Once again, tomorrow is the day we pretend does not exist – albeit unintentionally.

It is the day when the unsung heroes of our life simply look into the mirror and smirk while patting themselves on the back for a job done to the best of abilities.

Tomorrow is Father’s Day.

While we typically reserve this space to demystify and guide you through the most important events in the week, guess there’s nothing wrong in offering it to an event dedicated to the most important person in our lives – Dad!

It is ironic how most of us acknowledge the rigmarole our Dads have gone through yet find it awkward to do anything beyond wishing him a happy Father’s Day! Even if a few of us decide to gift him something, we are caught wondering what could we possibly give to someone who has never asked for anything all his life? Well, the usual love, care & respect does just fine.

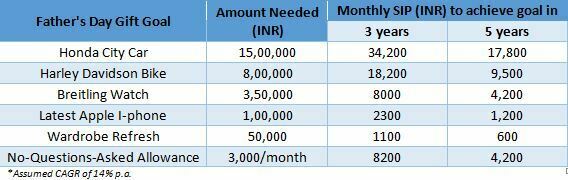

However, for those who wish to reinforce your gratefulness with a material gift that Dad wouldn’t have otherwise bought and immediately regret not having a lot of money to buy it, here’s what you can do to make it happen on the third, or perhaps fifth Father’s day from tomorrow.

Includes the top-voted products from a sample survey filled in by our kind investors.

While the amount needed may seem staggering at first sight, smaller and disciplined contributions can help you achieve it in three years – or perhaps, five years if you wish to go easy on the contribution. Let’s face the facts, you can afford to build a corpus for at least one of these but the only thing that will stop you from doing it is all the creative excuses your mind will make up just to justify the procrastination.

In fact, this Father’s Day, reply to this email and we will create a personalized plan for your Father’s Day Gift Goal and help you get there!

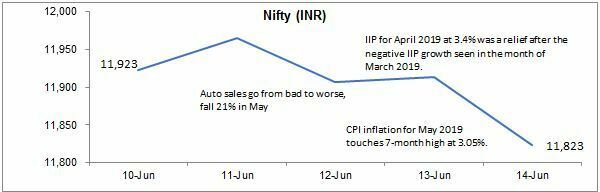

Meanwhile, it seems like there were many on Dalal Street who decided to sell-off and get some cash to buy their Dads a gift over the weekend:

For those missing their weekly dose of money-related events, here’s what happened in India on the macro-economic front and what should you infer from it:

- Industrial output for April’19 touched a 6-month high at 3.4%. This rise in IIP is majorly driven by growth in capital goods & consumer durables.

(After recording a muted growth in the last 3-months, a sudden spike in IIP numbers will help spur growth going ahead. It is positive for the GDP since manufacturing accounts for ~65% of the overall GDP growth. High production is associated with high demand and this is a signal of revival in economic activity.) - Retail inflation inched up to 3.05% – at a 7-month high, but well within RBI target of 4%. Higher vegetable and food prices were key factors.

(It is again a positive sign as it affords RBI enough headroom to cut interest rates further which will help to pick up growth in the economy. Also, in its recent monetary policy meet, RBI shifted its stance to accommodative from neutral as it cut the repo rate by 25 bps – this strengthens the probability of another round of rate cut soon.)