Yin & Yang

Two complementary principles of Chinese philosophy; Yin is negative, dark, and

feminine, Yang positive, bright, and masculine. Their interaction is thought to maintain the

harmony of the universe and to influence everything within it

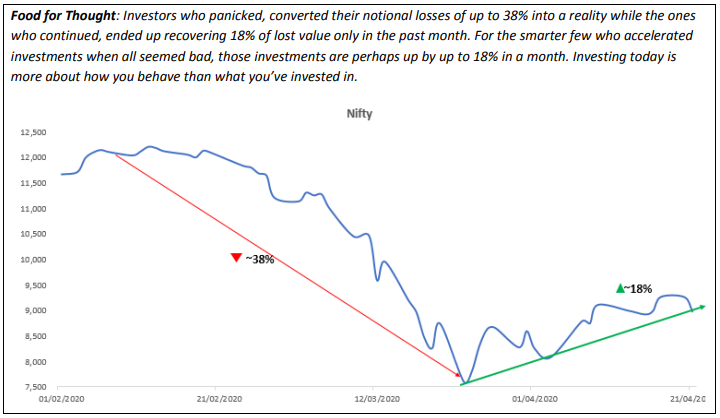

Indian equity markets have corrected significantly over the last one month (Nifty down ~38% from its 52- week high of 12,362 to the lows of 23rd Mar’20) in tandem with global equity markets due to headwinds from the Covid-19 outbreak across multiple countries. Well, we all might have heard negativity, concerns approximately from everyone around due to covid-19, lockdown extension resulting business impacts, subdued economy, etc.

The fall across the world is reminiscent of 2008. However, we note that such significant corrections have typically opened significant investment opportunities, especially in countries like India.

Let us understand why India is better placed during this volatile time:

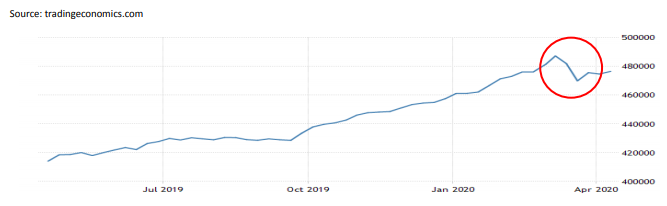

Stable foreign exchange reserve:

The International Monetary Fund (IMF) defines foreign reserves as external assets that a country’s monetary authority can use to meet the balance of payments financing needs, affect currency exchange rates in currency exchange markets and other related purposes. India maintainsits foreign exchange reserve in US dollar.

Finally, US federal reserve offered RBI the currency swap facility to help them fund their dollar requirements. With the currency swap option, RBI can now enter repurchase agreements with the Fed and can restrict the rupee depreciation.

It provides an ammunition to stabilize trade and forex outflows during volatile times such as the current crisis. The central bank’s dollar reserves fell to $437 billion as on 27 March from $447 billion a week earlier, due to the selling in the markets but remain robust, according to RBI data.

Takeaway:

India can do this as we are in the top 10 nations who are having the highest foreign exchange reserves

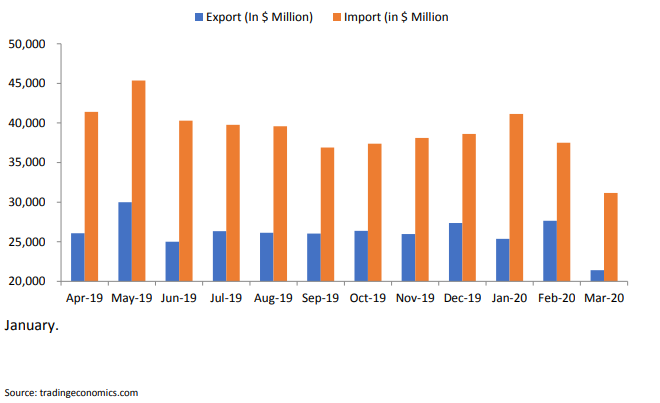

India’s Export & Import:

India importing nearly $40-$50 Billion worth oil every year; also, oil contribution in balance sheet is high followed by gold. Currently oil prices slashed down to nearly to $24.28% from its 60’s level in

As we know India imports more than exports. If we see Feb-March comparison, we have still saved $100 million. As due to lockdown extension we may see another drop-in export-import trade in the month of April.

Takeaways:

Though the import looks higher, major contributor to India’s import is oil as India’s 85% of the oil demand is met through import, which is trading at its low level right now. Typically, India benefits to a tune of ~$1.4 bn with every single dollar drop in oil prices. Brent oil prices have fallen by over 60% in 2020 till date.

A reduced bill implies more economic firepower for India to fight the current economic situation.

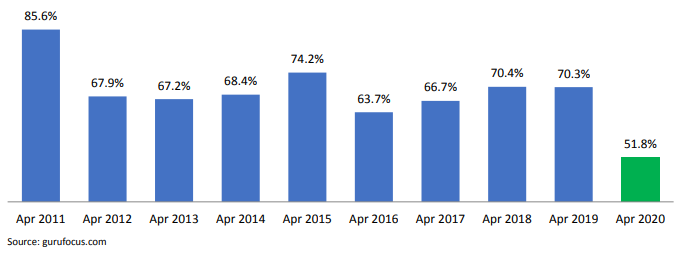

Market Capitalisation to GDP Ratio:

Takeaways:

M-cap to GDP ratios indicates us the valuation of markets I.e. whether undervalued or overvalued. Undervalued means that the market prices are cheaper and attractive to do investment and vice versa. Currently Market cap to GDP is hovering at 51.8% (18th Apr 2020) to its lower level since 2003 and looking undervalued after a very long time. There is an opportunity to invest now at cheaper valuation to ride the imminent economic recovery.

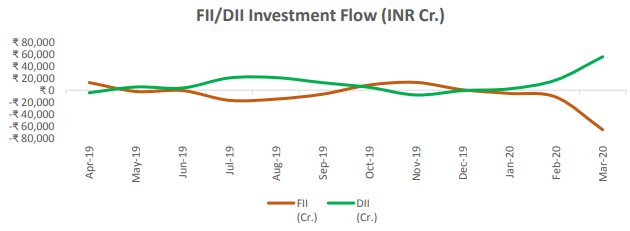

FIIs are sellers but domestic money is here to grow:

It looks like FII and DII inflows have inverse relationship. Foreign institutional investors are typically risk-averse – most of them by mandate. Foreign institutions include large pension funds, endowment funds, etc. which have a mandate to generate certain bps more than what their home markets can offer and hence diversify into emerging markets like India. An outflow of foreign capital is in no way indicative of a development in their outlook on Indian Capital Markets. Also, one would notice, the same has happened with global capital markets.

As illustrated in the above graph, Domestic inflows have a strong negative correlation with foreign inflows (-0.9) indicating that domestic investors are capitalising on every decline created by foreign money outflow and that this outflow is not indicative of a change in fundamentals.

Key Takeaways for Investors:

• Equity investors must capitalise on the situation by buying more on dips. Those investing equities via SIP/STPs can accelerate by increasing periodic deployment by 10%-15%.

• Debt fund investors must try stick to funds with sovereign/AAA-rated underlying.