What’s happening in arbitrage funds?

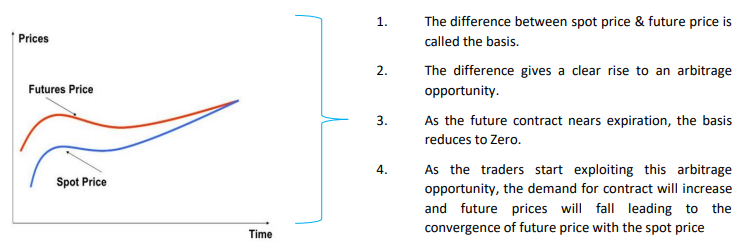

Arbitrage funds spreads turned negative for the first time. A spread is the difference between the price of stock and the price of its futures contract. Arbitrage funds delivers returns from a positive arbitrage spread and gives negative whenever there is negative spread.

How future prices converge with the spot price

What was the primary reason for such negative spread?

If you look at May end series, market-wide rollovers stand at 91% (vs. average rollovers of 86% seen in last 3 series). Stock future rollover stand at 94% (vs. average rollovers of 90% seen in last 3 series).

Due to this pressure from arbitrage players over short roll overs, spread across stocks dipped into negative zone from over 20bps. Even the large inflows in last two months and lower interest rates have also contributed to the dip.

How do we look at it?

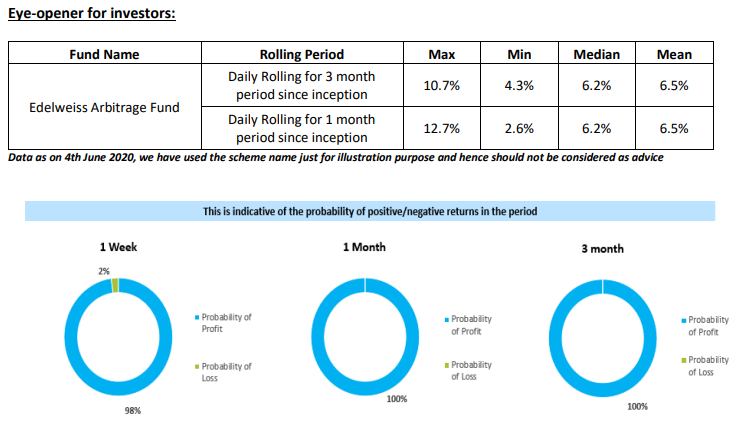

Amid such environment we all know that the arbitrage fund may generate lower returns over the next couple of weeks, however one should not forget that the market volatility during the May 2020 helps funds managers capturing better arbitrage opportunities by churning the portfolio in between. Hence, the actual returns are better than the spread captured on expiry days. One should ideally invest in arbitrage funds with at least 3-6 month’s investment horizon for stable investment experience.

Key Takeaways:

Existing Investor: Nothing will change for existing investor, they should stay invested for a horizon of 3-6 months.

For new investor who has time horizon of 3-6 months can definitely look at arbitrage funds cause they may generate better yields compared to liquid funds on a post-tax basis.

We believe that in couple of weeks the situation should normalize.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F3feSNXX||target:%20_blank|” button_position=”button-center”]