Markets have hit a rather rough patch amid concerns emanating from the pandemic. The decline is not restricted to returns on capital market instruments but also on returns offered by traditional instruments. However, this time the dark cloud has something more than just a silver lining – a gold lining.

Gold: Your friend in volatile times

Globally, gold has been known to be a safe-haven asset and tends to appreciate as investors move away from riskier asset classes.

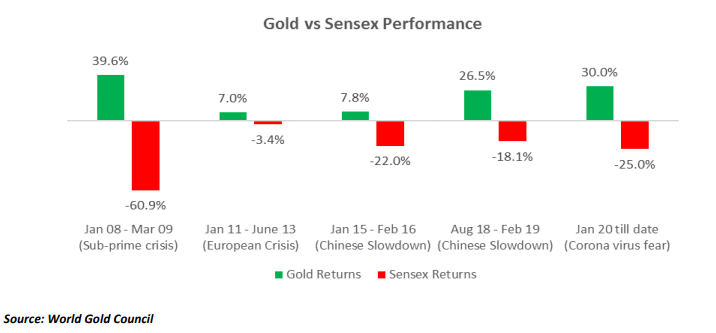

1. Gold performance during crisis times like now:

Gold and Equity market has an inverse relationship and hence during volatile times gold always shines over equity markets.

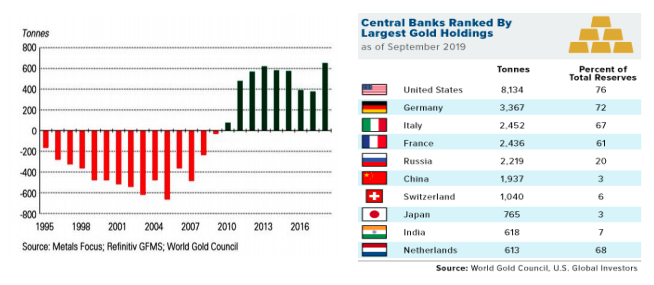

2. Economies of the world have learned from mistakes

Demand for gold took off well after 2009. The sub-prime crisis of 2008 was an eye-opener and used central banks to start creating a safe-haven reserve of gold instead of the US Dollar for uncertain times like now.

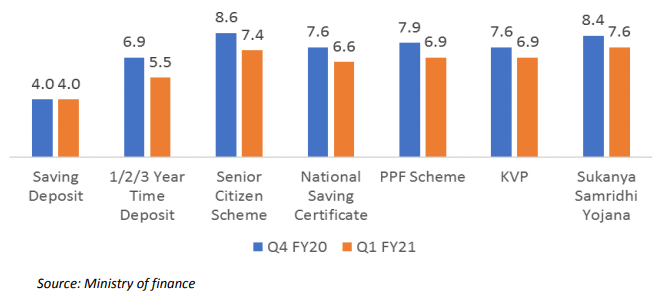

3. Interest rates are expected to fall further

Gold prices rise on the back of falling interest rates. Gold and interest rates traditionally have a negative correlation. Rising interest rates make stocks, government bonds and other investments more attractive to investors, while gold becomes less attractive (hence price drops). RBI has already slashed the interest rate by 75 bps in response to the pandemic, and this may not be the last cut.

4. Gold continues to sustain price levels; largely range-bound

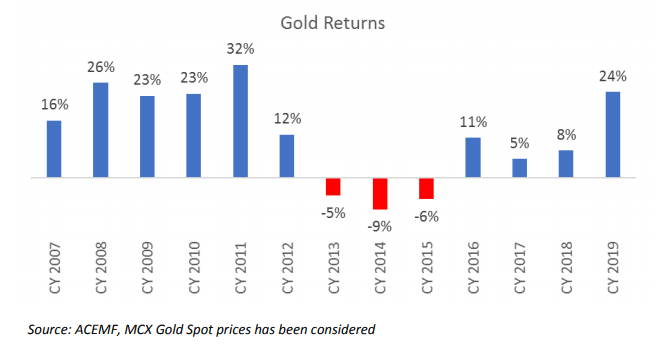

Since 2007, gold has returned positive for investors in ten out of 13 calendar years

Key Takeaways:

Including gold in your portfolio is important to preserve the value of your investments and retirement savings during recessions to some extent. Also, it’s important to do so before the next recession if you want to fully benefit from the safe-haven nature of the precious metal.

One should aim to have an allocation of between 10%to 15% of a portfolio in gold – especially through gold mutual funds.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F3fS9Wb2||target:%20_blank|” button_position=”button-center”]