DHFL is the gift that keeps giving – worries around delayed & defaulted payments. It has been months since DHFL has maintained its reputation as an NBFC that can keep lenders on the edge for quite some time. While the DHFL default on interest payment turned the street glum, RBI gifted debt investors a well-appreciated Eidi in the form of a rate cut and change of stance to accommodative.

Game of Loans: Winter is Almost Here!

Earlier this week, CRISIL downgraded DHFL’s commercial papers to ‘D’ (default) as it defaulted on an interest payment due for almost INR 900 crore worth of bonds on 4th June 2019. Per the latest communication received, DHFL has paid out almost INR 350 Cr. of its dues on 7th June 2019. While DHFL seeks to mobilize cash to service its obligations in full during the seven-day grace period, the liquidity situation seems tight. Many mutual funds, along with other investors, have suddenly found themselves in hot water – but we’ve got you covered; read on to know how.

Just as the IL&FS crisis surfaced late last year, it brought along worries around a domino effect in debt instruments – especially the ones issued by NBFCs. What followed next was a ruckus in India’s lending and liquidity scene with investors & lenders being wary of offering capital to anything related to NBFCs, which only aggravated the situation at hand.

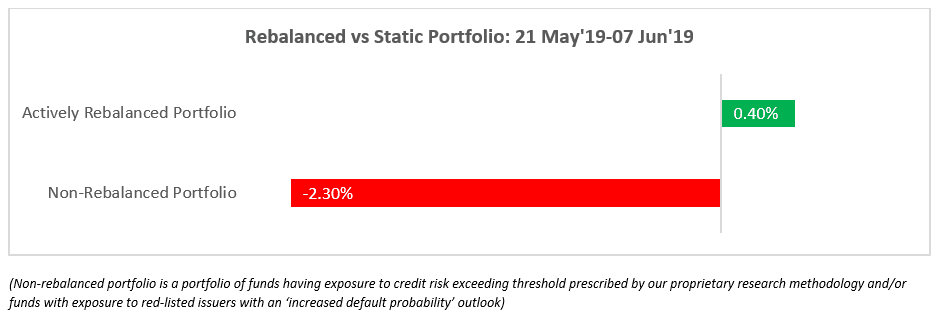

Meanwhile, beginning January 2019, we have triggered multiple rebalancing campaigns for all our investors who held an investment into any mutual fund having an exposure to low-rated debt instruments beyond a certain threshold and/or mutual funds having any exposure to debt instruments issued by issuers red-listed by us (eg. DHFL, Jharkhand Road Project, etc).

Along with a rebalancing notification on the app, you also would have received multiple emails outlining the increased risk in low-rated debt instruments. It’s been almost a year now that we’ve maintained a strong stance against investors accepting exposure to sub-rated debt instruments.

Here’s how we have helped you contain your downside and instead, generate profits through our Active Rebalancing System while other debt portfolios continue to stare at uncertainty.

Our constant endeavor is to be on top of your investments and ensure it delivers risk-optimal performance across cycles and events.

RBI seems to have made the cut!

On 6 June’19, in its first monetary policy committee meeting during the Modi 2.0 regime, RBI’s MPC unanimously decided to cut its monetary policy (repo) rates by 25bps from 6% to 5.75% & changed its stance from neutral to accommodative – which essentially implies that at least a rate hike is off the table.

The underlying objective for the rate cut is to facilitate adequate liquidity to spur economic growth through increased private investment, enhanced employment opportunities, increased income and consequent consumption. However, RBI is expected to keep a close watch on inflation and intends to maintain the target-range mandate. Our constant endeavor is to be on top of your investments and ensure it delivers risk-optimal performance across cycles and events.

RBI seems to have made the cut!

On 6 June’19, in its first monetary policy committee meeting during the Modi 2.0 regime, RBI’s MPC unanimously decided to cut its monetary policy (repo) rates by 25bps from 6% to 5.75% & changed its stance from neutral to accommodative – which essentially implies that at least a rate hike is off the table.

The underlying objective for the rate cut is to facilitate adequate liquidity to spur economic growth through increased private investment, enhanced employment opportunities, increased income and consequent consumption. However, RBI is expected to keep a close watch on inflation and intends to maintain the target-range mandate.

Notably, this is the first time since Sep’10 that the repo rate is pegged at 5.75% and the first time since early Feb’17 that it has maintained an accommodative stance.

What should debt investors do?

With the change in stance to “accommodative”, RBI is now looking at an effective transmission of the same to support growth & is expected to continue focus till inflation remains within a target range. However, the risks of contagion arising out of past credit defaults continue to loom large.

We suggest investors invest in funds with underlying debt instruments featuring a high aggregate credit quality & durations towards the shorter end of the curve up to 3 years – through the probability of a subsequent rate cut is high, we prefer to wait till more data unfurls before going aggressive on longer duration funds. Within the debt category, an investor can look at ultra-short term, money-market & low-duration funds to benefit from accruals.

Also, as key information, SEBI’s MTM guidelines state that debt instruments with more than 30 days to maturity (earlier 60 days) must be ‘marked-to-market’. This implies that funds holding such instruments in aggregate will reflect more volatility. This warrants the need for investors to be more careful while choosing liquid funds.

While this piece may be difficult to comprehend, feel free to write back to us and rest assured we will help you build your debt portfolio (including liquid funds) in an optimal fashion.

If you have any concern, please write to us at ask@fisdom.com or call at +918048039999, we would be happy to answer your query.