Usually, when we place orders online, we come across two products: those that don’t charge for delivery and the others that charge for the same. We usually opt or like the ones that provide “Free Delivery.” Right? The simple reason being we do not incur additional charges for our purchase, and that reduces the burden of our expenses.

Even Direct Plans and Regular Plans of Mutual Funds work on a similar concept. Let’s take a closer look.

Regular and Direct Plans: An Introduction

Regular Plans are mutual funds that you buy through an intermediary such as an advisor, distributor, agent, or broker. These agents charge commission, trail, or distribution fee for the service they provide, thus increasing the expenditure for your investment. And not always do brokers or intermediaries intent to sell plans that suit your financial needs, their primary objective would be to push the scheme and earn their share of profit.

Now let’s look at funds that are like the delivery of free online products.

SEBI made new regulations with regards to Mutual Funds, which was made effective on January 1, 2013, i.e. Introduction of Direct Plans. Direct Plans are those mutual funds in which investors can directly invest with Asset Management Companies (AMC) who do not involve intermediaries and do not charge any agent or broker fees.

How Are Direct Plans More Beneficial?

We are aware now what the difference between Regular and Direct plans. But what makes Direct plans more convenient for investments. Let’s find out:

- Direct Plans do not involve intermediaries, and hence, Fund Managers can generate better returns by reducing their expense ratio.

- The Net Asset Value (NAV – per share market value of a fund) is more when compared to Regular Plans implying that the returns that you can make are higher by approximately 0.5% for equity funds and 0.2% for debt funds.

- Investors can earn 1-1.5% more returns with Direct Plans. Additionally, a difference of 1% can be a huge gap with the compounding effect in the long-term.

Let’s look at a simple example:

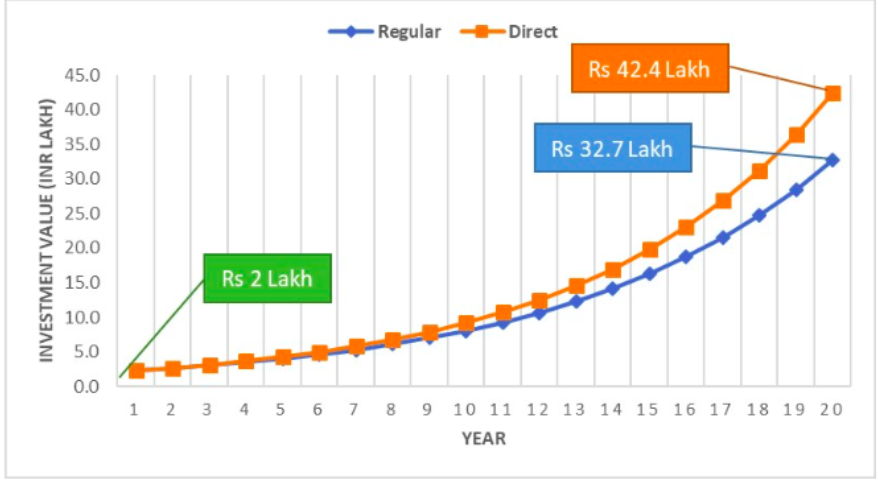

An investment of 2 lakhs in each Direct, as well as Regular plans for 20 years, yield different returns.

Direct Plans offer 42.2 lakhs, which means the investor is entitled to 16.5% returns, whereas Regular plans help you earn 32.7 lakhs, which are approximately 15% returns. This is a clear example that the Direct Plan is more beneficial and hassle-free than Regular Plans.

Direct Plans = Higher Returns

However, each investor’s risk appetite is different, and so is their knowledge or expertise about Mutual Funds. So if you are a newbie to investing and have no prior knowledge of mutual funds, then you can opt for Regular Plans, initially. However, once you have gathered enough experience and expertise, it’s highly recommended that you quickly switch to Direct Plans for the above-mentioned reasons.

Think Smart! Think Investments!