Weekly Capsule

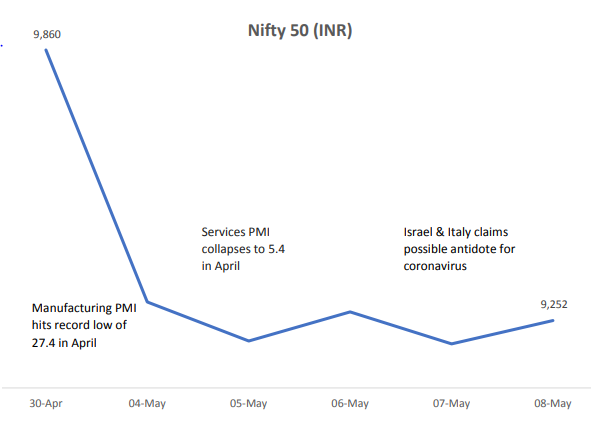

Israel & Italy claims breakthrough in fight against COVID – 19

News of Italy & Israel’s early success of vaccines candidates brought a sigh of relief to the world. Israel’s defence minister said scientist developed antibody to COVID 19 whereas Italy’s biotech firm Takis said during carrying out animal studies vaccine produced antibodies that had a neutralising effect on virus.

Not Just MSMEs! Government is working on a financial package to all sectors.

Mr. Girdhar Aramane who is a Secretary in Ministry of Road Transport and Highway has said that, ”Government of India, Prime Minister’s Office and the Department of Economic Affairs are already working on a package, which includes not only the MSME but also the entire industry. All sectors of the economy being taken care of by a comprehensive package, being worked out in the government”. MSME’s contribute 29% to India’s growth and 48% to exports, and is a major employment generator.

Government to gain Rs. 1.6 lakh crore this fiscal from the record excise duty hike on petrol & diesel.

The cash strapped government will be gaining close to Rs. 1.6 lakh crore as added revenue for this fiscal year on account of a record increase in excise duty on petrol and diesel. This move will help government to make up for the losses incurred by shutting down of businesses due to coronavirus lockdown.

Nifty at glance

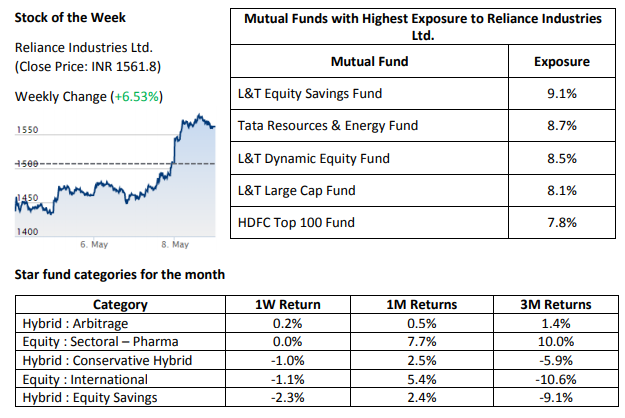

Mutual Fund News:

- Net redemption under credit risk funds down by 81.5% : AMFI

- Equity Mutual Fund inflows hit 4-month low of Rs 6,108 crore in April

Outlook:

Coming week on Tuesday, Manufacturing & Industrial production growth data for month of March will be released. On account of complete lockdown in month of March the year on year basis growth rate outcome will surely be negative. Along with that inflation rate for month of April will be released. Inflation rate lower than expected will provide RBI with headroom for another rate cut.

Investors must continue being cautious and keep investing in a staggered to benefit out of the current volatility. There are no signs of a V shaped recovery thus investors should not be carried away by any short term bear market rally.