Futures and options (F&O) trading on stocks, currencies, and commodities are fast gaining popularity among Indian trading community. However, not all F&O traders are aware that this is subject to taxation. This may lead to many small traders not reporting their income or losses from futures and options while filing their yearly income tax returns.

In this article, we discuss some of the important points that F&O traders should know around tax aspects and return filing.

Do gains (losses) from F&O trades need to be reported?

Salaried taxpayers who trade in F&O often do not report gains or losses in their income tax returns. While this could be due to ignorance, reporting all sources of income is mandatory as per Income tax laws in the country.

It is important to note that one could receive a notice from the tax department for non-compliance in such cases. In fact, reporting losses from F&O trades can have tax benefits. We will discuss this in the sections below.

So, how should one report F&O income?

Usually, futures & options trades should be reported as a business income unless there are only a few trades (2-3) in a financial year. This applies to individuals as well. The important point to note here is that a trader does not have to be formally incorporated as a company or a legal entity to earn business income. Individuals can have business income too.

How to report F&O trades?

Trading in futures and options must be reported as a business while filing returns, except in cases where there are only 2-3 trades. This is applicable even if an individual is formally incorporated as a company since Income tax laws state that individuals or salaried individuals may also have business income.

One has to use ITR-3 for filing returns for such business income. It is important to check ITR eligibility based on one’s income since each year sees different announcements in this regard. If an individual trader reports F&O trading as a business, he/she is also eligible to claim expenses from the business.

Which expenses can be claimed?

One of the benefits of filing income tax returns as a business is that one can claim the expenses incurred for the business. Some of the expenses include–brokerage, broker’s commission, subscription cost, telephone expenses, interest cost, consultancy fees, salaries of people supporting the business, etc.

These expenses can be claimed while calculating taxable income. It is important to maintain an accurate record of expenses. Expenses above Rs. 10,000 made in cash generally cannot be claimed.

How to compute income?

Those involved in multiple stock market investments, such as intra-day trading or investment in shares for a short term or longer-term, the tax treatment of each activity is different. For example, if an individual does intraday trading, then he/she must report the gains (or losses) as business income. High volume short-term trading in equity shares is also to be treated as a business.

One may incur capital gains while selling long-held equity shares or fewer short-term equity shares sales. Depending on the nature of the trades, volume, and duration, income computation could differ.

How to report losses from F&O trades?

Reporting loss from F&O trades is mandatory. It is common among F&O traders to not report a loss on their income tax return as no tax is payable on it. However, it has now become mandatory to report any losses in ITR. Failure to do so could result in a notice from the Income Tax Department.

By reporting losses at the time of filing returns, a F&O trader can gain multiple benefits. Any loss incurred by trading in F&O can be offset against other income except salary income. For example, if one has a rental income of Rs. 10 lakhs and loss from F&O is Rs. 5 lakhs, then the total taxable income will be Rs. 5 lakhs.

If such a loss is not fully offset against the income in the current financial year, it can be carried forward for a maximum of next 8 years. However, such a carry forward loss can be offset only against business income in subsequent years and not against any other income.

Loss from F&O trading is considered as non-speculative loss whereas loss from Intraday stock trading is considered as a speculative loss and can only be adjusted against speculative income.

How an F&O trader must keep accounting records?

Individuals who are running a business must maintain accounting records if their income exceeds Rs. 2.5 lakhs or gross receipts are over Rs. 25 lakhs in any of the 3 preceding years or in the first year for a new business. If an individual is doing a business like F&O trading, the same rule applies to him/her. Maintaining trading statements, expense receipts and bank account statements is essential in such cases. Using this information, the profit-and-loss account and balance sheet can be prepared.

Is audit important for F&O businesses?

An audit by an independent chartered accountant is mandatory in the following cases :

- If business turnover exceeds Rs. 2 crores. Turnover in this case indicates the absolute sum of settlement profits & losses for F&O per scrip and the sell side value of option contract.

- When declared profits are less than 8% of the turnover and total income exceeds Rs 2,50,000.

Those who do not maintain books of account or opt for audit are liable for penalty under the Income Tax Act. The maximum penalty chargeable for not maintaining books of account is Rs 25,000. In case of failure to get the audit done, the penalty is 0.5% of turnover or maximum up to Rs 1.5 lakhs.

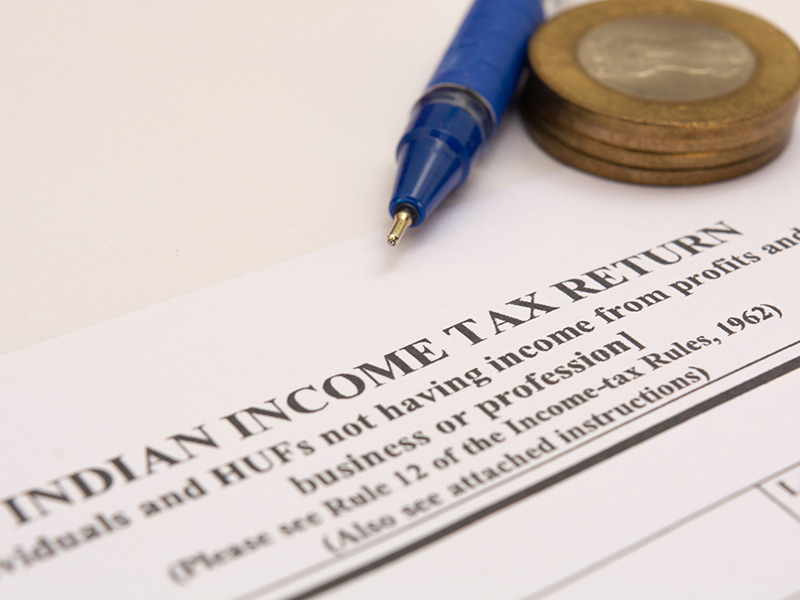

ITR filing for F&O income

The income or loss from F&O trading is considered as business income or loss. Therefore, one must use ITR-4 for reporting such income or loss. While most individuals file ITR-1 or ITR-2 but if they are engaged in F&O trading, it is important to check ITR form applicability every financial year based on income earned or losses made in that year.

In case of business where an audit is applicable, the due date for filing the ITR in 2021 is 30th Sep if not further extended by the government.

Conclusion

F&O traders must report all gains and losses while filing income tax returns to avoid penalties and notices from the IT department. It is important for F&O traders to read about the latest norms on return filing, including timelines, process, etc.

FAQs

- What is F&O trading?

F&O trading involves F&O contracts in which derivative instruments, including futures and options, are traded on a stock exchange.

- Which ITR to file for futures and options?

Individuals must file their tax returns using ITR 3 if involved in F&O trading. ITR 3 is meant for self-employed professionals, individuals with business income and salaried individuals as well.

- How do you calculate profit on F&O?

In F&O trading, the turnover of futures is the absolute profit measured as the difference between positive and negative returns.

- How are futures trades taxed?

Any income or loss arising from the futures trading is treated as business income or business loss. Thus, a taxpayer is required to fill the ITR-4 tax form while filing his or her returns. Any taxable income arising from the trading of futures is taxed as per prescribed income tax slab rates.

- Is it important to separate stock trading from F&O for ITR purposes?

Yes, for ITR purposes, an individual must separate stock trading from F&O as both are considered separate businesses as per Income tax laws.