Bitcoins have become the buzzword today. Bitcoins is essentially viewed as a parallel system capable enough of overthrowing the archaic financial and banking system. So, this brings us to the most important question – “What is a bitcoin?”

A bitcoin is nothing but a digital currency just like the ones we have in our wallet. The only difference is this currency can be stored on your computer and instead of banks verifying the transactions and updating your passbook with relevant figures, this is done by millions of people all around the world. These digital-bankers are known as “miners” and the system is known as blockchain (click here to read more about blockchain).

The Bitcoin (BTC) is a cryptocurrency – a digital currency which is encrypted with a unique alphanumeric series which makes it practically impossible to duplicate. Bitcoin mining is a legit profession where thousands of people and companies validate transactions to earn bitcoins with a unique code. This requires huge technology infrastructure, rare algorithmic skills and supercomputers to execute.

Bitcoins can be purchased, sold and transacted through various bitcoin wallets and merchant gateways. Currently, there are around 16 million BTCs generated and only 21 million unique BTCs can ever be created. Now, that we’ve at least got a fair idea that BTCs are a currency and like all currencies its value will fluctuate, lets shift focus to its scope as an alternative investment.

Since supply is slow and capped and demand is growing, like any other currency’s demand-supply metric the value of BTCs also fluctuate. While this is extremely volatile, as an investment it can make you a millionaire or bring you down to rags. Enter 2017, the value of BTCs have surged sharply on the back of diluted trust on governing bodies and increasing belief in the sustenance of a parallel economy.

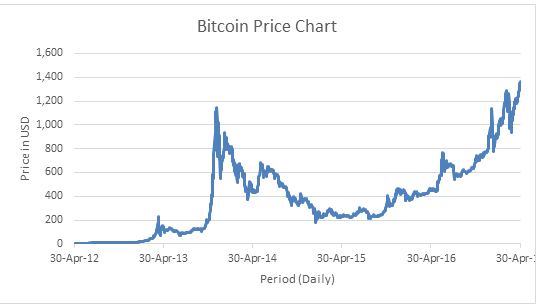

Here’s how the BTC prices moved in the last five years:

To help you interpret this crazy chart, you would be happy as well as sad to know that had you invested a hundred thousand USD, your Bitcoins would currently be worth a little over 27.5 million USD! That is a crazy 207% CAGR!

While this may look attractive, it is not advisable to miss the April of 2015 where the BTCs were a few hundreds away from crash and burn.

So, as an investor, these are the five golden rules to investing in bitcoins:

- Invest only what you can afford to lose

Like all currency, even BTCs are subject to major volatility. In fact, even worse. At least all other legal tender currency is backed by the respective government and assures the value of the currency whereas here, it is not backed by any entity. There’s nobody you can plead to. - Understand the system

While it may seem simple or ultra-complex to many of you, it is advisable you do a thorough self-study and due diligence to understand the mechanisms. There are various forums and tutorials available on the internet to help you. As Warren Buffett says, “Never invest in a business you don’t understand”. Tip: always move your BTCs to your personal wallet, don’t leave it at the exchange and always use a trustworthy exchange. - It is not a get-rich-quick scheme

Though the past returns have been phenomenal, it can only be attributed to initial momentum. The journey gets rough from here on. You need to hold it and try to redeem it only in the longer term. Get back to rule number one if you feel like you can bank on this investment in case you need money. - There’s fine line between risk and speculation

This is not Russian Roulette, in fact, it may be worse if you try to gamble on BTCs. The risk here closely tends to infinite. After all, BTC is a technology and there may come a day when this turns obsolete. Fun Tip: Try googling Bitcoin v/s Ethereum.

- Hazy legality

While the BTC fad is catching up, its legal validity lies in the gray. Many big governments have warned against the use of Bitcoins. In fact, in India many arrests and verdicts have been made against BTC hoarders. Again, this was not directly for holding bitcoins but for attempting to launder money through the system. However, you might want to be careful about the laws of the land.

Finally, there’s no straight recommendation on whether to invest in bitcoins or not. However, the above rules should help you deal with your crypto-portfolio better.

Anyway, the more you understand the sharper your investment skills get. Here’s a fun fact that will further fog your vision about BTCs.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2UYyG8N||target:%20_blank|” button_position=”button-center”]