With the ban on 500 and 1000 rupee notes, demonetization literally emptied our wallets. For a few weeks of the cash crunch, it was troublesome getting or making the simplest of payments.

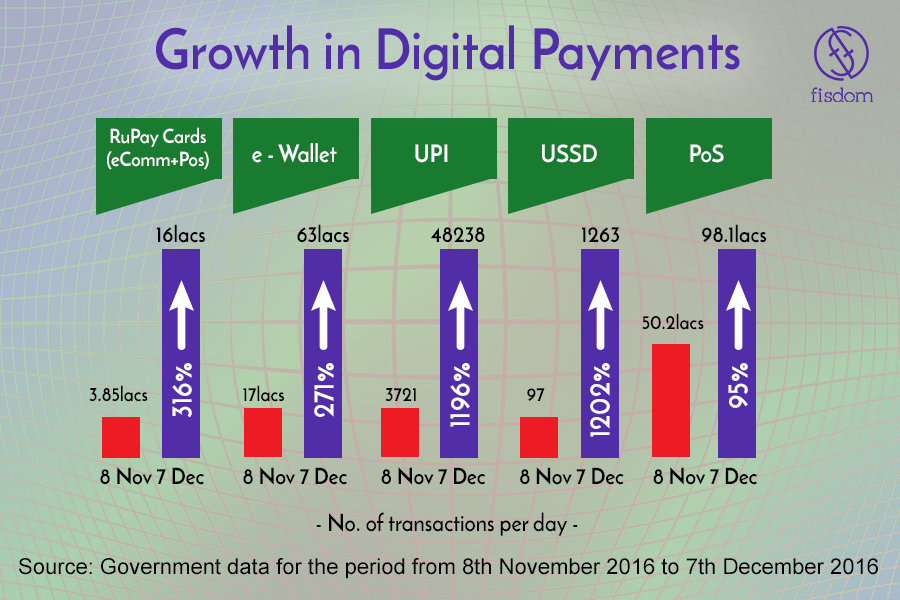

Happily, the world of investing has not been affected – it has always been cheque/digital based, with no cash. As part of the digital transformation, several payment options are now becoming mainstream rapidly as seen in the chart below. Let’s take a look at some of these options, and see how they work:

Options which are not linked to your bank account

- E-wallets –e-wallets are the second-most used payment gateway today. You download the e-wallet app or use their website portal, register yourself, add money to your wallet and you are set. You can make payments, shop and also send and receive money using the same wallet. The negative of e-wallets are the transaction charges – so you should read the fine print.

- Credit cards – already popular, but their main negative is that they promote money that you do not have yet! Its best to avoid falling into the trap of using credit cards to buy things you cannot afford.

Options which links your transactions to your bank account

- Debit / Rupay cards –You can not only withdraw cash from the ATM but use these cards for making payments at outlets which accept these cards. Again, there is no additional charge for doing transactions using the cards.

- UPI / BHIM app – UPI stands for Unified Payments Interface. UPIs have a similar working concept of e-wallets. They are facilitated by banks themselves and you can use the UPI of any bank you like. UPIs work through the BHIM app downloaded on your mobile phones. The BHIM app is an easy free-to-use application that can allow transfers to and from multiple bank accounts instantly. UPI is different from e-wallets in the sense that in the case of UPI, the transactions are done directly from one bank account to another.

- USSD – UPIs and e-wallets are possible means of payments only if you have a Smartphone and access to the internet. What when you don’t have such an access? USSDs come to your help in this context. Many people might not have a Smartphone and internet access. To help them make cashless transactions, USSD is available. Unstructured Supplementary Service Data (USSD) sends a text from your mobile, whether a Smartphone or not, to send and receive money through bank accounts. You simply dial *99*# on your phone and press ‘Call’. In the next screen, you are required to choose your language and then you would be presented with options to specify your bank details. By following the steps displayed on your phone you can transfer money from your bank account to another account directly.