The markets are presenting unanticipated movements across the two hot assets available – equities & bitcoins (not sure if this is an asset yet, or not; given the store of value we shall assume this to be an asset).

It would be interesting to look at the past, present and try to understand the future of these.

Equities

Characteristics & History

Equities have always been an inflation-beating asset class, which inadvertently translates to be one of the most rewarding assets available to the general public. Equities typically tend to offer returns in the ballpark of nominal GDP, which is simply the GDP growth rate plus inflation. While equities are driven by sentiments in the shorter term, over a longer horizon it tends to normalize returns to the rate around nominal GDP.

In the short term, equity prices are driven largely by investor sentiments and behavior (often irrational) more than any fundamental valuation. With millions participating on both sides of the spectrum – demand and supply of equities, it is almost impossible to gauge aggregate behavior and time the market. In fact, many experts in the field also fail to predict market movements.

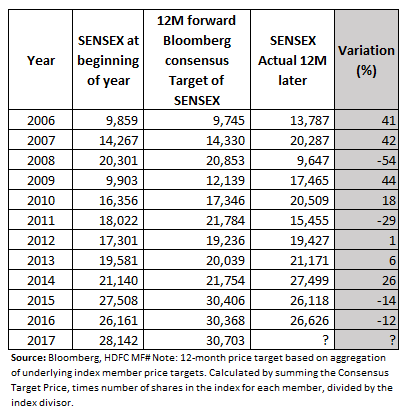

A classic illustration of the fallacy in the entire concept of timing the market is the consensus expectation v/s actual performance:

The breadth of deviation clearly reflects the unpredictable nature of the markets. Probably, the best person to predict the markets precisely needs to be a time-traveler.

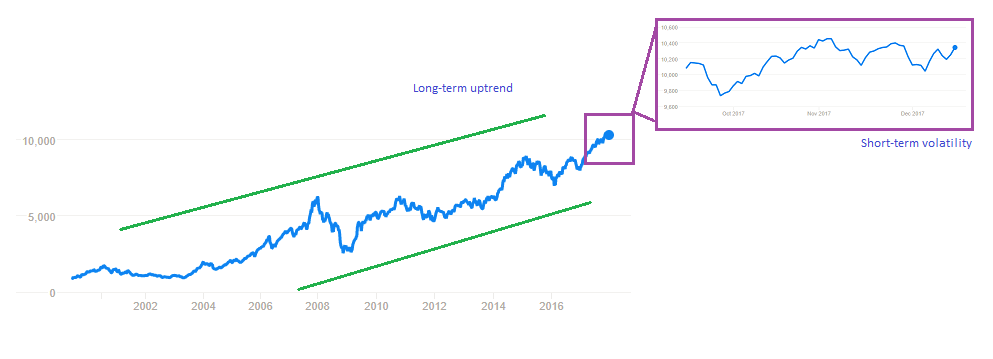

Short-term volatility; long-term uptrend. An investor should essentially avoid speculating equity market movements in the short-term and instead focus on participating in the long-term uptrend.

Fun Fact: If you would have invested in Nifty at any point in time from the year 2000 and redeemed after seven years, you would have never incurred a loss. Try it out.

The Present

The market is in a state of dizziness after the euphoric rally where despite big-bang structural reforms and voiced dissents, the equity markets kept going on the back of strong macro-economics, abundant liquidity and an overall belief in the Indian growth story.

The way the numbers are shaping up only strengthens the case for the Indian macros.

| Macro Indicators | |||

| Indicators | Jun-13 | Jun-15 | Now |

| CPI Inflation | 9.52 | 5.40 | 4.88%* |

| Fx Reserve(USD Mn) | 2,80,162 | 3,55,221 | 3,99,921^ |

| Oil Prices USD/bbl | 102.57 | 61.18 | 57.54 ^ |

| RBI policy rates | 7.25% | 7.25% | 6.00%^^ |

| 10 Year G-sec yield | 7.50% | 7.90% | 6.86 ^ |

| Fiscal Deficit (% of GDP)** | 4.80% | 4.10% | 3.20% |

| Political Scenario | Uncertain | Stable | Stable |

| Source: RBI, MOSPI. * Sept 2017,^^ Nov 2017 ,^ Oct 2017, **All figures are respective Fiscal Year: FY 13, FY 15, FY18. | |||

Outlook & Opportunities

- Heightened sentiments owing to growth measures by governments

The various growth measures like recapitalization of state-owned banks, announcing the mega-highway plan and a spike in the minimum support prices for Rabi crops has generated an uptick in investor sentiments.

While the bank recapitalization will allow for better visibility of capital for banks and consequently assist in improving the credit cycle resolution process, the ambitious highway project holds great potential in spurring activities in the infra-space. The MSP should help in boosting consumption in rural areas, which is a meaningful component of the Indian economy. - Scope for upcoming sectors to gain leadership in earnings growth

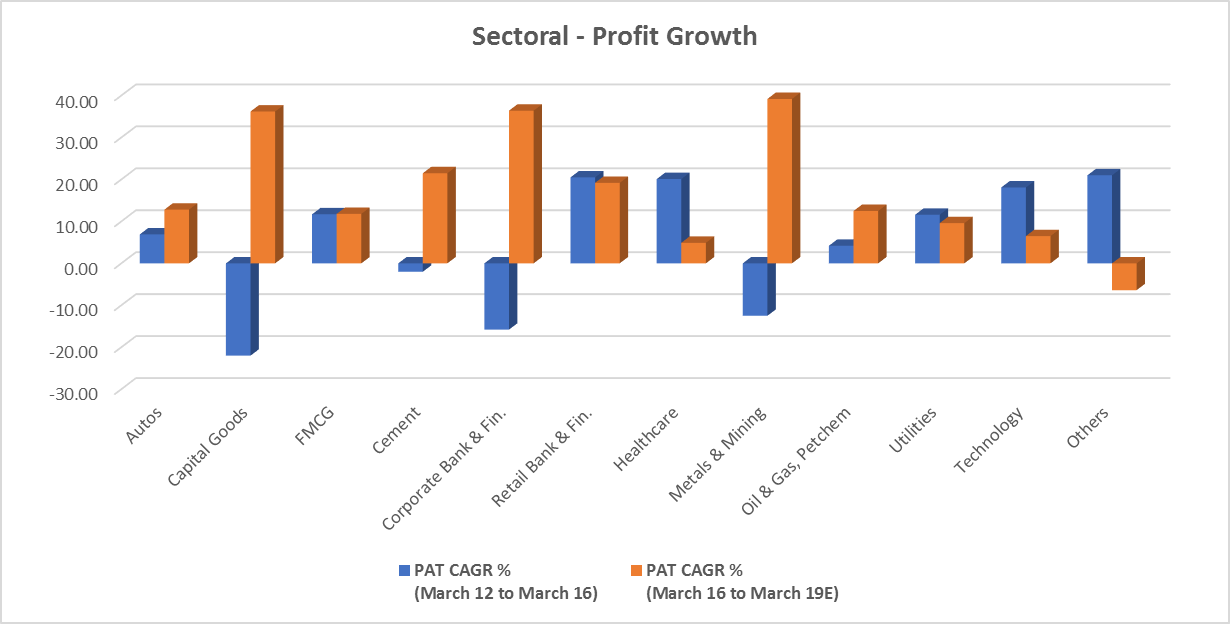

Source: CLSA, based on CLSA coverage universe, E-CLSA estimates

The wide divergence in historical and expected earnings across sectors clearly suggests the scope for growth in new sectors in the distinct future. Notably, it is worth understanding that while new sectors are opening up scope for value creation, there are a few categories which have essentially reached a certain level of penetration and would experience a natural dip in growth. This is typically because of an improvement in income distribution, consumption and subsequent shift in demand from necessary to comfort goods, which is a good thing.

- The markets hold a lot of potential waiting to be unlocked

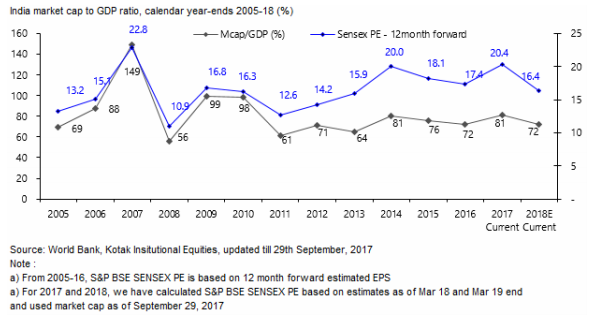

In line with the introductory paragraph, the index has been trailing the nominal GDP growth at ~7.5%-8.5% range. Consequently, India’s market-cap to GDP is still low at ~70% and is expected to continue.

Source: World Bank, Kotak Institutional Equities (As on 29 September, 2017), HDFC MF

- From 2005-16, S&P BSE SENSEX P/E is based on 12-month leading EPS (E)

- For 2017 and 2018, the S&P BSE SENSEX P/E has been computed basis estimates as on end of March’18 and March’19 and marketcap as on 29 September, 2017

The equity market has been proved to be a mechanism to transfer wealth from the impatient and undisciplined to the patient and disciplined. The opportunity lies in an adequate mix of focus sectors and diversified equity funds while maintaining asset-allocation at the core.

Bitcoins vs Ethereum

The rise of a ‘Bitcoin Bubble’? Maybe.

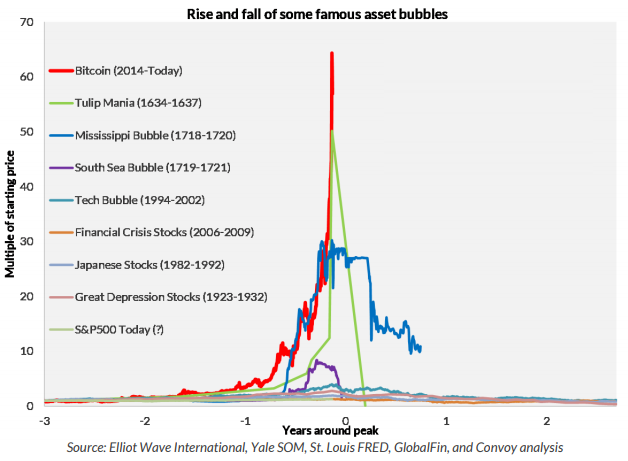

While speculators and investors all around the world are raving about Bitcoins and the same clearly reflects in the price which has shot up 17x this year and almost 64x in the last three years, this trajectory has clearly superseded the growth in the infamous ‘Dutch Tulip Mania’. The most troubling feature of bitcoins are the hazy and negatively skewed regulatory view along with being a momentum driven asset or cryptocurrency or who-knows-what. Bitcoins, today, hold all typical characteristics of a bubble – momentum driven rally, lack of intrinsic value and attracting demand from the common-ignorant.

Here is a brief comparison of Bitcoins v/s other previous bubbles which should help draw some perspective.

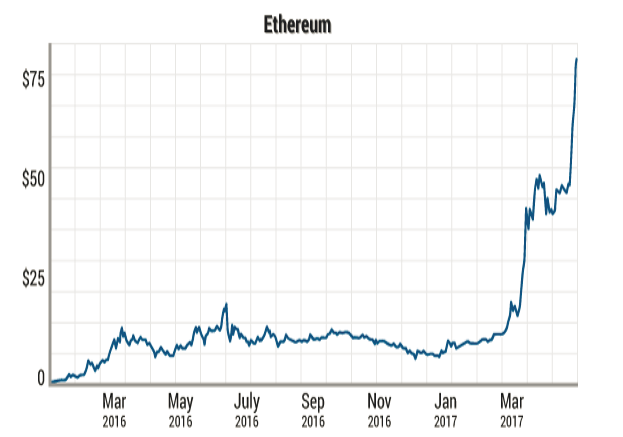

So, what’s next? There’s a rising star in the making which can be looked at – Ethereum. Not that it is recommended as an asset, but definitely worth understanding.

For those who are yet a novice in the cryptocurrency space, Ethereum is a digital currency which at its core is much more than just a digital currency. Ethereum is an open-source network which is technically far more superior as compared to the blockchain technology. So, while Ethereum is essentially the technology, it is the underlying to the network’s digital currency – Ether. So, essentially when you buy ether, you are essentially powering the Ethereum network and hence ‘Ethereum’ is used synonymously with the digital currency – “Ether”

Typically, every time you buy ether, you are owning a share of one of the most powerful ledger systems.

Efficiency

One of the key reasons where Ethereum has an edge over Blockchain is where Ethereum is a turing-complete coding language which essentially means that it is much more flexible in allowing a wide variety of applications to run on it. Also, it has a faster transaction processing speed at 17 seconds as opposed to the bulky blockchain which takes an average 20 minutes.

Strong backing

The advent of Enterprise Ethereum Alliance (EEA) has added a lot of heft to the long-term prospects of Ethereum. The EEA is a consortium of companies which include many Fortune 500 companies which decided to collaborate on strengthening the proposition for Ethereum technology with an ulterior motive of implementing it in their respective businesses.

Relatively stable and headroom for further appreciation

Though Ether prices have increased significantly on the back of rising awareness about digital currency and the hype around bitcoins, it continues to grow at a pace healthier than bitcoins.

(Source: Angel Publishing)

Though the point here is not to promote one cryptocurrency over another, but instead to broaden your vision and scope of understanding if you wish to explore this well-hyped space of digital currencies.