIIs faith in India recovery story was seen for the second week running as they poured ~20,000 crore in the equity markets.

– President approves insolvency suspension

The president on Friday, gave his approval to the suspension of 3 sections under the Insolvency and Bankruptcy Code which will not take into account any debt defaults after 25th March, the day since national lockdown was announced. The moratorium period is currently 6 months with a further extension not more than one year awaited in the near future.

– Forex reserves keep climbing

The RBI on Friday announced forex reserves in the country for the week ended on 29th May surged to it’s all-time high of ~$493 billion. The reserves which are the backbone of the country in uncertain times like these saw an increase of ~$3.4 billion in the mentioned week. One of the key drivers of the recently heightened forex reserves was the lower cost of oil, a major expense on the forex front

Nifty at glance

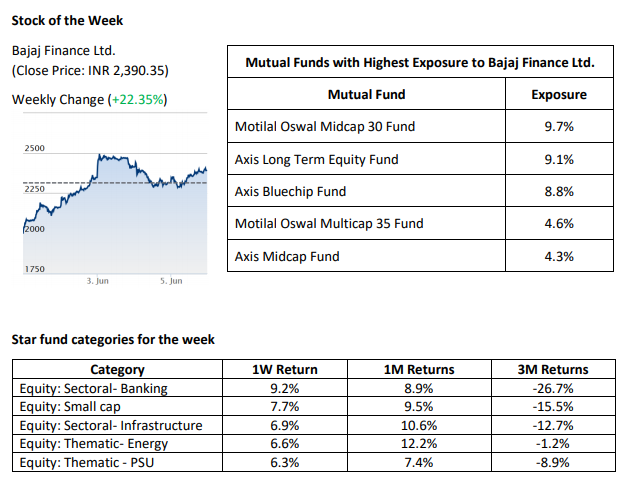

Mutual Fund news:

Mirae Asset Mutual Fund has launched Mirae Asset Arbitrage fund on 3rd June 2020 and the NFO will be open till 12th June 2020.

Outlook:

Going ahead, the flow of liquidity in the Indian markets will give hint of a possible long term direction. The markets will focus on the US Fed interest rate decision, IIP for April and inflation data for May among few data point to be released next week.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F3dTUUjE||target:%20_blank|” button_position=”button-center”]