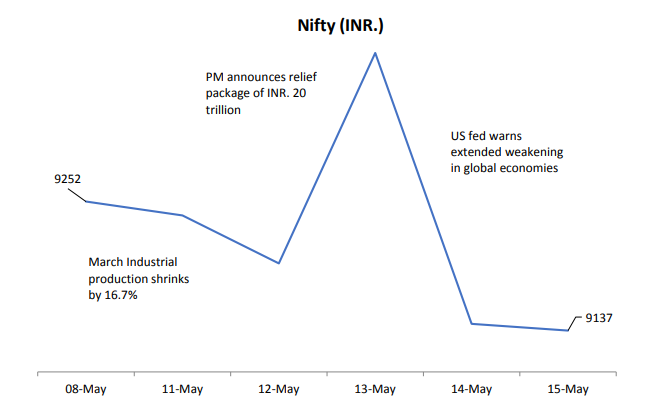

Indian market closed negative during the week. Nifty and Sensex down this week by 1.24% and 1.72% respectively

Weekly Capsule

– Government rolls out INR. 20 trillion relief package

(Prime Minister Modi announced the much-awaited relief package on 12th May which amounts to ~10% of country’s GDP in order to fight the current break in economic activities amid the ongoing lockdown. The package has brought in huge relief to the most hit sectors of economy like MSME’s, migrant workers, farmers and agricultural industry.)

– India’s retail inflation in March drops to 4-month low of 5.84%

(The retail inflation registered lowest levels for current calendar year at 5.84%, mainly due the food basket price inflation dropping to 8.76% for the month of March compared to 10.81% for the month February. RBI is expected to focus on reviving the economy hit and may further cut policy rates to boost lending through financial institutions)

– World coming together to help India fight COVID-19

(The World bank on Friday cleared a $1 billion assistance for social protection in order to combat the ongoing war against coronavirus; the bank’s spokesperson also said there are ongoing discussions around funding initiatives to assist micro, small and medium enterprises. The United States government on Saturday announced supply of 200 ventilators to India.)

Nifty at a glance

Outlook:

The announcements made so far by the government on the INR 20 lakh crore package have focused majorly on the supply side and investors fear that these measures may not result in a direct and immediate boost to demand, thus raising doubts over the country’s economic revival in the near term. For now, the market seems to be focused on global cues and continues to remain under pressure as the muted earnings season so far and the relief measures announced by the government have not been able to boost sentiments.