Life Insurance Corporation of India (LIC) is a government owned life insurance company. Being one of the largest insurance providers in the country, the government’s announcement of the LIC IPO has caught the attention of most investors. Through this IPO, the government plans to offload a part of its shareholding in the company to the public.

The government plans to launch the initial public offering (IPO) of Life Insurance Corporation (LIC) towards the end of the current financial year (FY22). The insurance provider will give preference to policyholders in applying for the IPO. Here is what current policyholders of LIC should know to be prepared for applying to LIC IPO.

What are the eligibility criteria for LIC IPO?

For existing policyholders to be eligible to apply for the LIC shares through its IPO, certain conditions must be met and details must be updated on the LIC portal. Listed here are the prerequisites:

PAN details to be updated

A policyholder’s PAN card number must be updated in the LIC records. It is also important to ensure that the PAN card details submitted for LIC policies are the same as the PAN information linked to their Demat account.

How to Link PAN Card with LIC Policy?

The PAN details of existing policyholders of LIC must be updated on the insurance provider’s portal.

How to check PAN link status?Here are the steps that policyholders can follow to check and update their PAN against their existing LIC policy:

- Visit webpage – https://linkpan.licindia.in/UIDSeedingWebApp/getPolicyPANStatus

- Enter a valid policy number along with correct Date Of Birth(dd/mm/yyyy), PAN, and captcha, as shown.

- Click on Submit.

- The page will reflect the status of your LIC policy and PAN linking.

Steps to follow if your PAN is not linked

- In case the page shows that your PAN is not linked, you can follow the below-mentioned steps:

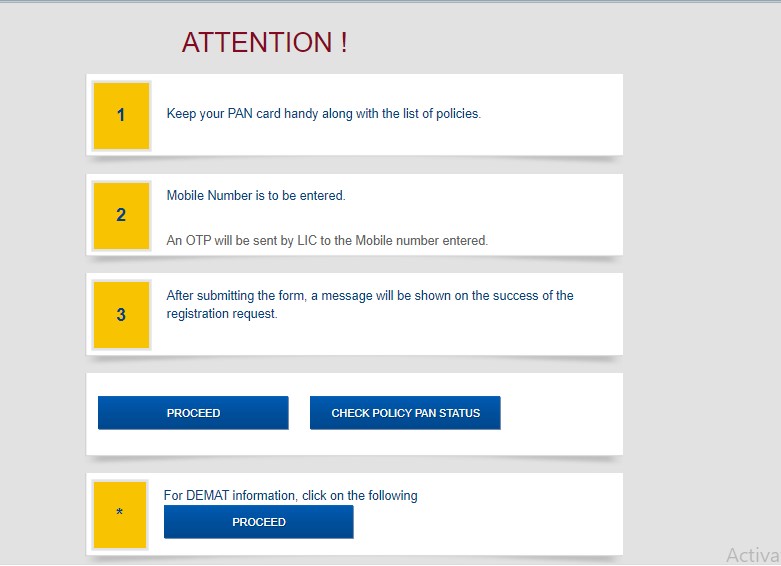

- Visit webpage – https://linkpan.licindia.in/UIDSeedingWebApp/

- Alternatively, if you are using the LIC official website, on the home page you can go to the ‘Online PAN Registration’ tab

- Under this section, click on the ‘Proceed’ button, which is at the bottom of the page

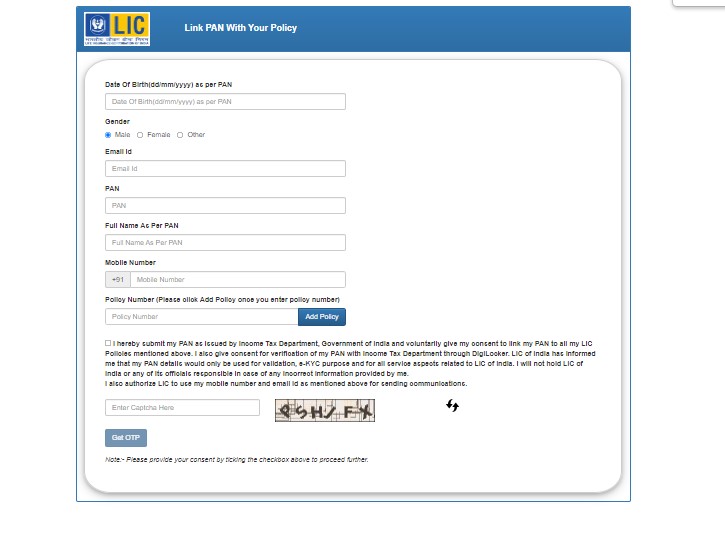

- On the next page, enter your email id, mobile number, date of birth, gender, PAN, full name as per PAN, and LIC policy number.

- Select the declaration checkbox and enter the captcha.

- You will get an OTP on your mobile number that is registered against the policy.

- Enter the same on the portal and click on submit to complete the process.

- Visit webpage – https://linkpan.licindia.in/UIDSeedingWebApp/

The necessity of a Demat account to apply for the IPO

An IPO is an Initial Public Offering through which a company invites investors to buy a share in the company. To participate in any IPO and buy shares of a company, investors must have a Demat account. Same goes for the LIC IPO.

LIC policyholders must have a demat account in their name. In absence of one, policyholders must ensure that they apply for one with a registered broker by submitting the required KYC proofs. Today, it is very easy to open a Demat account with most brokers offering seamless application processes.

Reasons for investors to look forward to the LIC IPO

Some of the top reasons why investors can look forward to the LIC IPO are:

- LIC is the largest life insurance provider in India with a command of over 66% market share in the country’s insurance sector. Being one of the biggest institutional investors in the country, LIC boasts of a large investment portfolio.

- The company has a huge employee base with nearly 2.9 lakh employees. It also has a widespread network of 22.78 lakh agents.

- Considering the past success of some of the PSU IPOs such as IRCTC, the LIC IPO has managed to build substantial anticipation among investors who expect a successful listing.

- Since the government has announced a special policyholder category for IPO subscription, existing policyholders are slated to benefit from the same.

How can policyholders apply for the LIC IPO?

Here are the steps that LIC policyholders can follow to apply for the LIC IPO after the subscription opens:

- On the broker app, select LIC from the initial public offerings list.

- Visit the IPO information page.

- Choose “Policyholder” from the drop-down and click on “Apply Now.”

- Complete the bid form and submit the same.

- After submission, the applicant receives a mandate from the sponsor bank.

- Upon acceptance of the mandate, the policyholder’s application gets approved.

It is important to note that an application to the LIC IPO does not guarantee allotment.

Conclusion

In July 2021, the Cabinet had cleared the disinvestment of LIC. A panel chaired by the finance minister will decide on the proportion of government stake dilution in LIC. Through the Finance Act 2022, the government has made necessary legislative amendments to the LIC Act for the upcoming LIC IPO.

FAQs

LIC policyholders have the opportunity to invest in the company’s IPO in addition to applying through the retail application mode. This way, policyholders can have a higher chance of allotment of an IPO share.

The LIC IPO is crucial for the government in meeting its disinvestment goals. The government aims to fetch nearly Rs 1.75 lakh crores through a minority stake sale and privatization of the insurance provider.

LIC IPO subscription is expected to be launched between Jan-Mar 2022 since the pre-IPO process has already begun.

Like any IPO, the markets will decide on the success of the LIC IPO. However, considering the recent surge in IPOs in the Indian market, there is a higher appetite for the LIC IPO among investors. Also, the Indian stock markets are seeing increased participation from retail investors, which will likely benefit the LIC IPO.

Retail investors can either benefit through listing gains post the IPO listing, depending on pricing levels, or they can avail benefits of long-term investment through wealth creation.