“The cost of college education today is so high that many young people are giving up their dream of going to college, while many others are graduating deeply in debt”

— Bernie Sanders

Even though this quote is said in the context of education in the USA, the situation isn’t much different here in India. When we meet our old friends over a cup of tea or coffee, we cherish our school/college days. These nostalgic memories take us back to the good old days when it was much easier to dream, set our goals and achieve them with ease. The inexpensive lifestyle in those days gave us a lot of room to lead a carefree life.

Do you remember that schools use to collect a ‘humble’ fee of Rs 11,000 from a standard 12 student 15 years ago? But now the same education would typically cost about 2 lakh which is ten times more.

We at Fisdom tell our customers how the inflation in the education system rises in double-digits while your purchasing power climbs by just 6-8% each year. Simply put, it is tough for us to make ends meet.

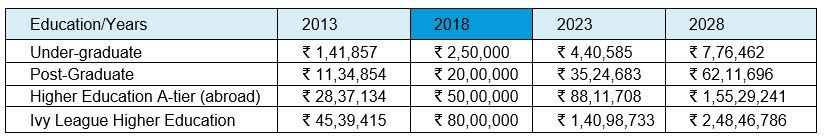

The table below shows how expensive your child’s education would be (in a 5-year spread timeline) if education costs keep increasing at 12% every year. Just so that numbers are relatable and easier to understand, we have normalized the education costs for 5 years ago by computing them at the same rate:

You would have realized by now that as years pass the expenses would keep increasing, while your salary wouldn’t increase in the same proportion, unfortunately. Moreover, these forecasts of education costs don’t take costs of gizmos, gadgets, sports amenities and extra-curricular costs into consideration, which make education unaffordable even further.

According to HSBC Value of Education Survey 2018, there was an INR. 4.15 lakh shortfall between what parents contributed and what students needed for a complete education.

This is quite an eye-opener and reflects the under-preparation by parents for their children’s education. A major reason for such a discrepancy is the fact that parents do not fully understand education inflation and so, are unable to financially plan in an adequate manner.

Let us explore some investment options which are specifically focused on financially securing your child’s future:

Sukanya Samriddhi Account:

- This investment can be made only in the name of a minor girl child and should be initiated before she turns 10 years of age.

- Each girl child can have only one account and this can be opened for a maximum of two girl children.

- The current rate of interest is 8.5% per annum which is tax-free.

- Scheme qualifies for tax deduction under section 80C.

- Minimum Investment amount: INR. 250, maximum investment amount: INR.1.5 Lakh in a financial year.

Children’s Fund

- These funds have a lock-in period of 5 years or till the child attains the age of majority; whichever is earlier.

- An investor can choose debt-oriented or equity-oriented schemes in the name of his/her minor child.

- Minimum SIP amount: INR 500.

“The problem with Indian education is that education in itself is overrated while the need to financially plan for it is underrated”

Now that we’ve understood the need and benefits of long-term planning, don’t hesitate, make the smart choice and starts investing. Let your aspirations come alive.